Liquid staking has emerged as the largest part in decentralized finance (DeFi) by Total Value Locked (TVL), serving as a crucial foundational infrastructure in DeFi. After intense competition, each public blockchain has effectively established its own leading Liquid Staking Token (LST) protocol—for example, Lido on Ethereum and Jito on Solana.

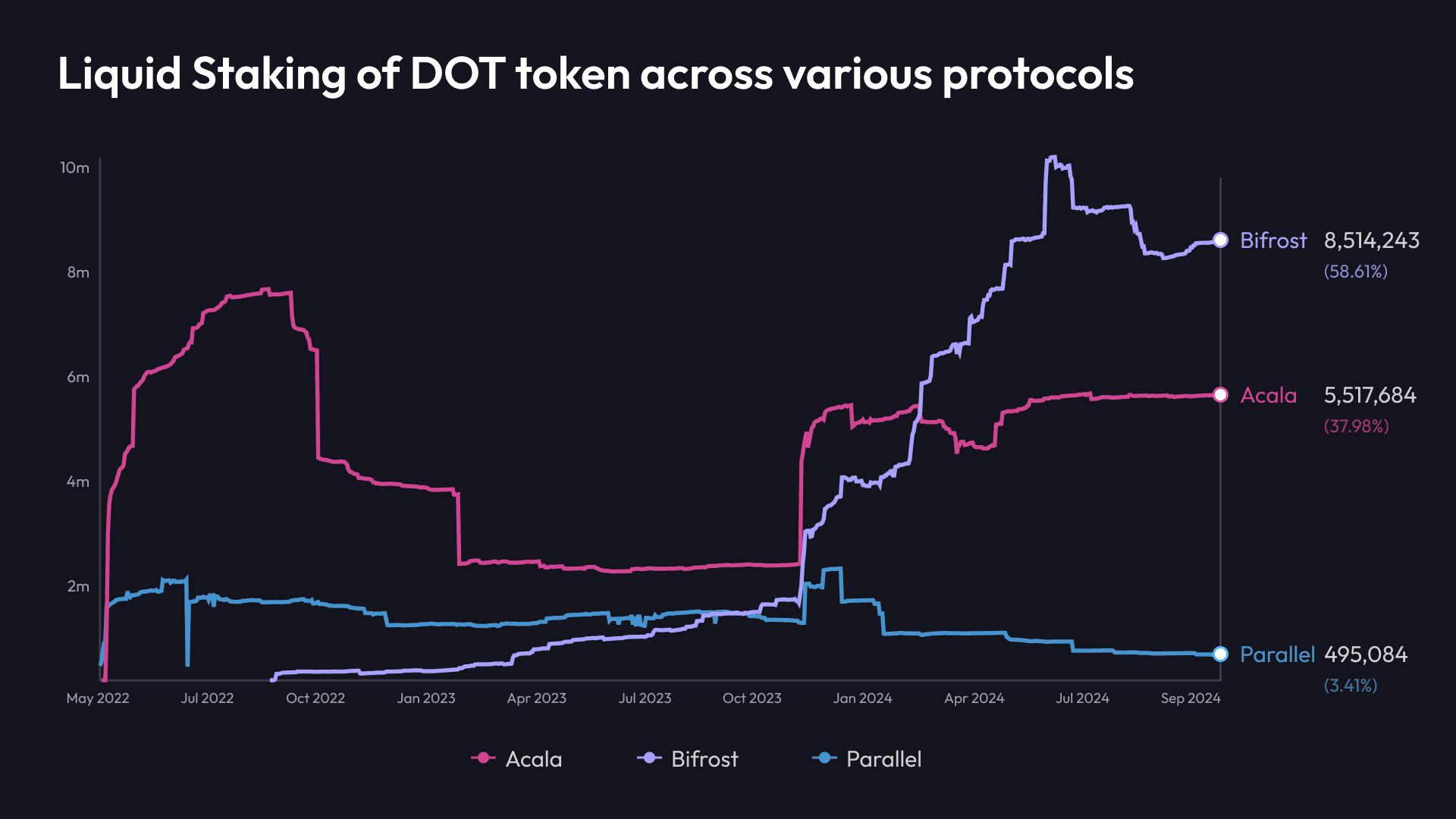

Turning our attention to Polkadot, Bifrost stands as the leading LST protocol within its ecosystem. Boasting a TVL exceeding $100 million, it accounts for over 60% of the total TVL in Polkadot's Liquid Staking Tokens (LST).

