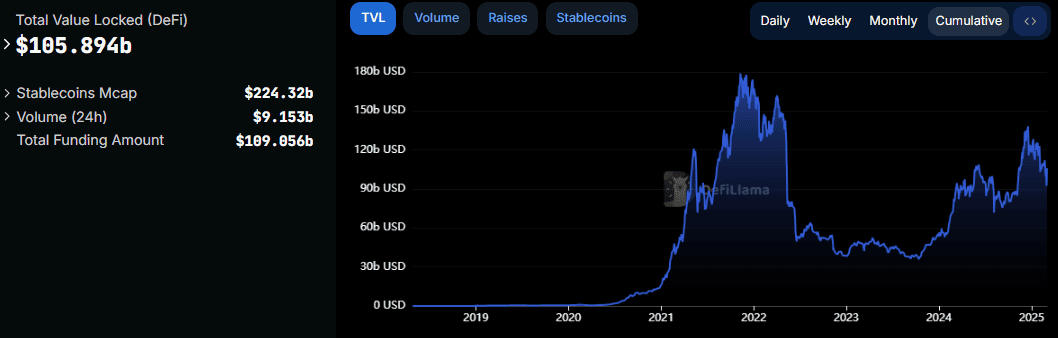

The Luna and FTX collapses in 2022 triggered an 18-month crypto winter, yet by 2024, DeFi has staged a remarkable recovery. Despite its “Renaissance”, DeFi remains far from reaching its full potential, presenting an opportunity to uncover undervalued alpha.

