The crypto market is known for its high volatility. Even liquid staking tokens (LSTs), which are backed by underlying assets, are not immune to depegging and severe price swings during extreme market conditions. As a leading LST in the Polkadot ecosystem, how does vDOT manage to recover its price quickly during volatility? This article offers a deep dive into the mechanics behind vDOT's quick price recovery.

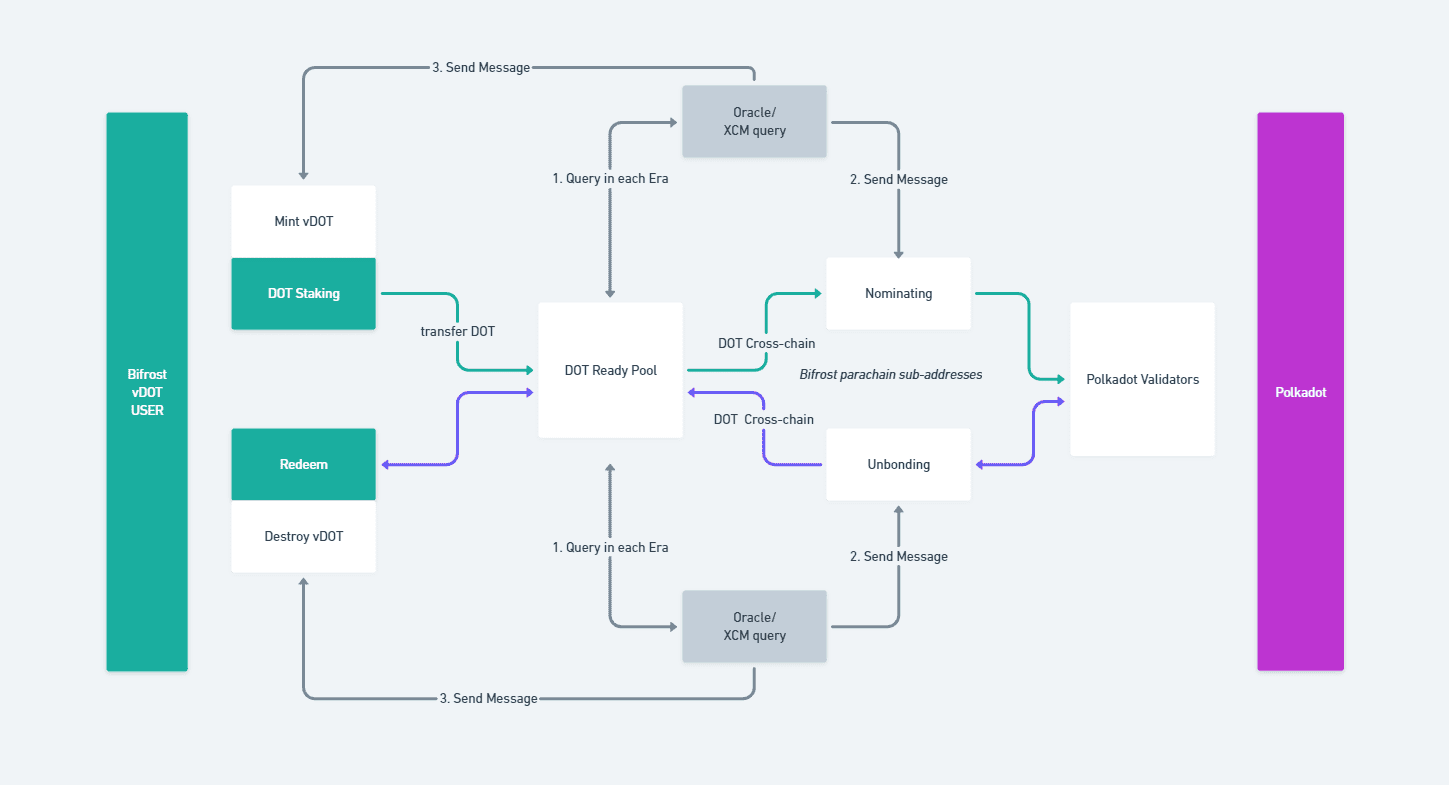

vDOT, issued by Bifrost, is a liquid staking token of DOT. When users stake DOT through Bifrost, they receive vDOT in return—an interest-bearing token that accrues staking yield while remaining fully liquid.