However, this dominance wasn't always the case. Bifrost entered the Polkadot LST arena relatively late and initially lacked scale advantages. So how did Bifrost, through steady and strategic progress, achieve such a remarkable turnaround in growth? Let's delve into its journey.

On July 15, 2021, Bifrost participated in the Kusama parachain auctions and won one of Kusama's Top5 slots by raising over 140,000 KSM through its crowdloan. Shortly thereafter, the Bifrost network officially connected to Kusama, becoming a Kusama parachain. Through our continuous upgrades and refinements, the Bifrost Kusama parachain entered the stable operation phase of the mainnet.

During this phase, Bifrost built the Staking Liquidity Protocol (SLP), launched vETH, and completed the initial exploration of its LST business.

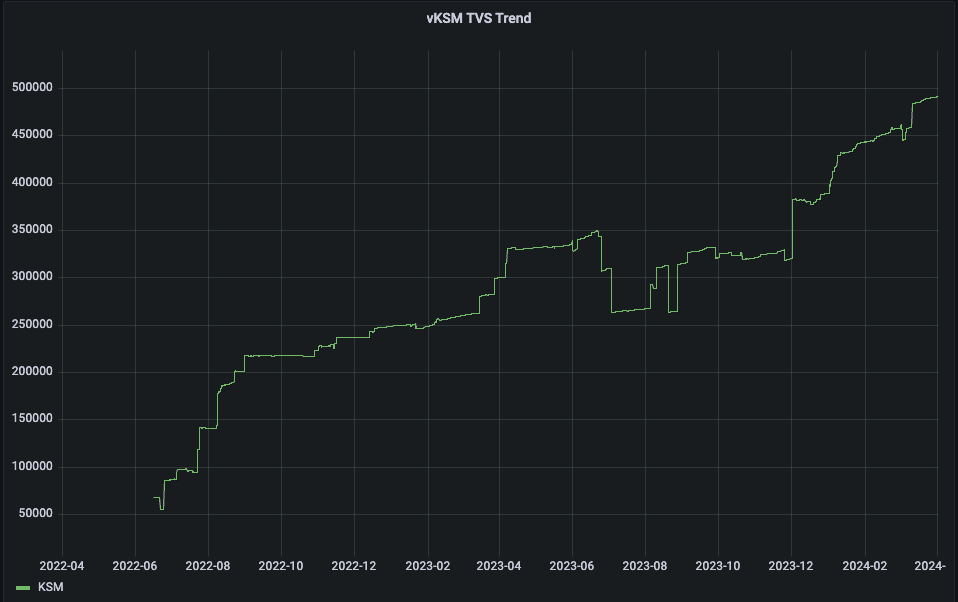

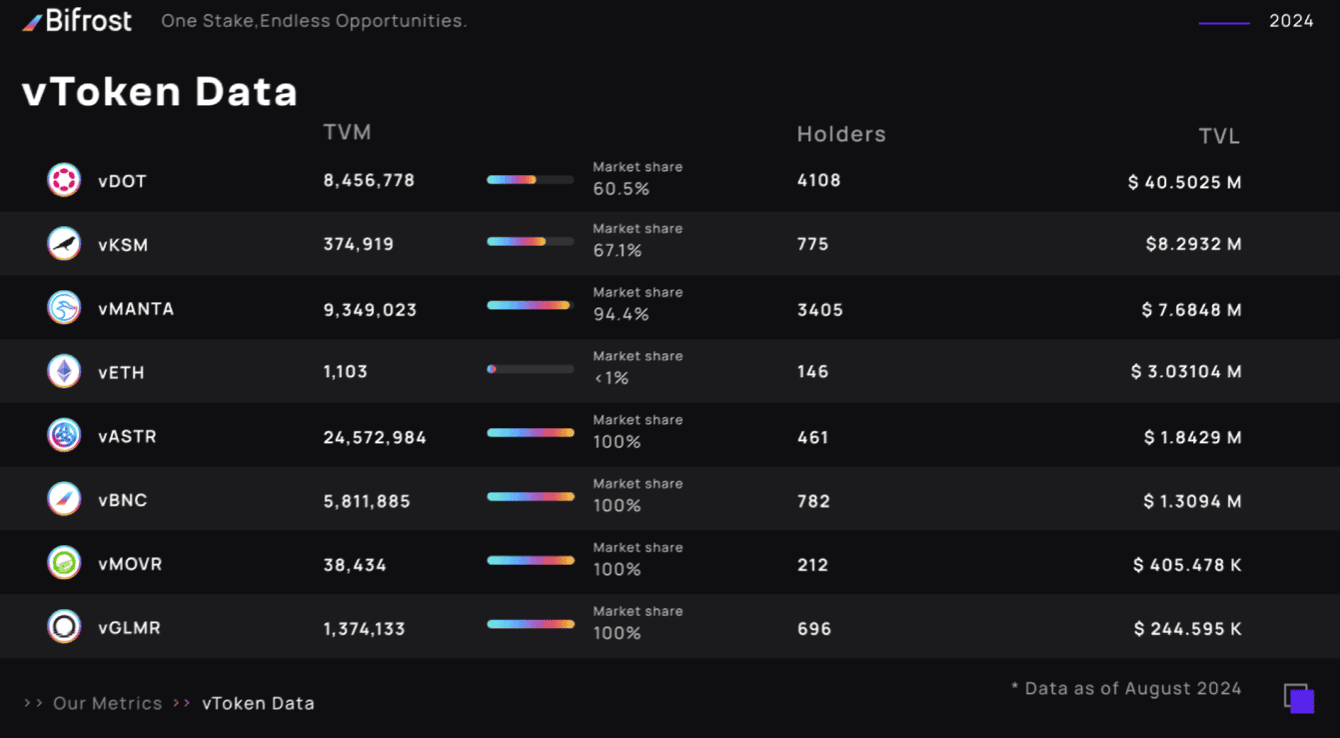

Between 2022 and 2023, Bifrost successfully won a Polkadot slot auction and migrated most of its operations to the Bifrost Polkadot Parachain. It successively launched six LSTs of parachain asset: vKSM, vDOT, vMOVR, vGLMR, vBNC, and vASTR.

During this phase, vKSM became the primary contributor to Bifrost's TVL. Through several Rainbow Boost events, the total minted volume of vKSM grew from about 50,000 to a peak of around 500,000, and currently stabilizes at around 350,000, with a market share exceeding 60%.

While growth may seem superficial and incentives from operational activities offer only short-term effects, the fundamental reason behind Bifrost's sustained TVL growth—and its explosive surges when opportunities arise—is its continuous development and accumulation. The suite of extended services that Bifrost has built around vTokens provides holders with greater capital efficiency and flexibility.

These extended services include:

Node Delegation Strategy and Slash Protection: Based on VBL, Bifrost adopts a flexible node delegation strategy, which allows vToken yields to be slightly higher than competitors. When nodes experience failures or security risks, it automatically switches nodes to ensure that holders' earnings are not affected. Moreover, Bifrost provides protection against slashing through the BNC Vault. When a slash loss occurs, the funds in the vault are used first for compensation, ensuring that users' earnings are not impacted.