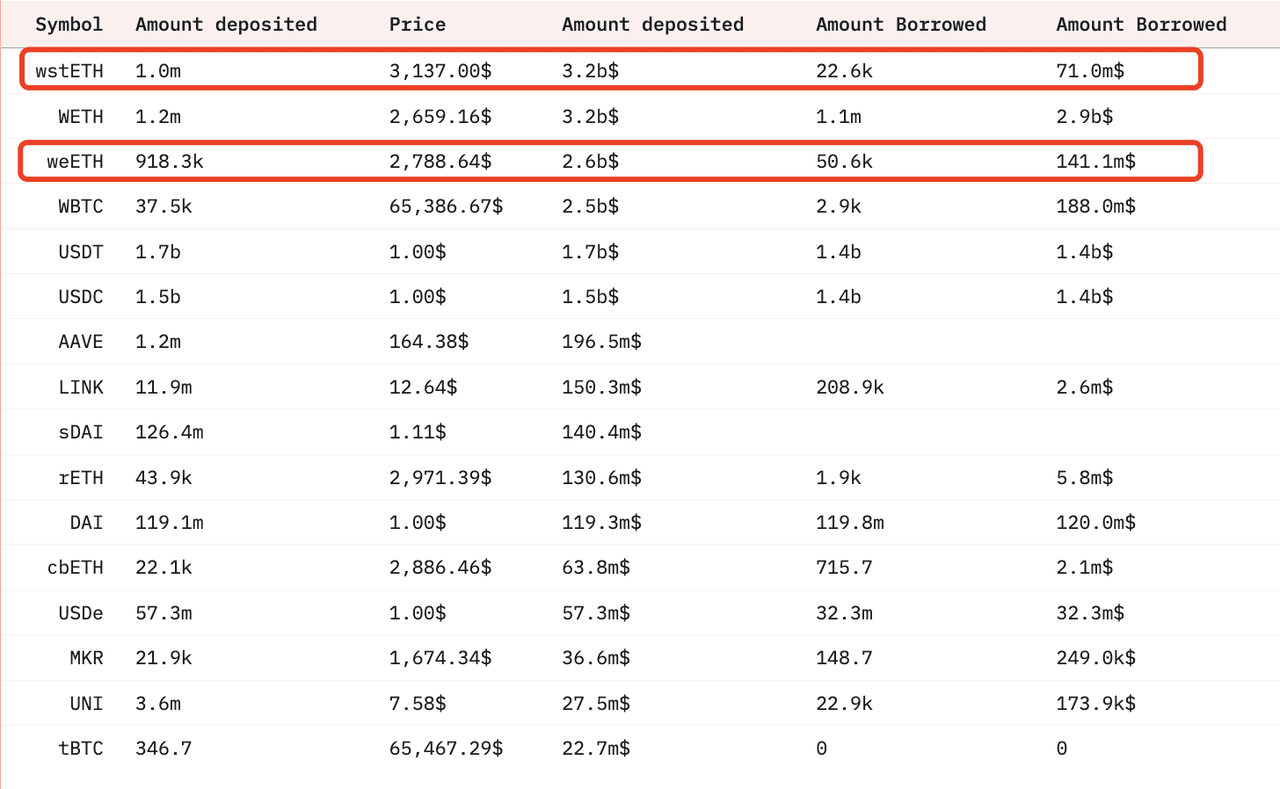

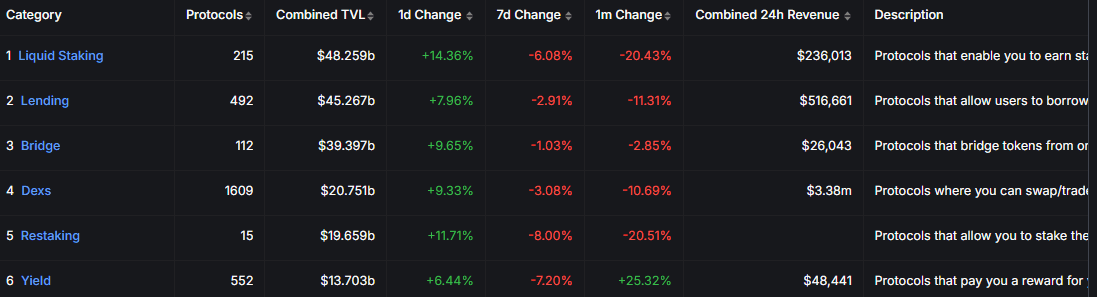

Liquid Staking Tokens (LSTs) is an important part in DeFi have been widely used as collaterals in lending market. Beyond essential DeFi infrastructure, a thriving ecosystem hinges on robust LST liquidity, making effective liquidity management a top priority.

Thanks to DeFi’s inherent composability, LST liquidity plays a crucial role in the economic security of the broader ecosystem.

When factoring in Liquid Restaking Tokens (LRTs)—tokens generated by restaking LSTs—the capital efficiency expands even further.

Given the need for multi-chain operability and diversified DeFi strategies, LST protocols must integrate seamlessly with external ecosystems. While technical implementations may vary, their business models remain largely similar. The ideal solution would be a highly secure LST issuer capable of providing robust infrastructure, allowing projects to focus on business development.

Bifrost, a Polkadot parachain designed for liquid staking, provides a robust cross-chain solution—SLPx, which unified liquidity on its own chain and enable remote calls across external chains.

The SLPx techstack allows users to:

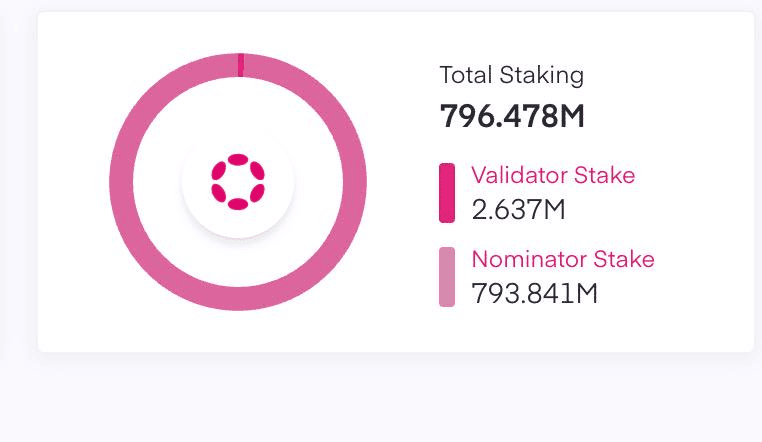

As a Polkadot parachain, Bifrost benefits from inherent security advantages. Polkadot employs a relay chain model where all parachains share the relay chain’s security framework. With over $3 billion worth of DOT staked in Polkadot, economic security is well assured. Compared to other chain abstraction solutions, Bifrost requires minimal security investment, allowing it to focus on business development.

