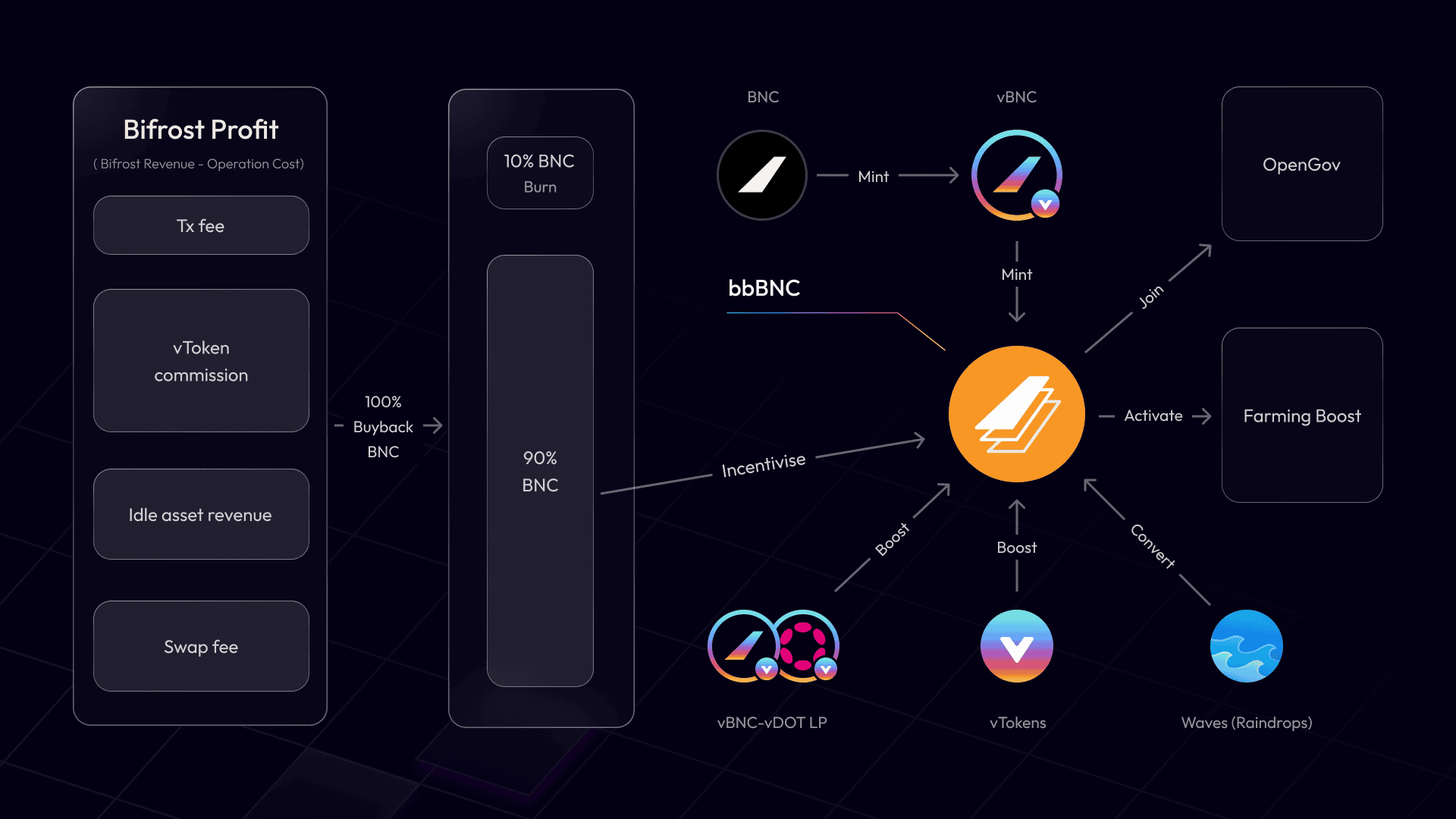

In the Bifrost Tokenomics 2.0 proposal, Bifrost plans to use 100% of protocol profits for BNC buybacks, with 90% allocated to bbBNC holders and the remaining 10% to be burned.

