As liquid staking continues to expand, staking has evolved far beyond simple “lock-and-earn” models. Today, it’s a multi-dimensional race involving liquidity, yield, and capital efficiency.

Loop Stake, developed by Bifrost, is a leverage management tool tailored for liquid staking tokens (LST). It allows users to set and manage their preferred leverage level with just one click—unlocking higher yield potential without the hassle of manual recursive lending or high gas costs.

Following successful support for vDOT and vKSM, Loop Stake now officially supports vBNC leverage staking. Backed by 1,000,000 BNC in initial liquidity from the Bifrost Treasury, the opportunity to maximize your BNC staking returns is now open.

What Is Leverage Staking for LSTs

Leverage staking is a key growth strategy for LSTs. The core idea is to use your LST tokens as collateral to borrow more of the native asset, then stake it again—creating a compounding loop.

Because the collateral (LST) and the borrowed asset (typically the native token) are closely correlated, the strategy boosts yield significantly while carrying relatively lower liquidation risk than other leverage schemes.

Traditional Leverage vs. Loop Stake

Traditionally, leverage staking involves multiple repetitive steps:

Deposit → Borrow → Stake → Repeat until there is no arbitrage opportunity left

It’s complex, gas-intensive, and not user-friendly.

Loop Stake solves this by bundling the entire loop into a single on-chain action. Through flash loan-powered smart contracts, it automates the full leverage cycle for you—reducing transaction count and gas fees, while delivering a seamless user experience.

Since its launch in March 2024, Loop Stake has run smoothly for over a year. It has processed over 170,000 DOT in supply and borrowing volume with a stable 60% utilization rate, proving both its market fit and protocol reliability.