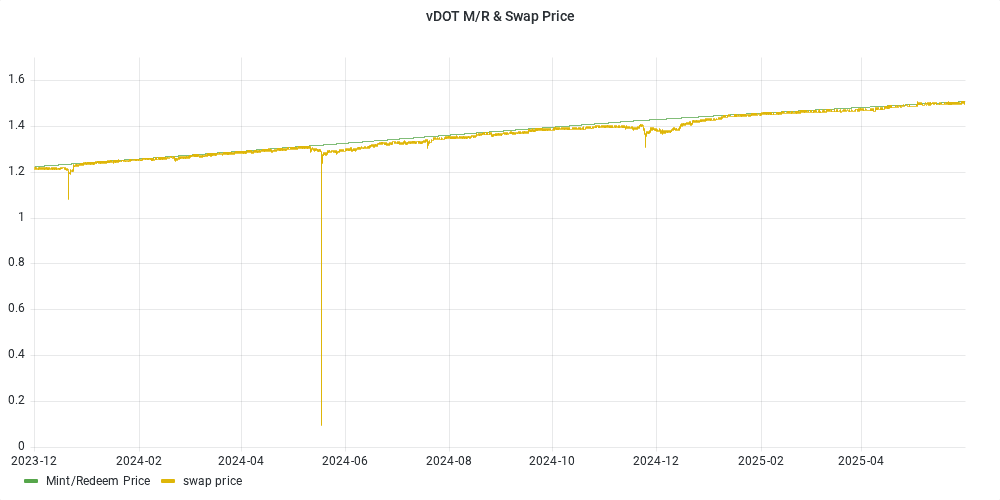

As a result, 1 vDOT is generally worth more than 1 DOT, since it includes both the principal and the accumulated rewards. Additionally, vDOT can be used across DeFi applications—for lending or as liquidity in pools—further enhancing its utility value.

vDOT holders can exit their positions through two primary mechanisms: Redeem (protocol-level unbonding) and Swap (secondary market trades on DEXs). Under normal market conditions, the vDOT-DOT exchange rate remains stable and tracks closely with its intrinsic value. However, deviations may arise depending on the chosen redemption method and prevailing liquidity conditions.

Users can submit a redemption request directly to Bifrost. In this mode, the redemption rate is based on vDOT’s accrued yield (approximately 1:1 plus staking rewards), and is not affected by secondary market prices. Therefore, this process does not trigger price volatility.

The unstaking time depends on market conditions. If there are new users staking DOT and minting vDOT, redemption can complete faster than Polkadot’s native 28-day unbonding period. If no new staking occurs, users must wait the full 28 days.

Alternatively, users can swap vDOT via decentralized exchanges such as Bifrost’s StableSwap or Hydration. This offers instant liquidity but is subject to AMM pricing mechanics and liquidity depth. In volatile markets or under abnormal selling pressure, insufficient pool depth can result in slippage and short-term depegging from the vDOT-DOT fair value.

For instance, on May 17, 2024, a wallet compromise led an attacker to liquidate approximately 222,000 vDOT (~$1M USD) on Bifrost StableSwap. This aggressive dump briefly pushed vDOT’s exchange rate to an all-time low.

Despite the rapid selloff, vDOT’s price rebounded within hours. The primary drivers of this recovery were market arbitrage mechanisms and protocol-level safety features.

