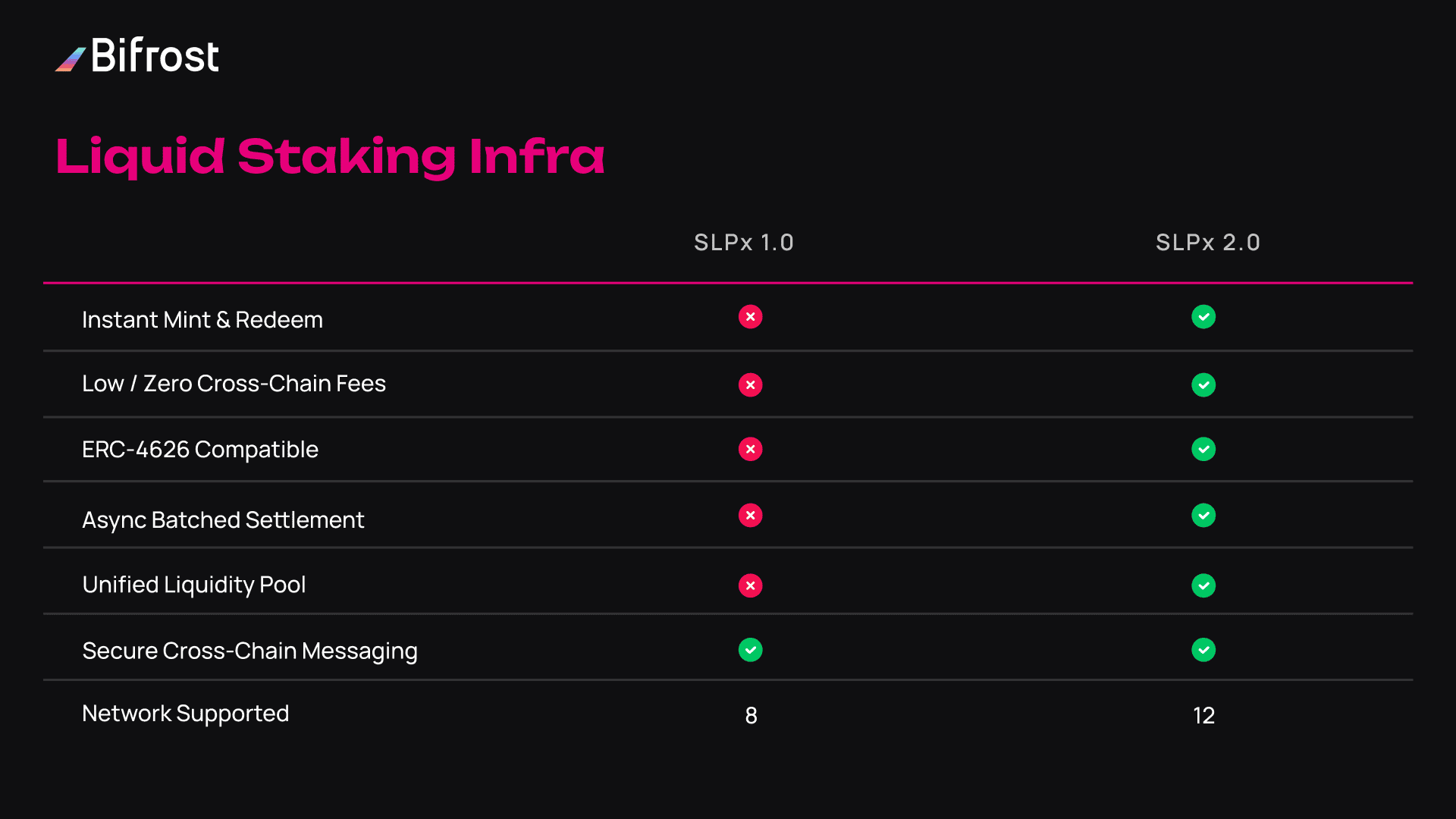

With the launch of vETH 3.0, Bifrost unveils the next-generation liquidity infrastructure for crypto staking — SLPx 2.0. This marks a significant leap from the earlier SLPx 1.0 framework, bringing substantial improvements in mint/redeem UX, cross-chain efficiency, protocol compatibility, and scalability — paving the way for standardizing multi-chain liquid staking.

vETH is Bifrost’s multi-chain liquid staking derivative for ETH. The 3.0 release introduces a host of upgrades:

All of this is made possible by the architectural overhaul behind SLPx 2.0.

SLPx is Bifrost’s foundational protocol for enabling Liquid Staking Tokens (LSTs) to be minted and redeemed across multiple chains — with yield-bearing utility and full composability.

Picture this: your staked assets earning yield, while being free to move and interact with DeFi apps across multiple networks. That’s the promise of SLPx. With a single click, users can convert native assets into liquid staking derivatives (vTokens) and unlock liquidity without compromising yield.

SLPx turns passive capital into active cross-chain collateral — powering the next era of fluid on-chain capital.

As multi-chain deployments become the new normal, the original SLPx 1.0 model began to show its limitations — users had to wait for cross-chain confirmation to receive vTokens, redemptions involved long settlement times and costly bridging, and lack of a unified standard made it difficult to plug into protocols like Aave or Balancer.