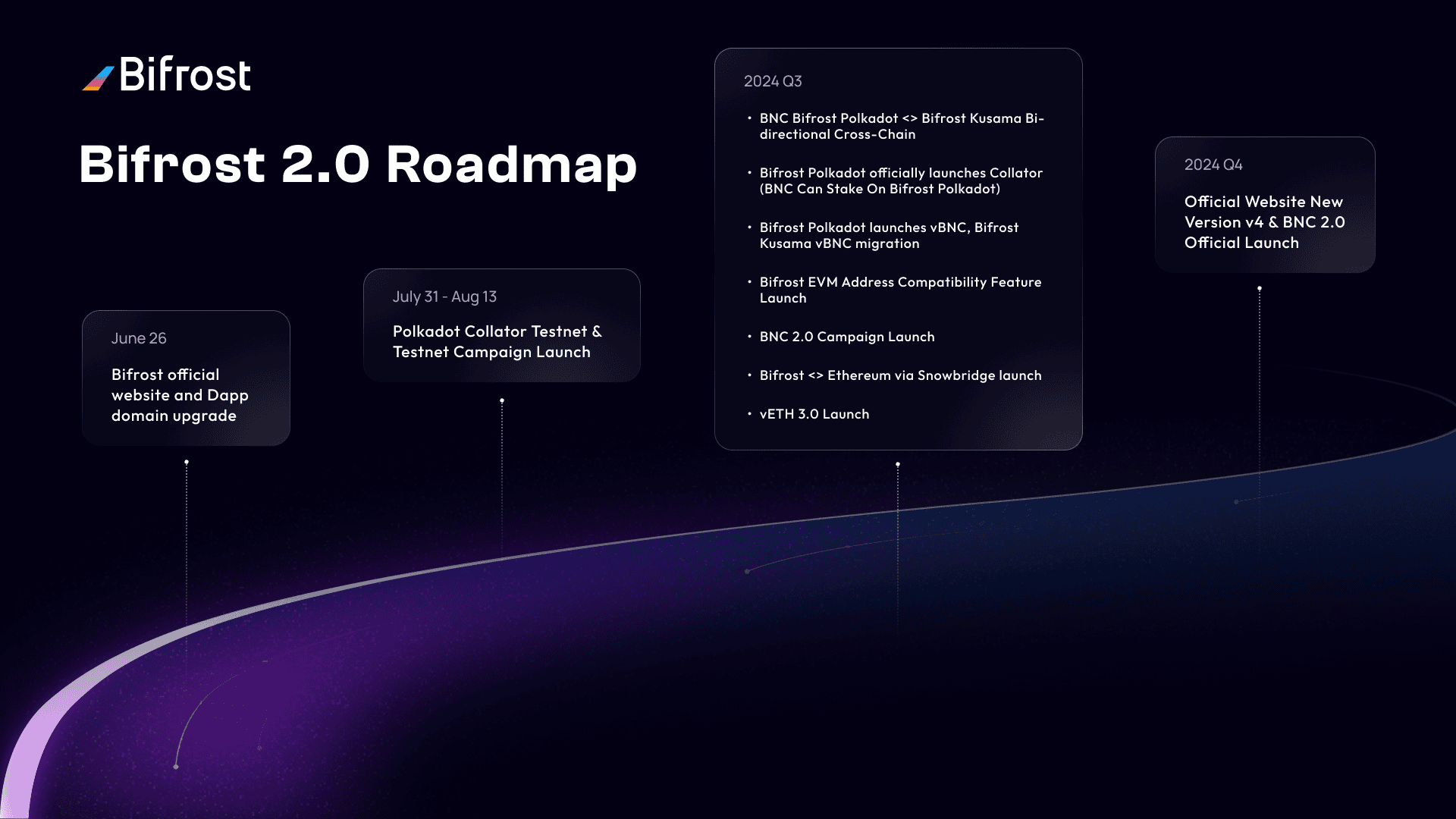

In the second half of 2024, the core mission of the Bifrost Team is to launch Bifrost 2.0. This major update includes several key initiatives:

In the field of cryptocurrency, there is a viewpoint that suggests: Tokens are a greater invention than blockchain technology itself. This statement may sound sensational, but it serves as a reminder that tokenomics design is crucial for the success of crypto protocols and broadly for businesses.

