When the Uniswap community flipped its “fee switch” in March 2025 and AAVE followed with a “buyback + distribution” plan in April, a quiet revolution began sweeping through DeFi. Protocol profits were no longer left idle in treasuries or spent in opaque ways — instead, they started flowing directly into token holders. This marked a key milestone in the journey toward true decentralization.

DeFi is entering profit-sharing era, where protocols share real yield with their communities. This shift will attract more traditional investors and gradually transform token holders from speculators into value-oriented participants.

In traditional markets, dividends form a one-way connection between companies and investors. Shareholders passively wait for quarterly payouts without influencing operations.

But in crypto, profit sharing means something deeper. DeFi communities are not just investors — they supply liquidity, build products, write code, and shape narratives. By distributing protocol profits back to contributors, projects strengthen alignment, deepen engagement, and create a lasting symbiosis between the protocol and its community.

A loyal, value-driven stakeholder base becomes not just an audience — but the protocol’s growth engine.

As “profit distribution” becomes a DeFi standard, designing how to distribute value has become a new competitive frontier. Unlike traditional companies, protocols have extraordinary flexibility — they can choose between buyback-and-burn, buyback-and-distribute, or hybrid mechanisms.

To build a sustainable growth flywheel, Bifrost introduced Tokenomics 2.0 — a simple yet powerful framework that aligns yield, governance, and participation.

In Tokenomics 1.0, BNC (Bifrost’s native token) served primarily for gas fees and governance. It didn’t fully capture the protocol’s value creation.

With Tokenomics 2.0, Bifrost embeds a continuous profit-sharing mechanism: 100% of protocol profits are distributed to the community — part through monthly BNC buybacks, part through revenue sharing.

To enable this, Bifrost introduced bbBNC (Buy-Back BNC) — a non-transferable token representing users’ share of protocol profits.