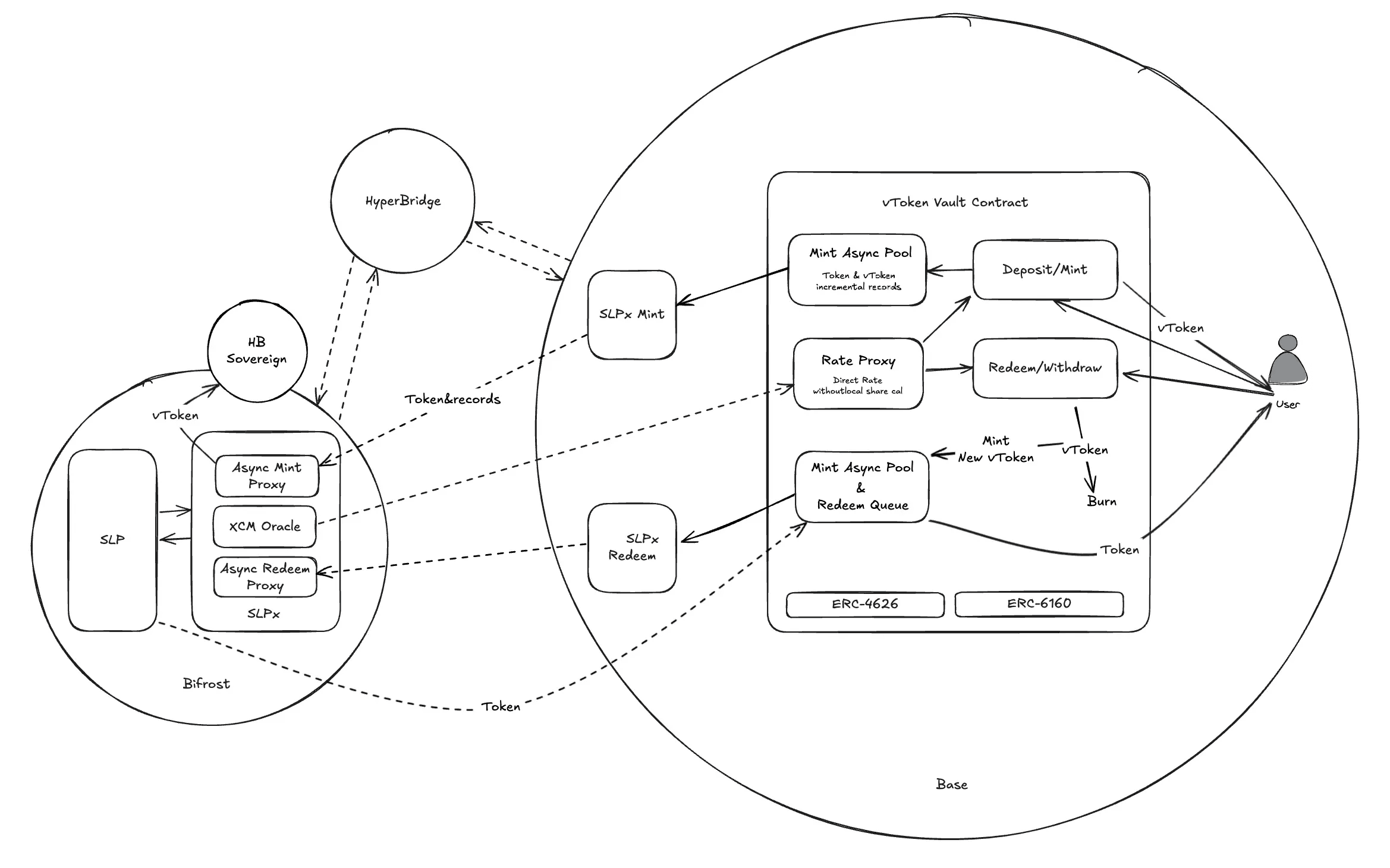

SLPx 2.0 solves this by adopting the ERC-4626 vault standard and introducing an Async Pool mechanism — which cleanly decouples user interactions from underlying cross-chain operations.

1. Instant Mint & Redeem

Users receive vTokens immediately after staking — no need to wait for bridging. Redemptions are auto-queued and settled in batch cycles, cutting latency from minutes to seconds.

2. Drastically Lower Fees

With batched async handling, operations no longer require full cross-chain execution per transaction. Cross-chain fees drop from "standard bridge fees" to "minimal or zero", making small or frequent actions feasible.

3. Seamless DeFi Integration

By leveraging ERC-4626, vTokens become “plug-and-play” yield-bearing assets. Any DeFi protocol supporting ERC-4626 vaults can integrate them permissionlessly.

4. Scalable Cross-Chain Management

SLPx 2.0 treats each supported chain as a unified liquidity pool, rather than managing user-level cross-chain accounts. This significantly reduces overhead and enhances scalability for future chain expansion.

A key design shift is also worth noting: exchange rate synchronization has moved from “strict consistency via Bifrost” to “eventual consistency via XCM Oracle.” While this introduces brief periods of rate discrepancy, it enables a smoother UX and lower system costs.

| Feature | SLPx 1.0 | SLPx 2.0 |

|---|---|---|

| Minting | Delayed, requires cross-chain confirmation | Instant, no bridging required |

| Redemption | Requires burn + cross-chain settlement | Instant burn, auto-queued and batched |

| Fee Model | High (full cross-chain per tx) | Minimal or zero via async batching |

| Cross-chain Account Handling | Per-user mapping required | Unified pool per network |

| Exchange Rate Consistency | Bifrost-controlled, strict | XCM Oracle, eventual consistency |

While SLPx 2.0 will power Bifrost’s future staking products, SLPx 1.0 remains operational — especially for use cases requiring Commission Channel support or full on-chain traceability. This dual-track architecture ensures backward compatibility and flexibility across diverse integration scenarios.

Looking ahead, SLPx 2.0 integrate tightly with HyperBridge, expanding to more L1 and L2 ecosystems and pushing liquid staking toward a modular, standardized, multi-chain future.

And vETH 3.0 is your gateway to experience that future today.

Whether you're an ETH holder chasing higher returns, or a developer building next-gen LST infrastructure — the combination of vETH 3.0 and SLPx 2.0 unlocks new possibilities in cross-chain DeFi.