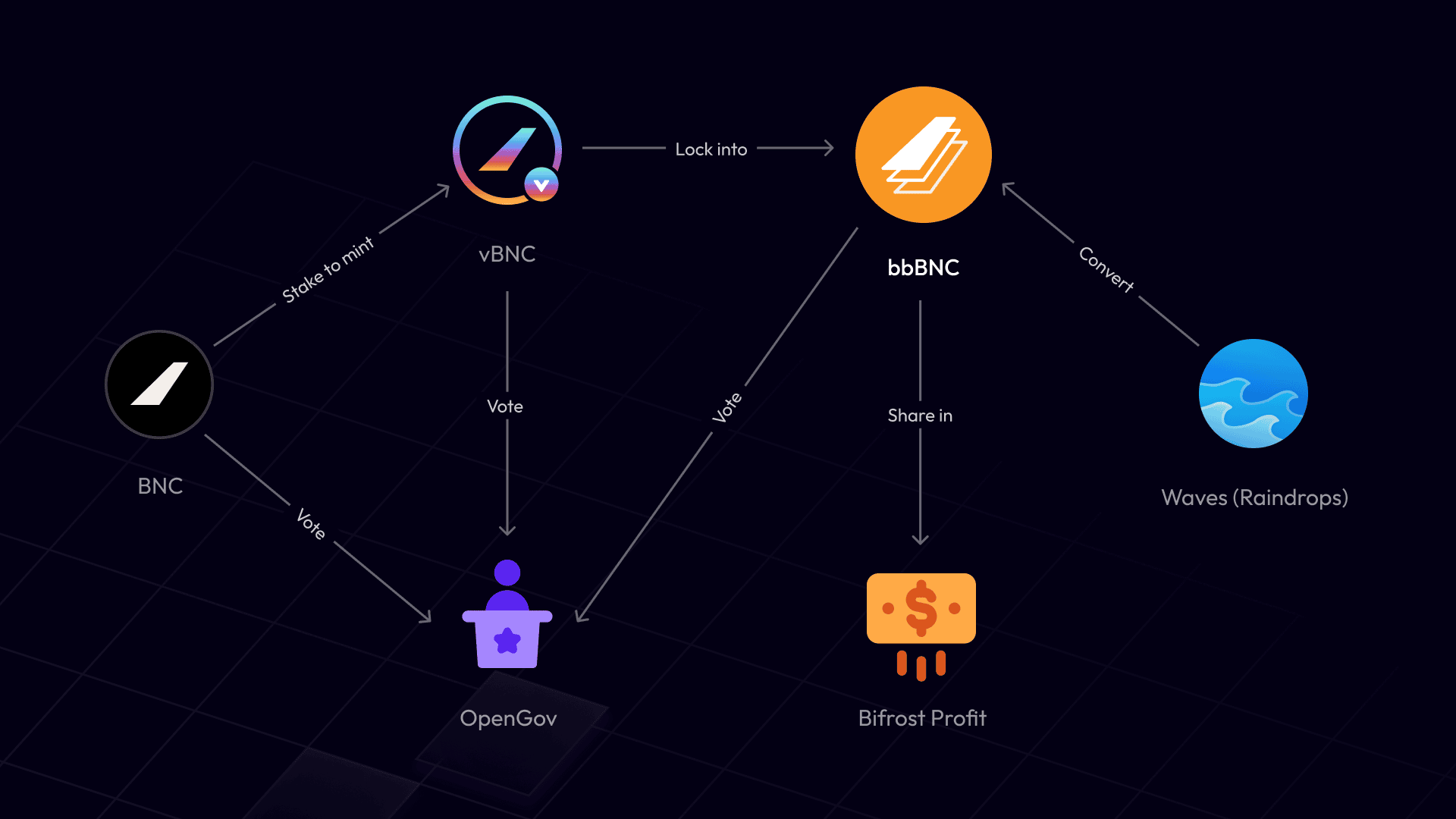

The Bifrost Tokenomics 2.0 proposal has been released in the community, and the most significant change in the proposal is the introduction of bbBNC (Buy Back BNC). bbBNC, is obtainable by obtaining Bifrost liquid staking token “vBNC” and locking it. Holders of bbBNC receive staking rewards accrued in vBNC, enjoy protocol governance rights, and directly share Bifrost protocol Profits.