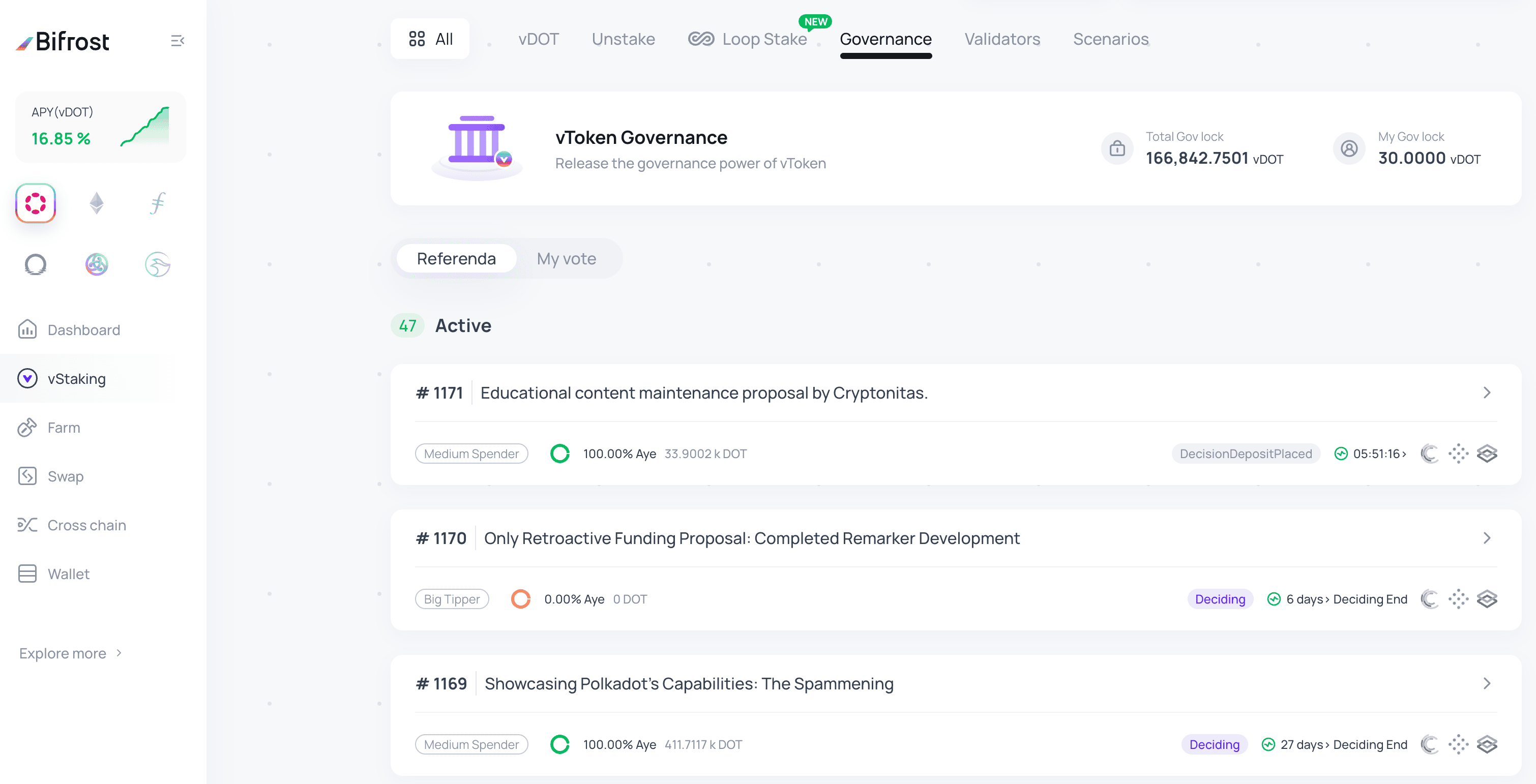

Governance Rights Inheritance: vTokens can be used to participate in OpenGov governance (currently supporting vDOT and vKSM, with more vToken governance support coming soon). For stakers, governance rights always remain in their own hands and are not transferred to the Bifrost protocol. For users who inherently need to participate in governance, staking for vTokens first and then using vTokens to participate in governance allows them to earn additional staking rewards—why not?

Rich Applications: All LSTs aim to unlock liquidity, allowing users to enjoy both staking rewards and liquidity. However, the key issue is how users can realize or utilize this unlocked liquidity. Therefore, Bifrost is always committed to expanding the use cases of vTokens.

