Protocols have mostly rewarded those who provide liquidity, not token holders. However, there have always been discussions about distributing the platform's profits to token holders, but the plan was previously paused due to regulatory concerns and broader uncertainty.

As the political environment improves, this idea is making a comeback, with many voices loudly declaring that the DeFi Renaissance is upon us. But what does this renaissance look like, and how can DeFi evolve to better share its profits to its users?

The challenge facing many leading DeFi protocols is a lack of direct profit sharing with token holders. Take Uniswap as an example, whilst it generates substantial revenue from liquidity provision, token holders don’t directly benefit from this, unlike traditional finance where shareholders receive dividends. Instead, DeFi tokens often serve as governance tools, susceptible to volatility, speculation, and dilution risks.

Here’s where the Fee Switch concept comes in. By implementing a mechanism that redistributes protocol profits—such as transcation fees or staking rewards—to both liquidity providers and token holders, protocols could start to create a more sustainable, inclusive ecosystem.

When more users can benefit financially, more users join the protocols. This creates a virtuous cycle: higher total locked value (TVL) generates more fees, which are then redistributed, leading to even more activity.

But if this idea is so promising, why hasn’t it been widely implemented? Let’s explore the obstacles that still stand in the way.

However, implementing a Fee Switch isn't as straightforward as it might seem. Despite the potential for significant revenue, many protocols hesitate to adopt this model for various reasons. Uniswap’s proposal to share fees with $UNI stakers in February 2024 met resistance due to a study by Gauntlet, which suggested that a 10% fee could hurt liquidity and trading volumes, possibly pushing users to competitor platforms.

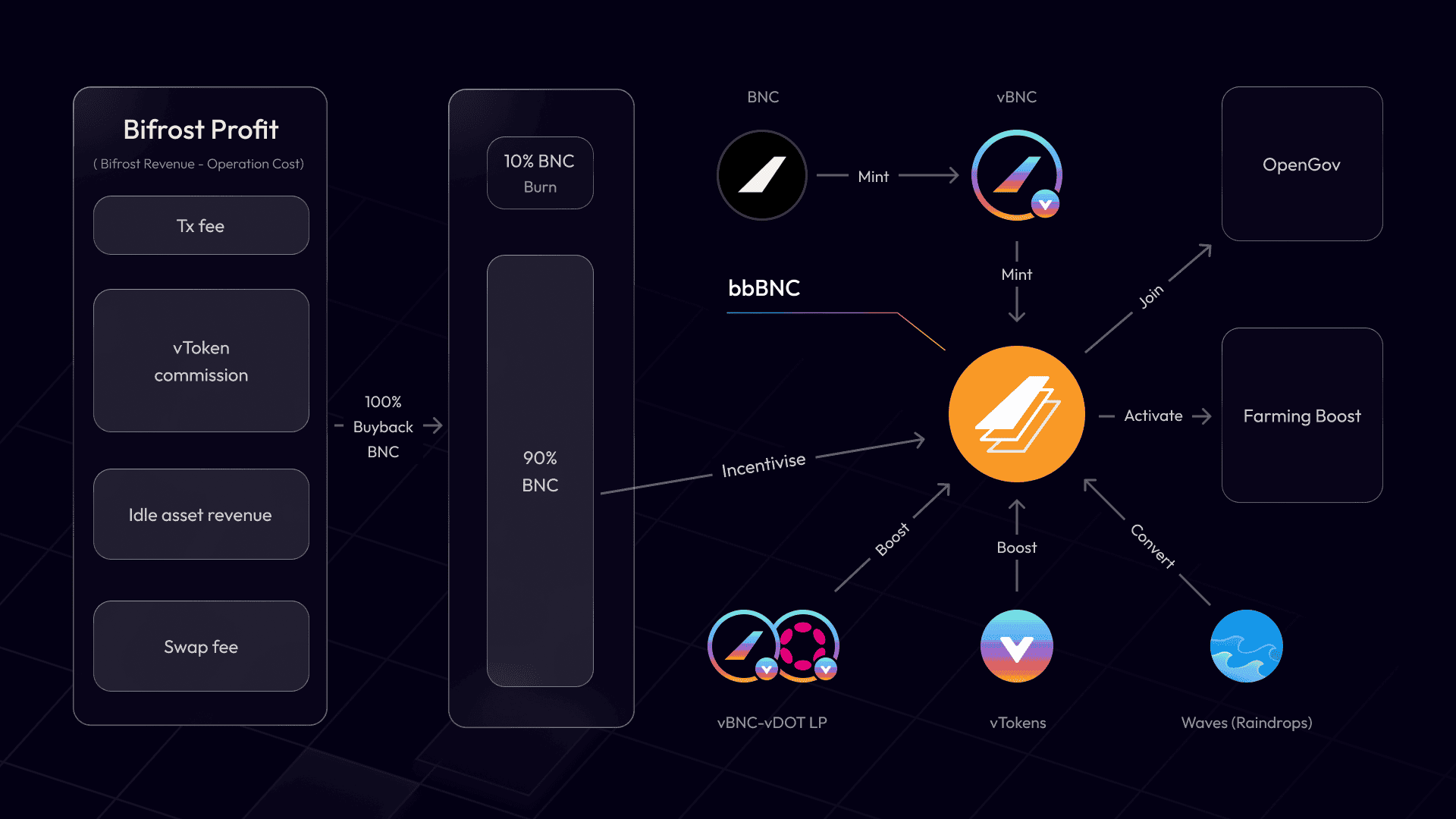

Bifrost Tokenomics 2.0 goes beyond the basic Fee Switch idea. Enter bbBNC, an escrow token designed to foster long-term alignment to the protocol. Users can lock their vBNC—from liquid staking—to receive revenues proportional to the duration of their lockup.