How vBNC Loop Stake Works

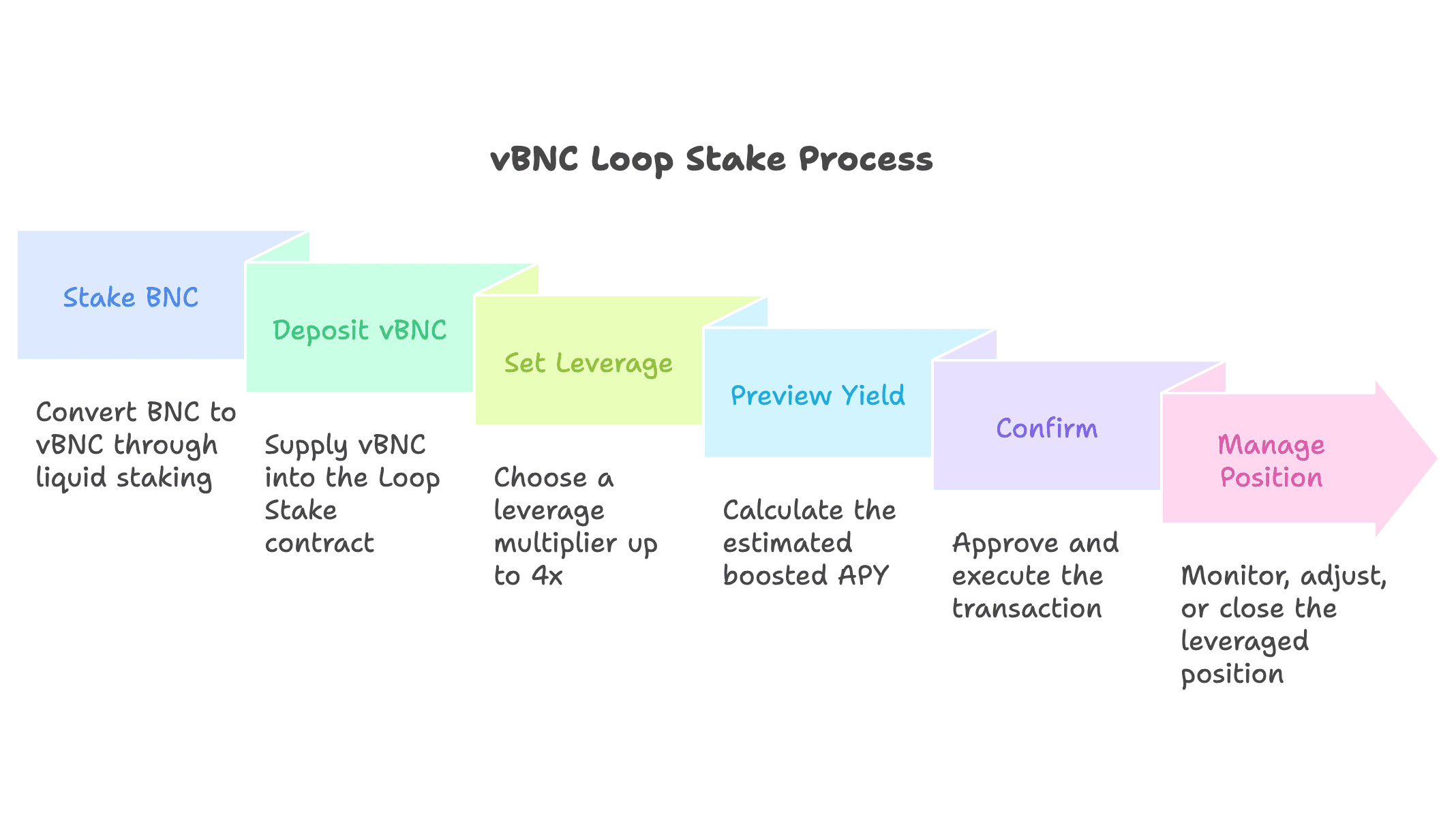

Here’s how to use Loop Stake with vBNC in just a few intuitive steps:

- Stake BNC: Convert your BNC into vBNC via liquid staking.

- Deposit vBNC: Supply vBNC into the Loop Stake contract.