This proposal suggests using 100% of the profits from the Bifrost protocol for the buyback of BNC, with 90% allocated to bbBNC holders and the remaining 10% to be burned. bbBNC, short for Buy Back BNC, is a type of escrow token used for sharing the protocol's profit.

*Protocol Profits = Protocol Revenue - Operation Cost

Users can obtain bbBNC by liquid staking BNC to acquire vBNC and then locking this vBNC to receive bbBNC. The amount of bbBNC a user gets depends on the quantity of vBNC locked and the duration of the locking period. For example, the longer a user locks vBNC, the more bbBNC they receive. This mechanism mirrors the veCRV mechanism in the Curve protocol.

In past community activities and Bifrost campaigns, participants earned Raindrops points. After the launch of Bifrost 2.0, these points can be exchanged for bbBNC. These bbBNC will not be minted directly but disbursed from the Bifrost treasury.

bbBNC is non-transferable and can be redeemed for locked vBNC upon maturity. However, bbBNC can be redeemed before maturity, but users may face slash for redeeming earlier than the set date. Slash will be fully counted as protocol revenue and will participate in BNC buybacks, burns, and bbBNC incentives.

Holding bbBNC entitles you to the following benefits:

As a leading cross-chain liquid staking protocol, Bifrost generates multiple streams of protocol revenue, including:

In the current Bifrost Tokenomics, the main revenue of the protocol enters the treasury and is directly used for business expansion (such as vToken minting incentives, liquidity incentives, channel incentives, etc.). This model has played a role in promoting Bifrost's business growth, but it has not provided direct benefits to BNC holders. In the Bifrost Tokenomics 2.0 proposal, it is assumed that 40% of staking BNC be converted into bbBNC. Based on the current revenue scale of the Bifrost protocol and the price of BNC, the annualized yield for holding bbBNC could exceed 100%.