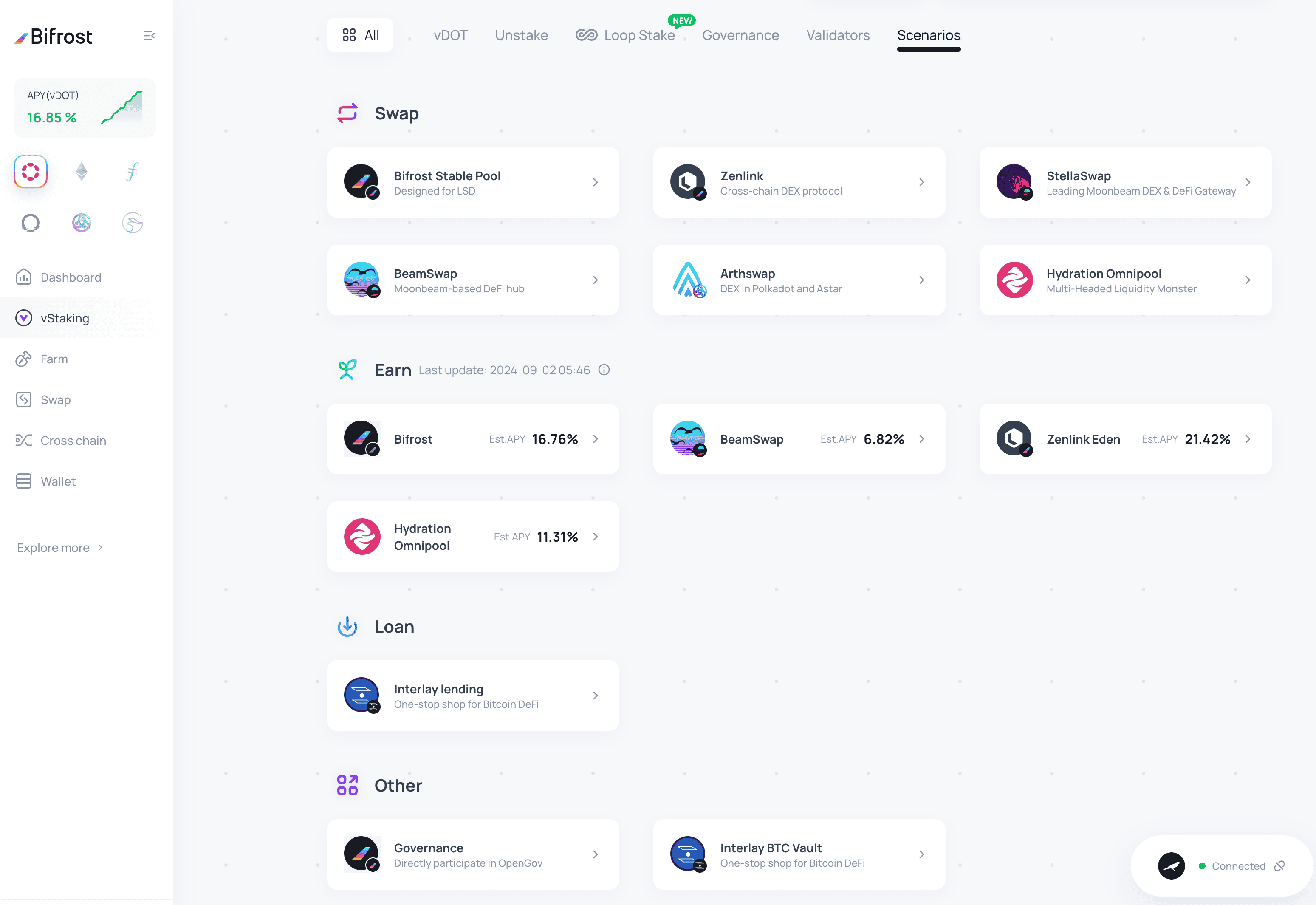

Within the Bifrost Dapp, we've aggregated various use cases for vTokens. Using vDOT as an example, let's delve into these possibilities.

Swap

vDOT can be swapped to DOT at any time thanks to the deep liquidity we've established. Beyond the official pool, we've provided liquidity on Moonbeam (Stellaswap, Beamswap), Astar (Arthswap), and Hydration to facilitate swaps across these chains.

Earn

vDOT is inherently an interest-bearing asset, accruing staking rewards from the underlying staked DOT. However, for vDOT holders, this is just one stream of income. vDOT can also generate additional earnings through supported DeFi protocols.

Loan

Through Interlay Lending, you can deposit vDOT as collateral to borrow other assets such as DOT or iBTC.