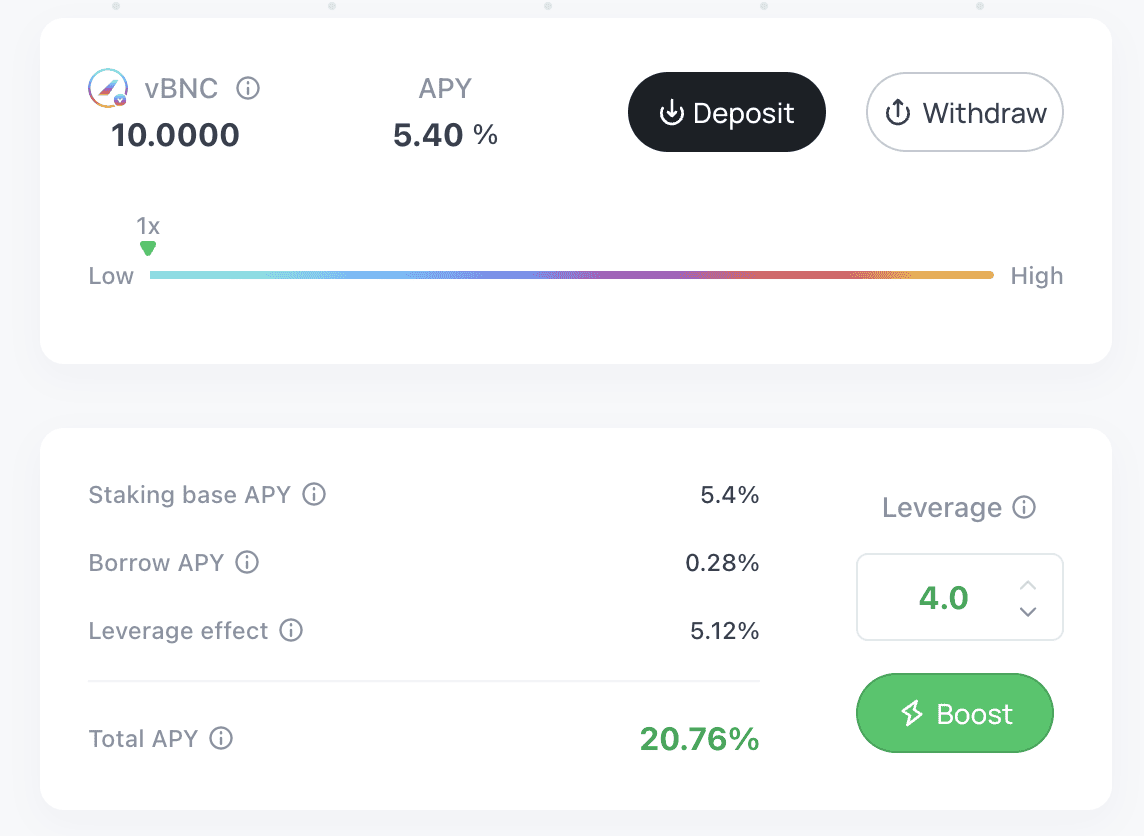

- Set Leverage: Choose your preferred leverage multiplier (up to 4x).

- Preview Yield: The system will auto-calculate your estimated boosted APY.

- Confirm: Approve and execute the transaction in one click.

- Manage Position: Monitor, adjust, or close your leveraged position anytime.