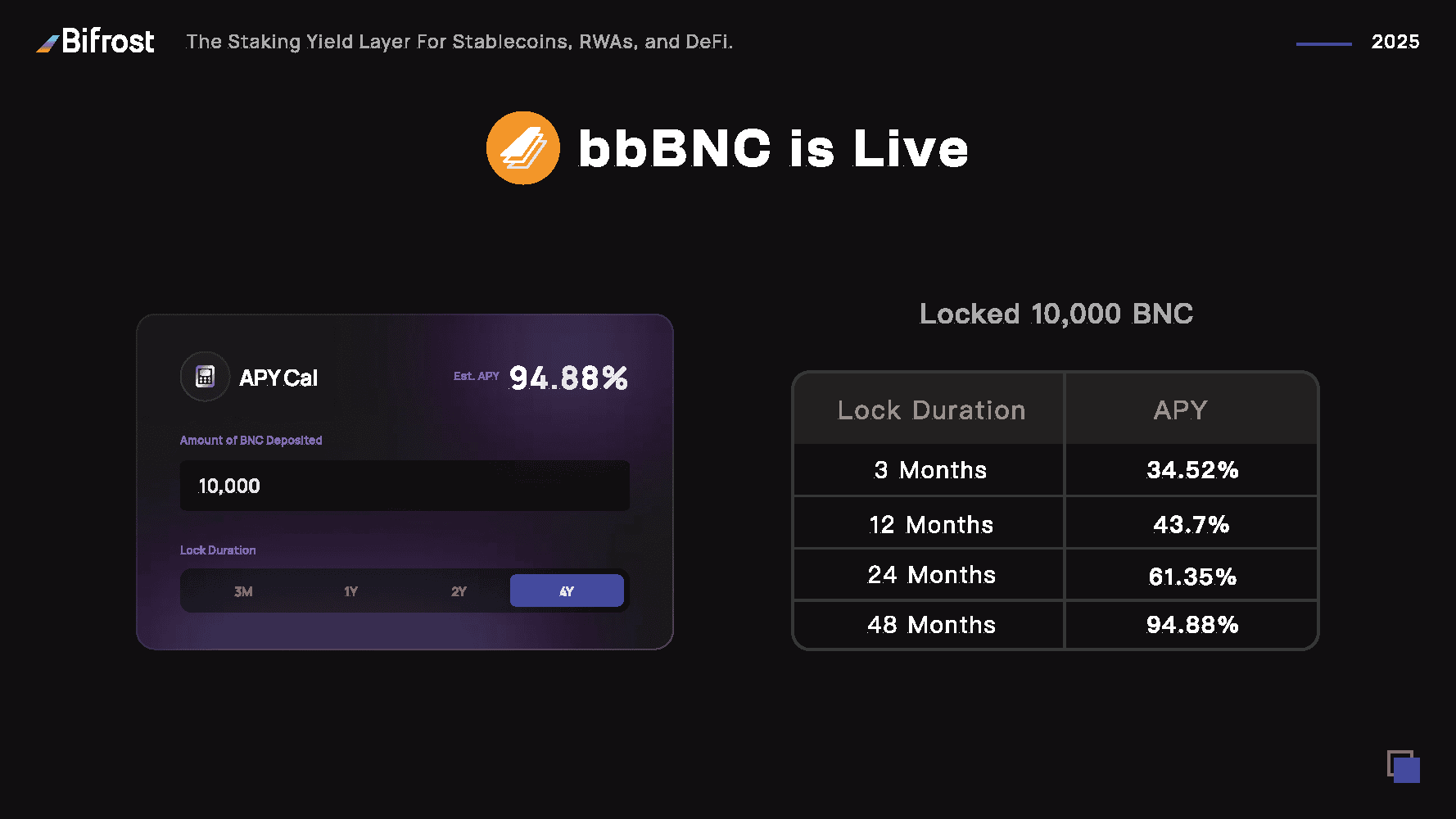

bbBNC can only be obtained by locking vBNC, the liquid staking derivative of BNC. The amount of bbBNC a user receives depends on both the quantity of vBNC locked and the duration of the lock:

Lock vBNC for 4 years → receive bbBNC 1:1

Lock for less → receive proportionally (vBNC × lock period ÷ 4 years)

As the lock approaches expiry, bbBNC gradually decays — but users can extend their lock anytime to maintain full rewards. The logic is similar to Curve’s veCRV, yet more flexible: bbBNC supports soft unlocking, allowing users to withdraw early at a discount.

Each month, Bifrost’s net profits are used to buy back BNC from the market. Of this, 10% is burned, and 90% is distributed to bbBNC holders.

This creates a natural incentive balance: the longer and larger you lock, the greater your share of ongoing revenue.

bbBNC holders also enjoy boosted rewards in vToken Farming campaigns — rewarding those who actively provide liquidity and strengthen the ecosystem.

The result is a well-tuned value loop:

Together, these mechanics turn Bifrost’s profit engine into a transparent, self-sustaining system — rewarding participation, not speculation.

As a leading staking yield layer, Bifrost’s income streams are diversified and predictable:

Future growth lies in two directions:

Together with Hyperbridge, Bifrost has submitted a Polkadot Treasury proposal for 795,000 DOT to fund multi-chain incentives, boosting vDOT liquidity and adoption across the broader DeFi landscape.

As the market matures and hype fades, only protocols capable of transmitting real value to their participants will endure.

True DeFi innovation isn’t about complex financial engineering — it’s about reprogramming how value circulates. When every protocol dollar earned becomes on-chain yield for its holders, and every governance right is backed by long-term commitment, DeFi completes its leap from a trading revolution to a value revolution.

This transformation is quiet — no wild price charts, no social media frenzy — yet it’s fundamentally rewriting how protocols sustain themselves.

For long-term investors, this is the moment to pay attention. Bifrost’s bbBNC model may not only redefine value alignment within its own ecosystem but also set a blueprint for how DeFi can evolve — from speculation to sustainable on-chain economics.

The age of algorithmic, transparent, and community-owned on-chain profit sharing has just begun.