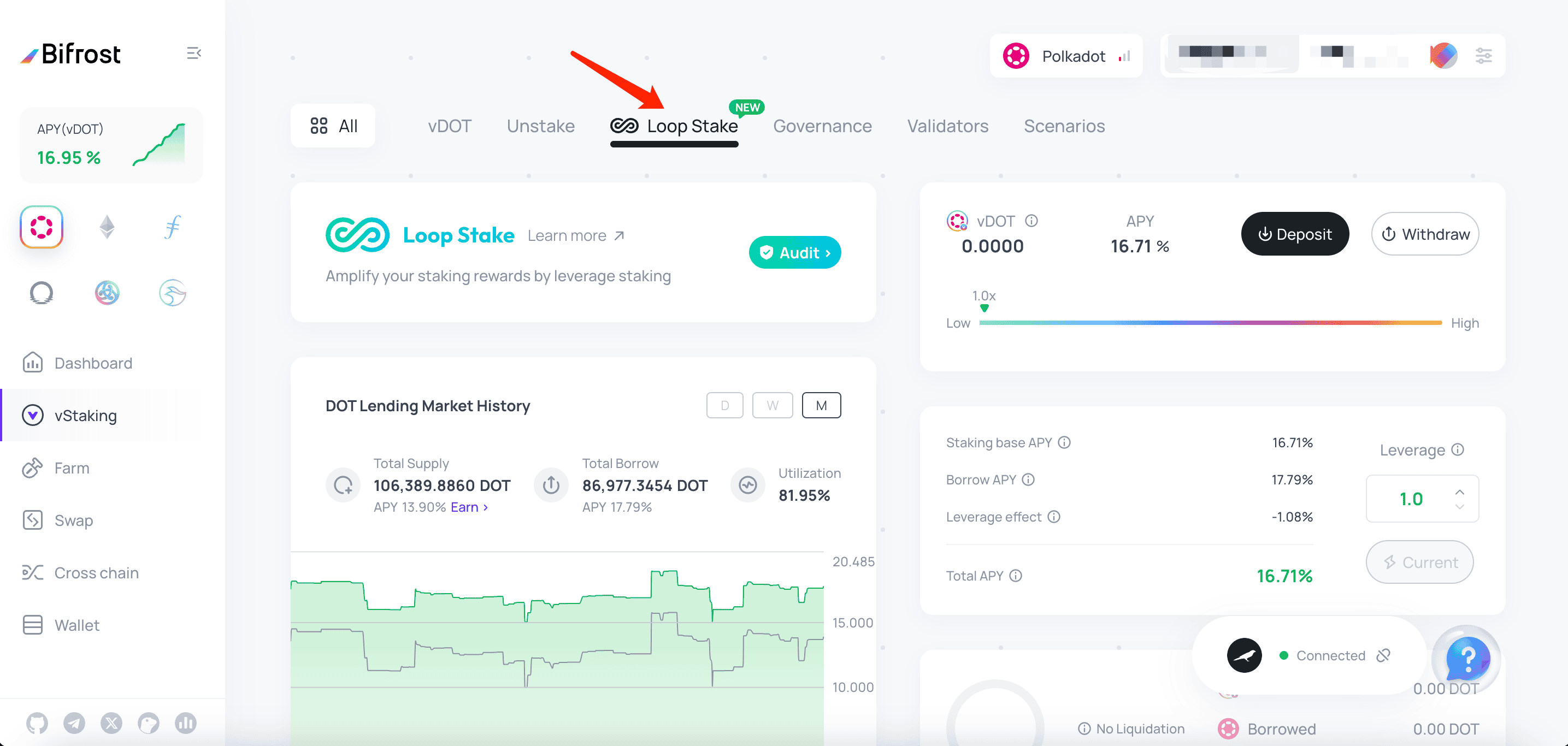

Loopstake

On March 13, Bifrost launched Loopstake, a leverage staking tool for Polkadot assets (supporting up to 4x leverage). Accessed via the vToken management interface in the Bifrost DApp, Loopstake offers seamless, one-click leveraged staking. Initially supporting DOT and KSM, there are plans to expand to more parachain assets in the future.

In summary, we can say: Anything DOT can do, vDOT can do as well; whatever benefits DOT holders have, vDOT holders also enjoy. The same applies to other vTokens, which is why vTokens are favored by stakers!

Currently, vTokens hold a dominant market position in the Polkadot ecosystem. Both vDOT and vKSM command over 60% of the market share, and on many parachains, Bifrost serves as the exclusive LST protocol, occupying nearly 100% of the market share.

Due to the interoperable multi-chain structure of the Polkadot ecosystem, Bifrost adopted a different approach from other LSTs when building the vToken module, namely the SLP.

In supporting parachain asset LSTs, Bifrost uses its own parachain as the sole protocol hub rather than deploying on multiple chains. When users mint vTokens on other chains, the process involves three steps: cross-chain transfer → minting → cross-chain transfer. For example, when a user deposits MOVR to mint vMOVR on the Moonriver chain, the MOVR is first transferred cross-chain to the Bifrost chain, minted into vMOVR, and then transferred back to Moonriver for the user.

We call this the "Omnichain Architecture." It enables a chain abstraction level user experience, allowing users on other chains to interact with the vToken module on the Bifrost chain to perform remote minting, redemption, swap, and other activities—without the need for intermediate cross-chain steps. This architecture also allows vTokens to derive multi-chain yield combination strategies, achieving maximum capital efficiency.

