The native token of the Bifrost protocol is the Bifrost Native Coin (BNC). BNC is used as the gas fee and governance token for the Bifrost Polkadot and Kusama chains.

Holders of BNC can engage in protocol governance by submitting proposals and voting. This includes:

We will empower vBNC with governance rights in the future, in line with other vToken Voting mechanisms.

The total supply of BNC is capped at 80,000,000, with no mechanism for additional issuance.

Bifrost is set to launch BNC 2.0, a new tokenomic model designed to create a sustainable and attractive economic framework for the protocol. This model introduces a protocol revenue-sharing mechanism, enhancing BNC's utility and value and transforming it into a yield-bearing asset. Long-term holders will benefit from fair income distribution through these mechanisms.

Bifrost's new Tokenomics will be released soon, stay tuned!

What can vTokens be used for?

vTokens have diverse applications across the Polkadot ecosystem. They offer substantial base yields, are tradable within a unified liquidity pool, and can be quickly redeemed through peer-to-peer matching. Additionally, vDOT and vKSM inherit the governance rights of the underlying assets and and offer other advantageous features.

As the Liquid Staking Token (LST) sector evolves, competition among LST protocols has shifted from basic feature comparisons to ecosystem-level contests. The focus is now on additional yield opportunities and whether LST protocols can provide diversified yield strategies to cater to various risk appetites.

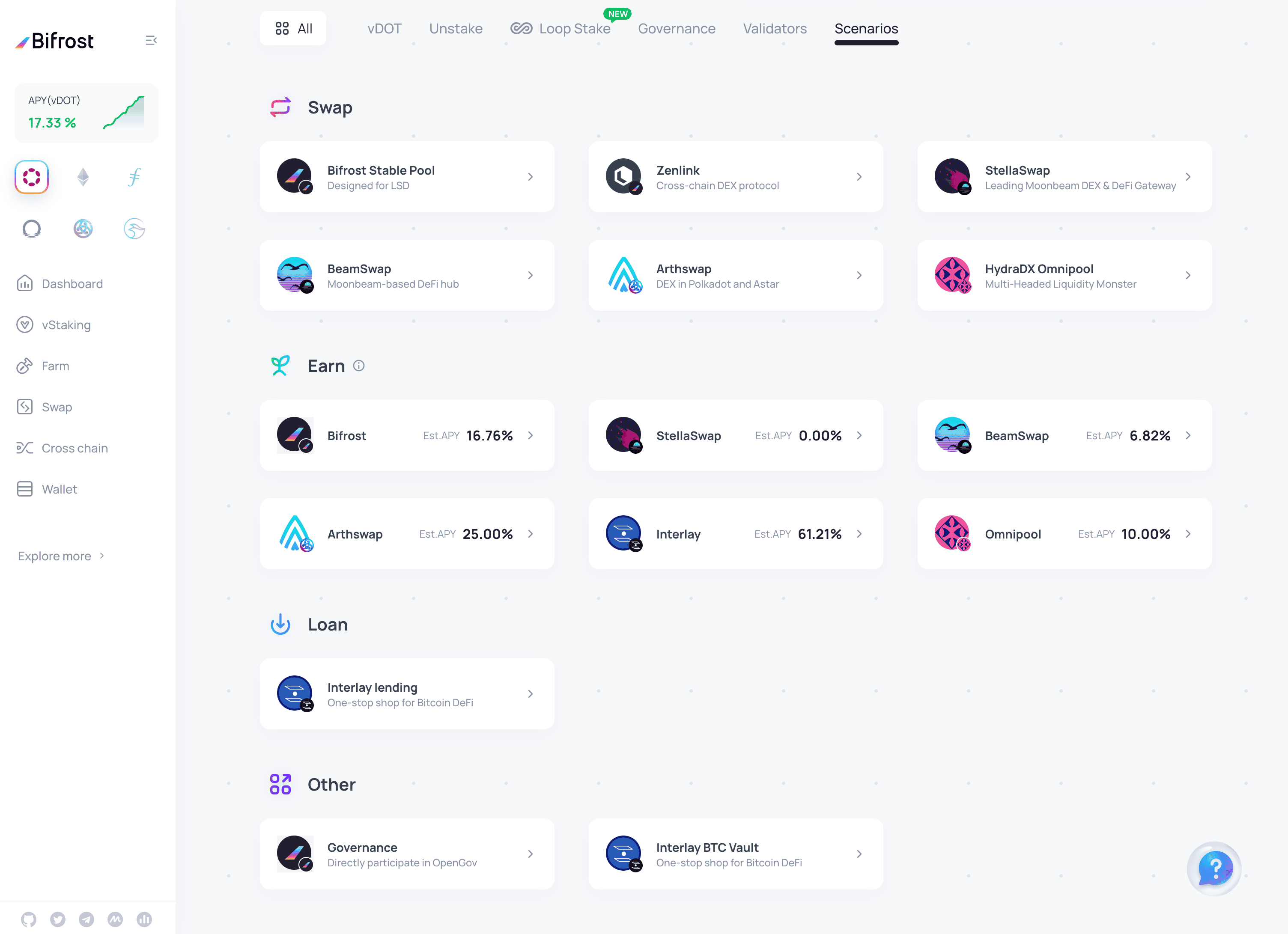

To address this, Bifrost has developed dedicated application pages for each type of vToken on its dApp, highlighting their specific use cases and benefits.