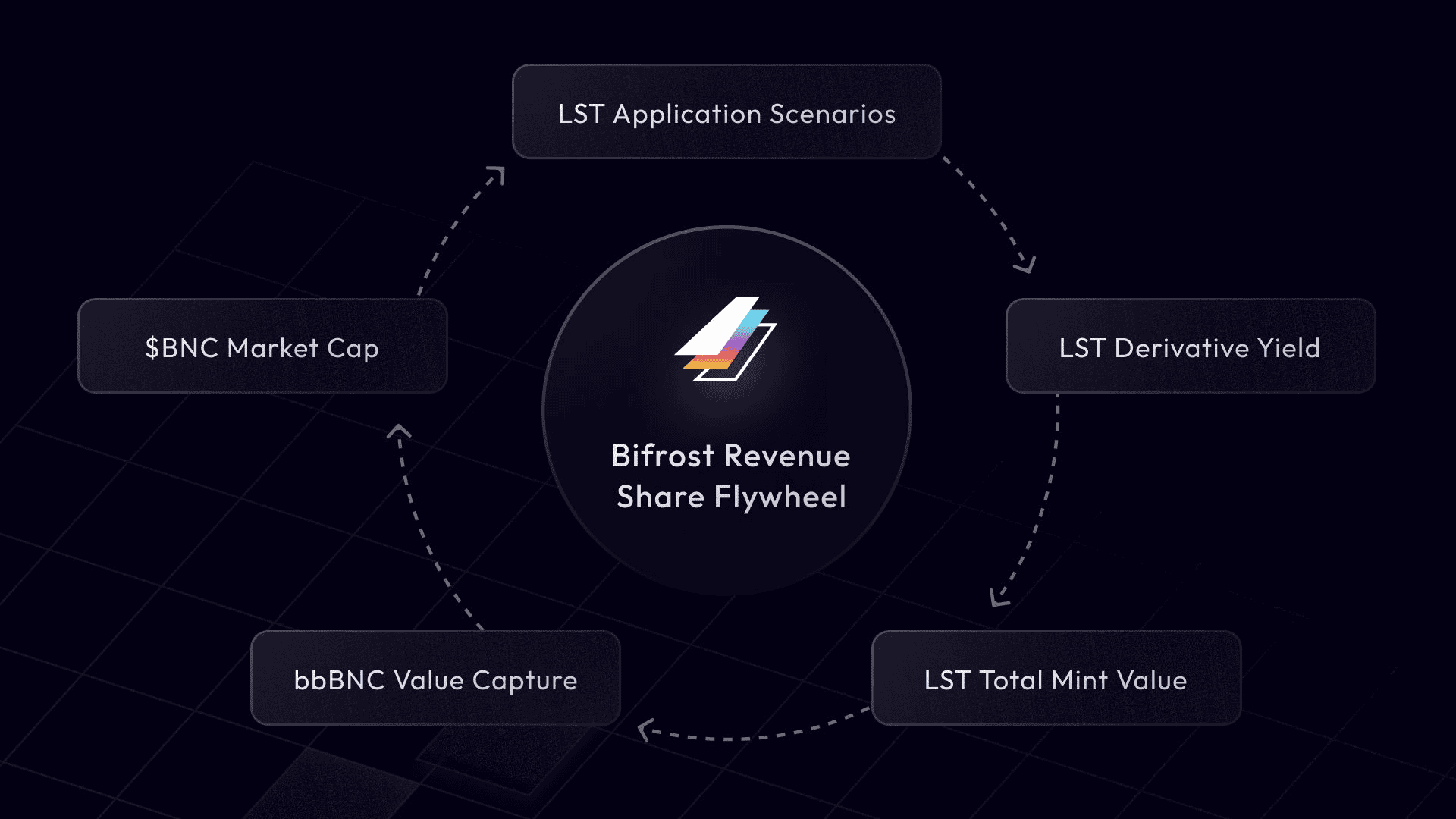

Higher BNC value capture leads to a higher market capitalization for Bifrost, which in turn drives more LST application scenarios. More application scenarios will promote an increase in the comprehensive yield of vTokens (staking yield + vToken restaking yield), resulting in more vToken minting. More vToken minting means more protocol revenue, which will enhance the returns for bbBNC holders, further capturing more value for BNC and forming a positive growth flywheel. bbBNC serves as the engine of this growth flywheel, aligning the interests of token holders closely with those of the Bifrost protocol and providing greater motivation to contribute to the co-development of the Bifrost protocol.

The Bifrost 2.0 upgrade has officially launched. Below is the ongoing roadmap. You can join Bifrost Discord community to get the latest updates or participate in the proposal discussions on the Bifrost Tokenomics 2.0 in the gov-discussions channel.

DeFi protocols are among the few crypto market sectors that have successfully achieved Product-Market Fit (PMF), with many demonstrating stable profitability. However, DeFi protocol tokens have primarily served as governance tokens, giving holders no share of the revenues generated.

These tokens should represent total equity, not just governance rights. We believe that as the community becomes more aware, the market shifts from financial nihilism to value investing, and regulatory policies become more explicit, sharing profits with token holders will become the norm for DeFi protocols.

Examples like Uniswap announcing revenue sharing with UNI holders and Bifrost introducing bbBNC in its new economic model are responses to this trend.

Founded in 2019, Bifrost has matured through two market cycles, refining its product and operational strategies to achieve stable business and revenue generation capabilities. With its pioneering efforts in chain abstraction, Bifrost has enormous growth potential. As more capital flows into the ecosystem, the protocol's value and revenue will continue to rise.

The launch of bbBNC will officially lead Bifrost towards community governance and community sharing, establishing a robust and resilient protocol.