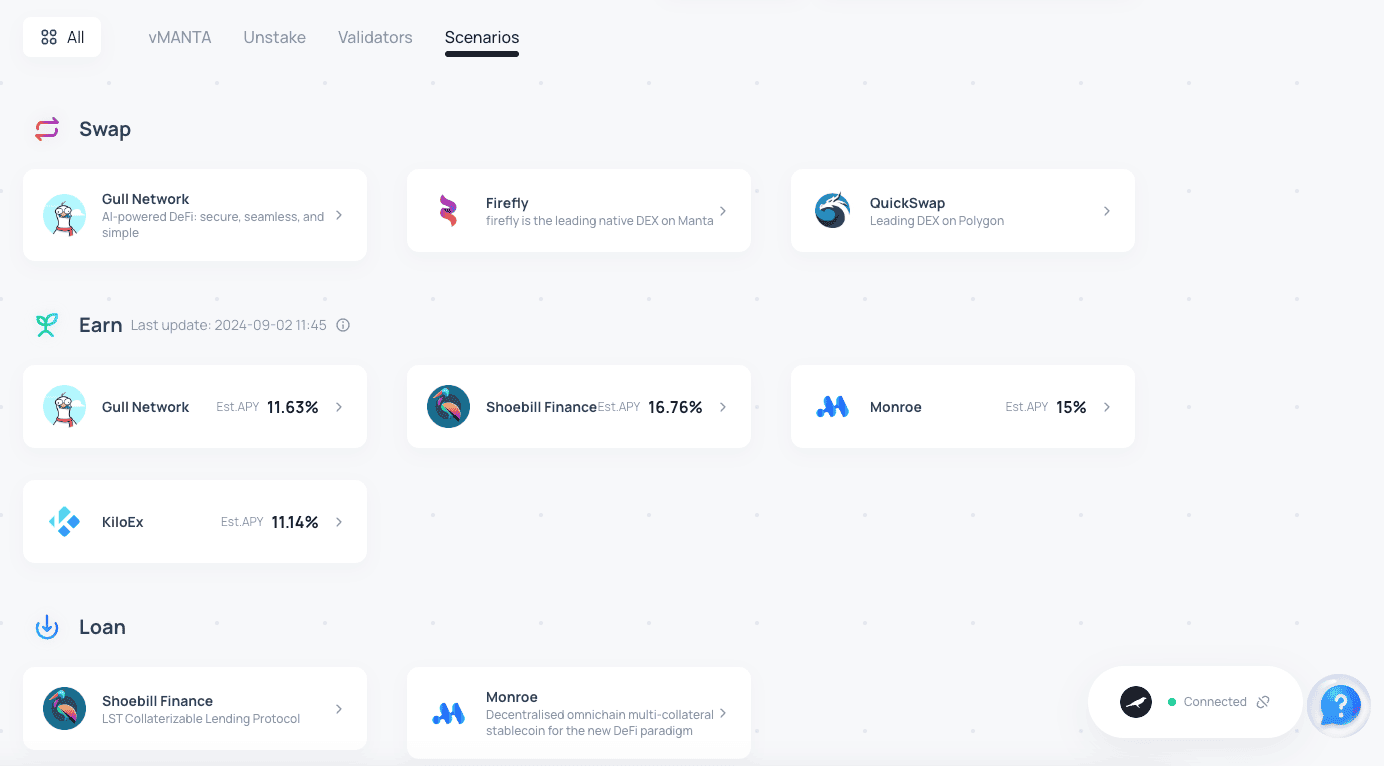

Earlier this year, Manta launched its mainnet. When the Manta chain needed an LST service provider, Bifrost became the preferred choice and received support from the Manta Foundation, primarily because Manta itself has a multi-chain architecture.

Manta operates two chains: Manta Atlantic and Manta Pacific—the former being a Substrate chain and the latter an EVM chain. However, Manta aims to avoid ecosystem fragmentation between these two chains. Bifrost's omnichain architecture allows users on both Manta Atlantic and Manta Pacific to access Bifrost's LST services locally to mint, redeem, and trade vMANTA. Moreover, applications on both chains can easily integrate vMANTA, providing it with more use cases. This is the unique advantage of the omnichain architecture

Currently, vMANTA's market share among LSTs in the Manta ecosystem has reached over 94%.

However, for Bifrost, this is just the first step in its omnichain LST journey. While Bifrost originated from Polkadot, its goal is to leverage the omnichain architecture to provide LST services for more heterogeneous chains—as cross-chain infrastructure matures and trends like chain abstraction and intent-based application development gain traction.

There's still a lot of work to be done!