How Leverage Magnifies BNC Staking Yield

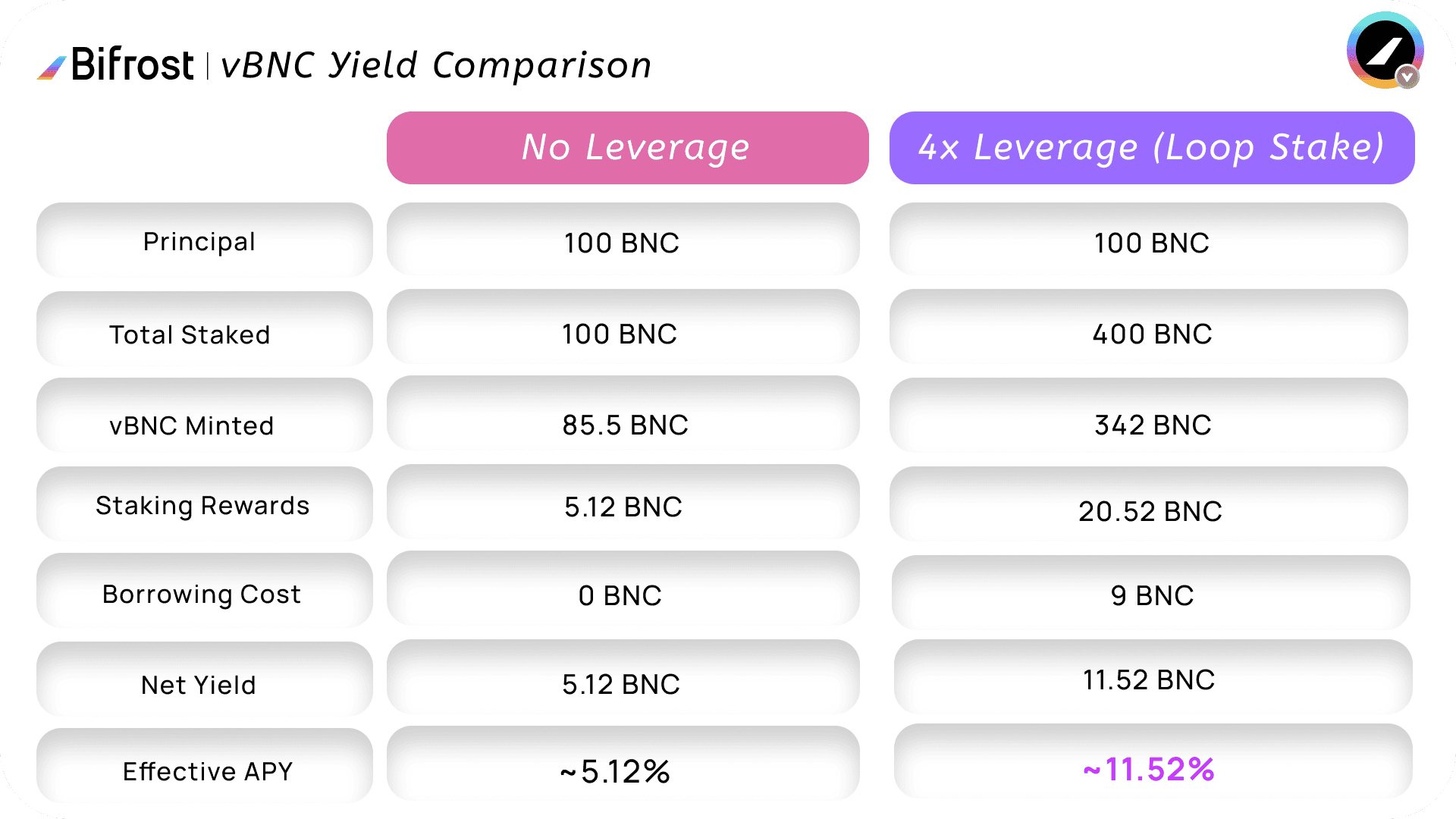

Let’s say Frosty holds 100 BNC and wants to explore higher yield:

- He stakes 100 BNC and receives approximately 85.5 vBNC (based on July 8 exchange rate).

- The base APY for staking is around 5.12%, giving him about 5.12 BNC in expected annual rewards.

Now Frosty decides to use 4x leverage via Loop Stake:

- Leverage Execution: Loop Stake flash-loans 300 BNC, combining it with Frosty’s 100 BNC to stake 400 BNC in total, minting approximately 342 vBNC.

- The 342 vBNC is locked as collateral; the flash loan is converted into a regular loan.

- Frosty earns staking rewards on the 342 vBNC, while paying interest on the 300 BNC loan.

Yield Breakdown

- Borrowing cost (3% interest on 300 BNC) = 9 BNC/year

- Staking reward (5.13% on 400 BNC) = 20.52 BNC/year

- Net profit = 20.52 - 12 = 11.52 BNC/year

That’s an 11.52% net APY on his 100 BNC principal—roughly a 2.25x boost compared to staking without leverage.

Why Loop Stake Makes Sense

In a maturing LST ecosystem, Loop Stake offers an efficient, low-cost, and one-click solution to multiply staking rewards.

By automating traditional looping strategies and minimizing gas overhead, it empowers both advanced and casual users to safely explore leveraged staking based on their individual risk appetite.

From vDOT to vBNC, Bifrost continues to expand the boundaries of what’s possible with liquid staking—and brings new utility and value to BNC in the process.

Try out vBNC Loop Stake and take your staking yield to the next level.

Loop Stake Risks and Mitigations (FAQ)

Q1: Can vBNC lose its peg to BNC?

Yes, in extreme market conditions. Although vBNC is designed to track BNC value (plus staking yield), sudden large trades or slash events can cause temporary depegging.

vBNC/BNC pairs use a Stable Curve AMM that maintains stable pricing and low slippage. MEV bots operated by Bifrost (and open to third parties) help rebalance prices in real time.

Q2: Is there liquidation risk?

No. In Bifrost Loop Stake, only loans between related tokens are supported, such as in the vBNC Loop Stake, only the operation of mortgaging vBNC to borrow BNC is supported. Since their relative prices on the market are relatively stable, when the price of BNC rises or falls, vBNC will also change synchronously.

In extreme market conditions, if the price of vBNC deviates significantly from BNC, since Loop Stake only accepts vBNC as collateral, the LTV of all mortgagors may exceed the liquidation threshold, but they will still remain in position (no liquidation), just waiting for the price of vBNC to return to its expected ratio.

Q3: Are the interest rates fixed?

No. Borrow rates are dynamic and adjust based on pool utilization.

Q4: Are oracle prices safe from manipulation?

Bifrost uses four independent oracle providers, filters out outliers, and protects against price manipulation attacks.

Q5: What if a validator gets slashed?

Slashing can slightly impact staking yield and vToken value. Bifrost has implemented slash protection mechanisms to reduce user impact.

Q6: Is Loop Stake audited?

Yes. All contracts have been audited by Oak Security, check the report here.