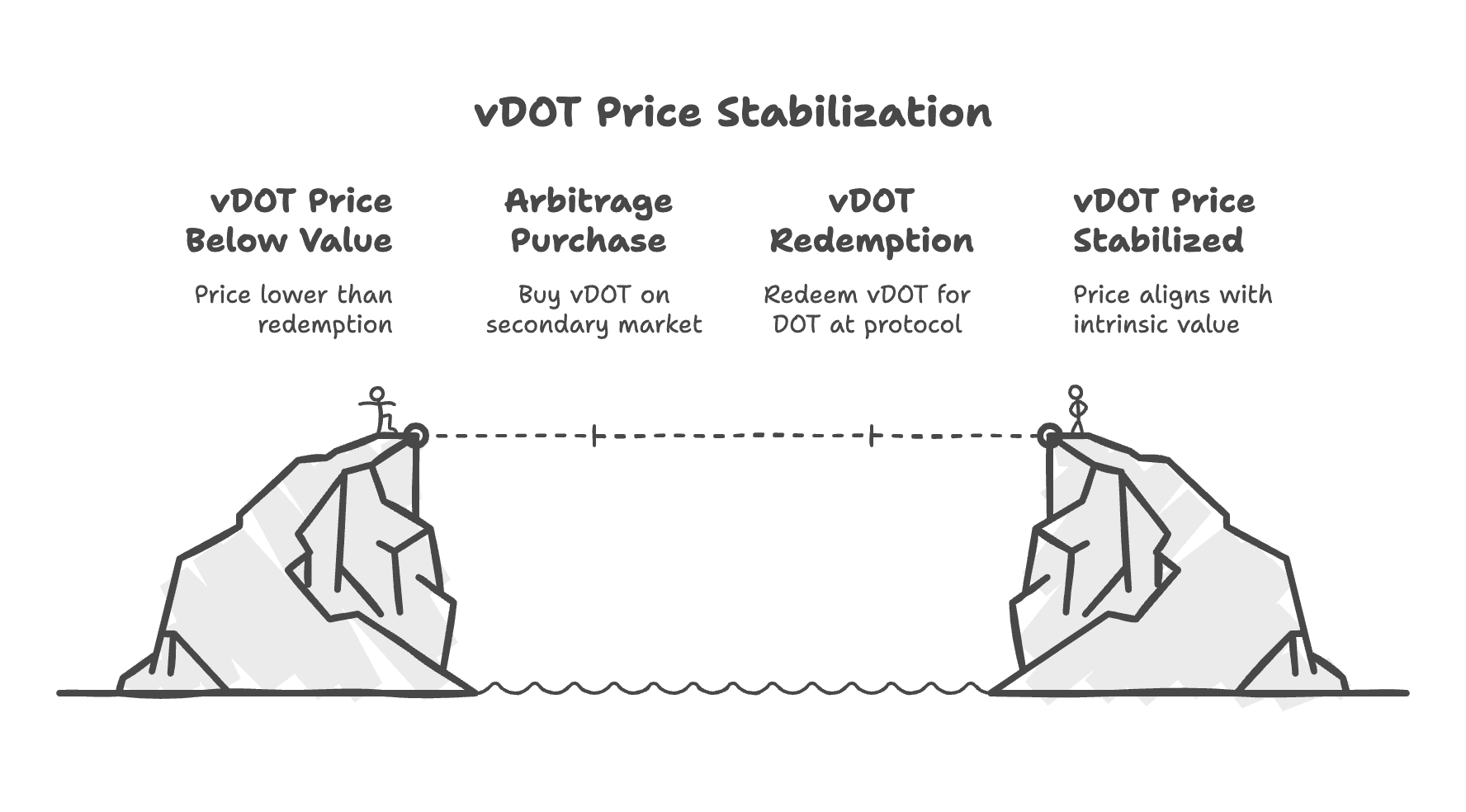

When vDOT’s market price falls significantly below its intrinsic redemption value, arbitrageurs seize the opportunity to buy low on the secondary market and redeem high via Bifrost. Some bought discounted vDOT directly from DEXs, while others borrowed it via lending platforms like Interlay to deploy delta-neutral strategies. These buy-side actions increase demand and help absorb sell pressure, thereby stabilizing the liquidity pool.

Next, Arbitrageurs then redeemed vDOT for DOT at protocol-determined rates (roughly 1:1 plus yield), locking in risk-free gains. The resulting market activity created a price feedback loop that narrowed the peg deviation.

As many arbitrageurs submitted redemption requests in a short span, the system quickly reached Bifrost’s redemption cap per Era (approximately every 24 hours). Once the cap is hit, the system automatically pauses further redemption requests. This redemption cap is a built-in safety mechanism designed to prevent draining of redeemable liquidity or overloading the unbonding queue on Polkadot during extreme events.

Although the redemption feature was temporarily paused, the earlier arbitrage-driven purchases had already absorbed the excess supply in the market and balanced the liquidity pool. As a result, the market price of vDOT rebounded rapidly to near its intrinsic value.

vDOT’s ability to maintain price stability is built on several key mechanisms: its intrinsic value is backed by staked DOT principal and accrued rewards; it offers a redemption path that is insulated from market volatility; price deviations attract arbitrageurs who help bring the price back in line; and redemption caps provide critical safeguards. Together, these mechanisms allow vDOT to maintain a relatively stable value peg and quickly recover from short-term volatility.

Importantly, during the May incident, the StableSwap pool performed as expected. Despite momentarily hitting the curve’s slippage extremes, the system only experienced a short-lived depeg. Arbitrageurs demonstrated strong confidence in Bifrost and acted quickly to stabilize the pool. Meanwhile, the redemption cap enforced by the SLP protocol played a key role in preventing wider market disruption.

At the protocol level, all DOT backing vDOT remains securely held in Bifrost’s sovereign account, governed by protocol-level logic and impervious to secondary market activity. In addition, the Bifrost team responded quickly to mitigate the incident, helping the affected user protect his remaining assets.

Volatility is inevitable in crypto—but systemic risk doesn’t have to be. vDOT’s architecture, grounded in staking yield fundamentals, liquidity-layer protections, and well-aligned market incentives, enables the token to weather temporary shocks and rebound with precision.

Whether you're a DeFi power user or a long-term DOT holder seeking liquid staking exposure, vDOT offers a robust way to stay yield-generating and liquid—even when the market gets rough.