Below is the scenario page for vDOT:

On this page, Bifrost aggregates various application scenarios for vDOT and offers a comprehensive library of yield strategies under the "Earn" category to meet the needs of yield maximizers.

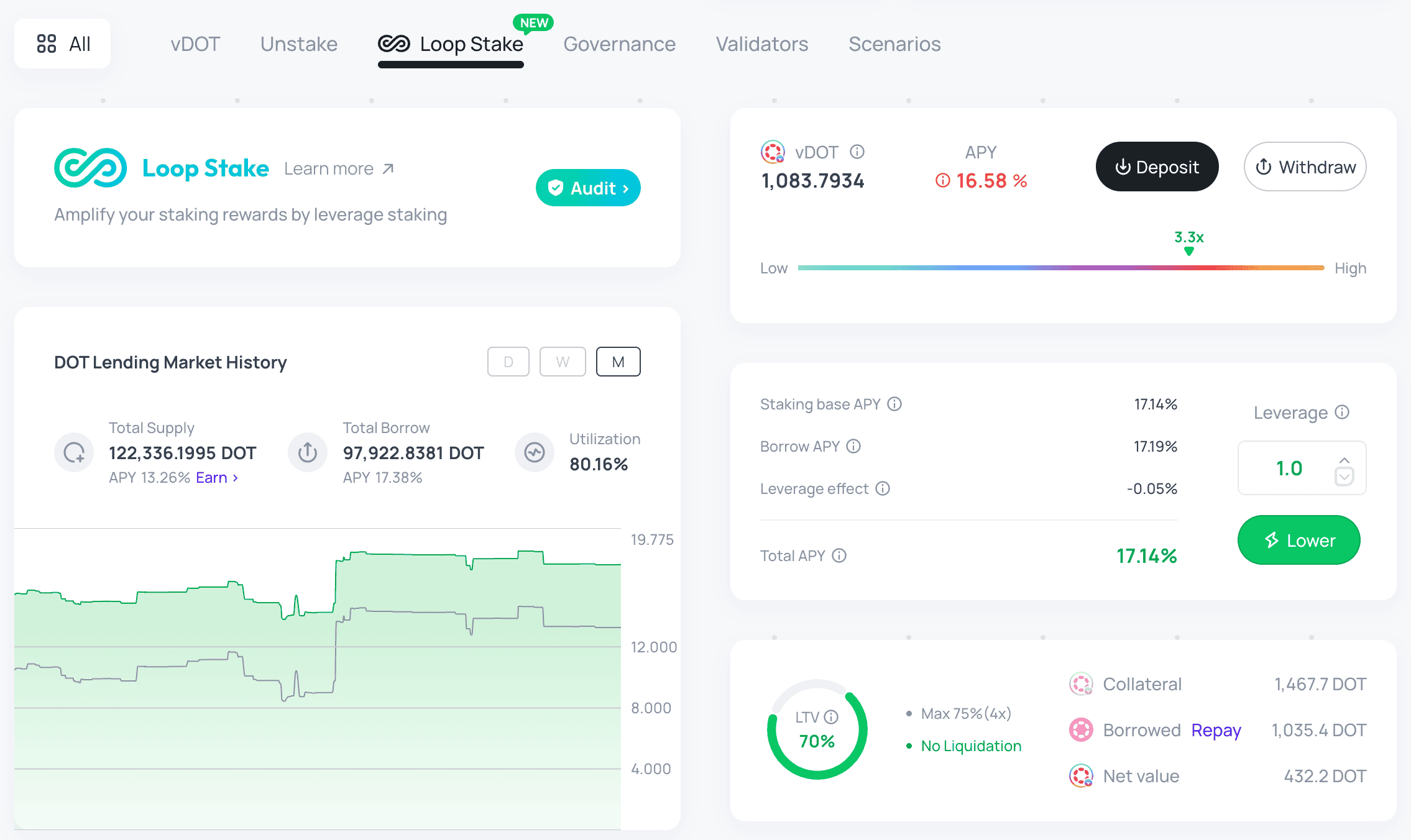

One noteworthy yield strategy for LSTs is leveraged staking. This involves combining LST and lending protocols to amplify staking returns, albeit with higher liquidation risks. Bifrost has developed Loop Stake to support leveraged staking, which allows users to set up to 4x leverage.

Leveraged staking requires liquidity from lending pools, and Loop Stake will remain open to aggregate cross-chain liquidity, offering users the best lending rates. By leveraging Polkadot’s XCM messaging and Bifrost’s cross-chain architecture, Loop Stake can remotely access liquidity from lending pools on other parachains, such as the DOT/vDOT lending pools on Interlay Lend and Hydration Omnipool.

However, considering that the growth in leveraged staking demand is a gradual process, Loop Stake initially created a local lending pool on Bifrost to provide lending liquidity, with plans to gradually expand in the future.

In the DeFi sector, "Farming as a Service" is gaining traction. DeFi protocols now offer a single source of yield and a series of combined yield strategies. This simplifies the process, enhances capital efficiency, and provides greater flexibility.

Loop Stake is just the beginning. Bifrost plans to introduce more combined yield strategy products, expanding options for vToken holders.

For more information about Loop Stake, please read:

Bifrost launches LoopStake - Supercharge Staking Rewards through Leverage Staking