Here’s how it works:

The idea behind bbBNC is clear: incentivize long-term holding and align token holders with the protocol's growth.

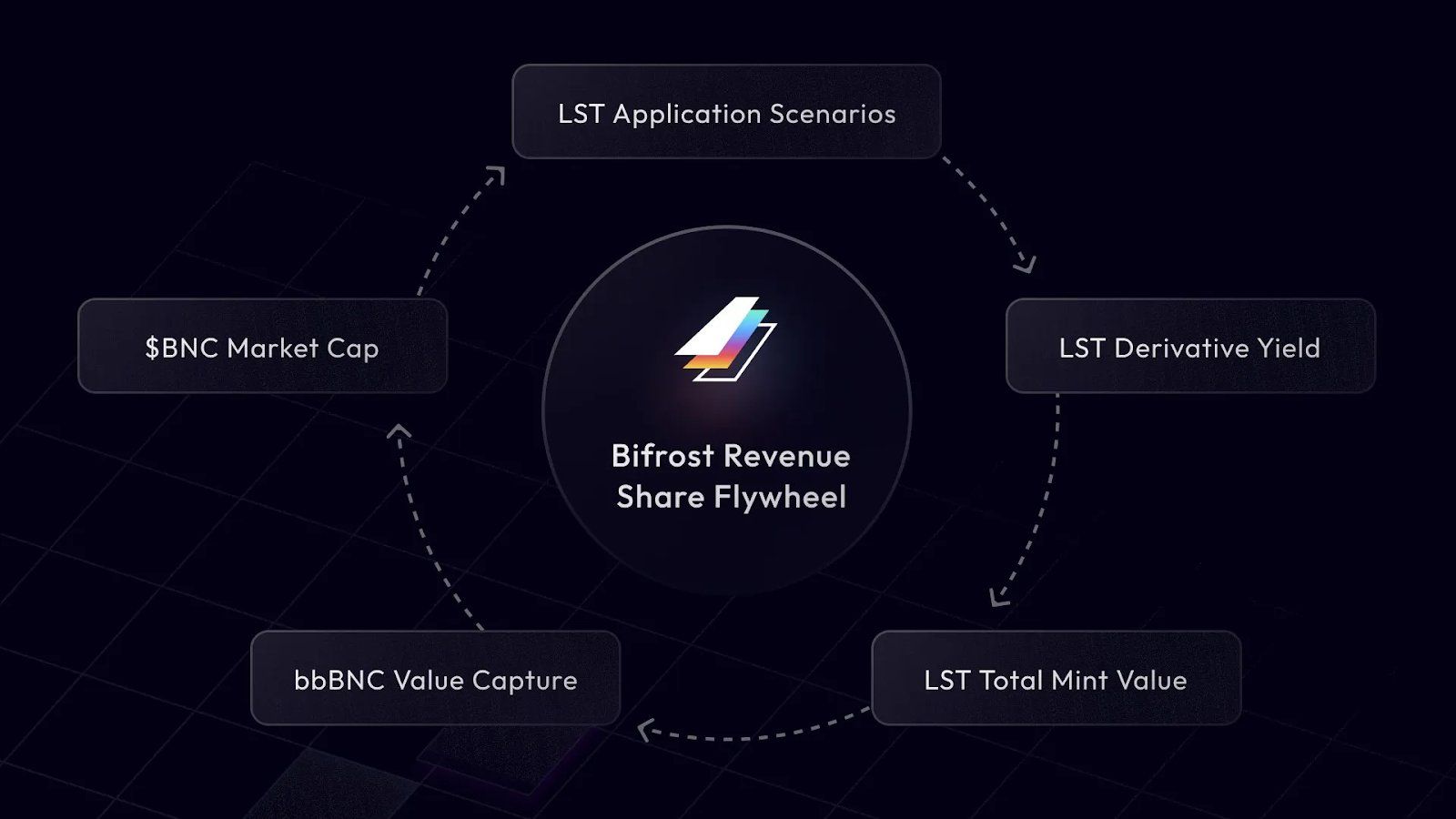

As utility for products increases, it draws in more TVL. This increase in TVL generates greater revenue for the protocol, which is then partially used to buy back BNC, thereby increasing its value.

You can check Bifrost Revenues and Profits on this page: Bifrost Stats

Furthermore, this revenue is strategically funneled into incentivizing key liquidity pools, offering competitive and sustainable yields. This strategy attracts more stable, long-term TVL, enhancing liquidity and perpetuating a virtuous flywheel.

More TVL leads to more revenue, which supports Bifrost's growth by encouraging broader engagement with vTokens. This flywheel effect not only boosts BNC's value but also motivates all participants to contribute to the ecosystem's expansion.

The design of bbBNC offers a vision for the future of DeFi: stable, committed users who are directly rewarded for their contributions to the protocol's success. By locking tokens for longer periods, participants can earn a larger share of the protocols revenue, potentially increasing the value of the protocol’s native token over time.

Build protocol value → Capture earnings → Fuel buybacks

Repeat until...There are no market cycles, only compounding curves.

Earn, Share, Grow – The Bifrost Way 🌈