Additionally, as a sovereign chain tailored for LSTs, Bifrost avoids the liquidity fragmentation issues that typically arise from deploying LSTs across multiple chains. The flexibility of its Substrate-based techstack enables seamless composability and expansion. For example:

Originally, Bifrost’s native token, BNC, primarily functioned as a governance token—a common challenge among Polkadot-based tokens. In today’s market, pure governance tokens struggle to capture long-term value, prompting even established tokens like UNI to explore revenue-sharing models. To address this, Bifrost is introducing a revamped token model with a strong focus on economic sustainability.

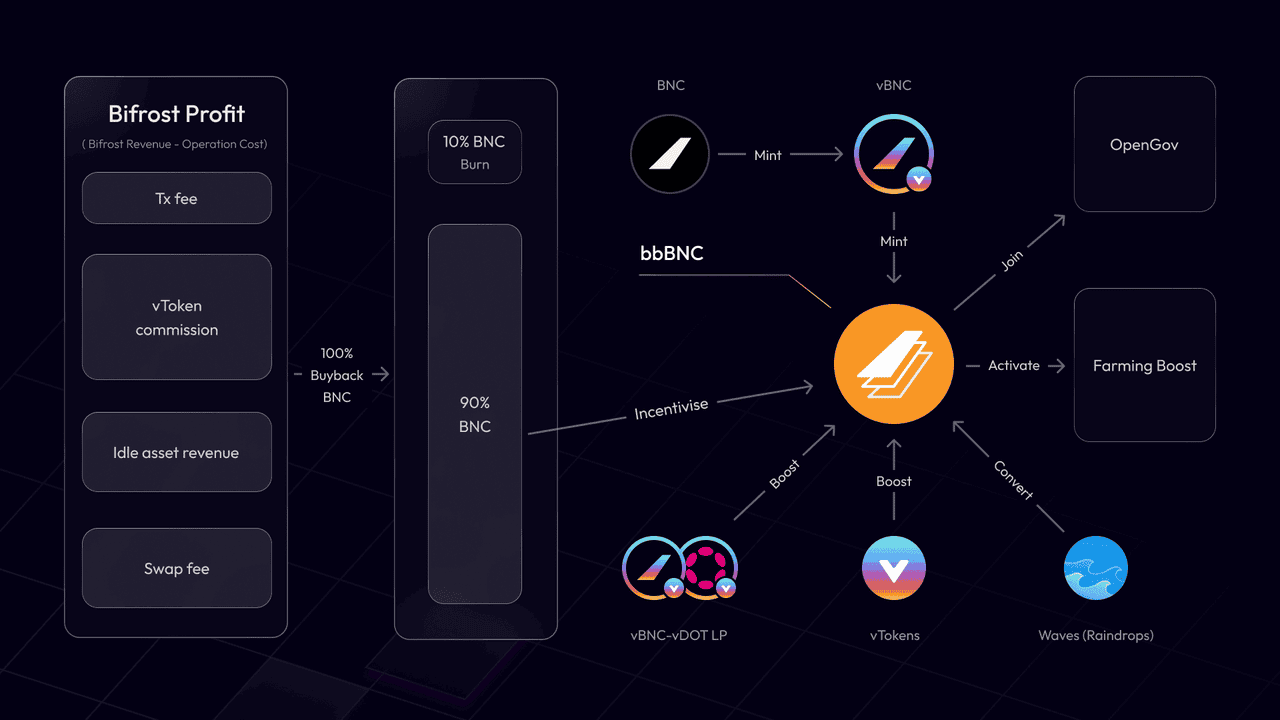

Currently, Bifrost’s protocol revenue flows directly into the treasury without benefiting BNC holders. Tokenomics 2.0 will change this by implementing a 100% revenue buyback mechanism, allocating:

This shift aligns BNC with the flywheel effect seen in successful DeFi tokenomics. A well-executed buyback model can drive value accrual by reducing token supply while incentivizing long-term participation.

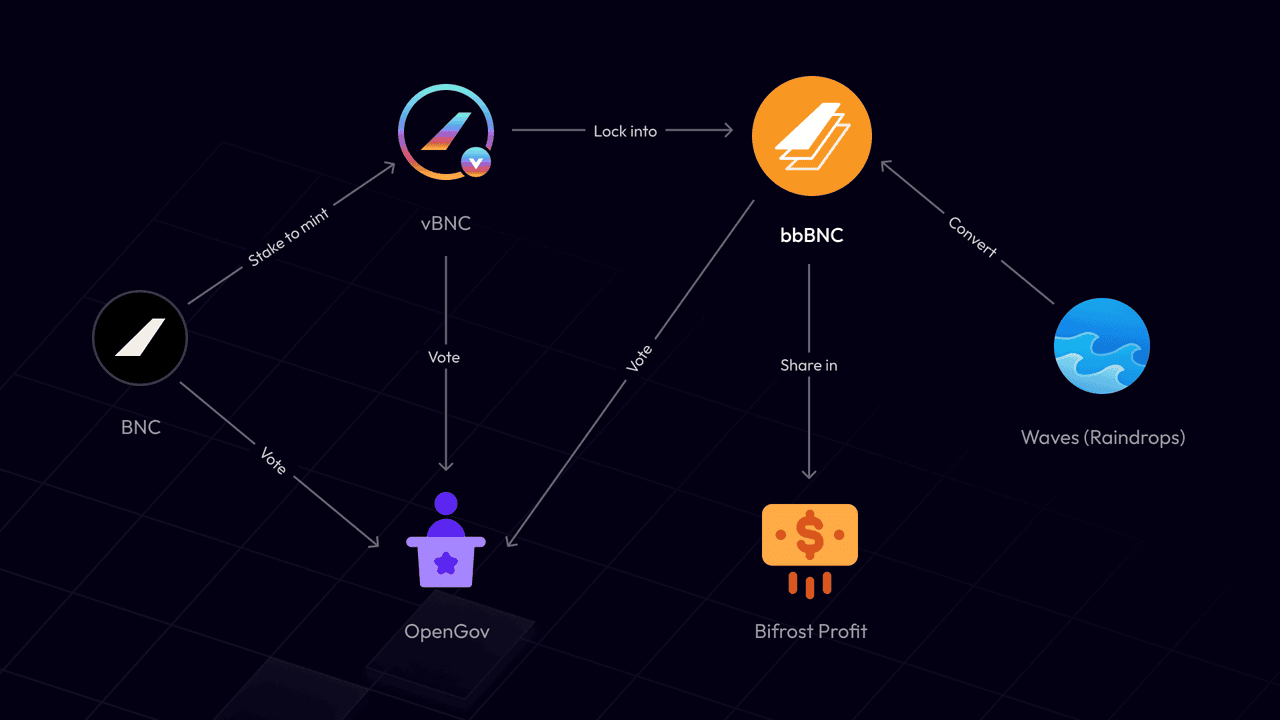

The new model introduces bbBNC, a buyback-based governance token. Users can stake BNC for vBNC (Bifrost’s liquid staking token) and then lock vBNC to receive bbBNC. The amount of bbBNC received depends on the locked amount and the duration of the lock-up period.

bbBNC provides several key incentives:

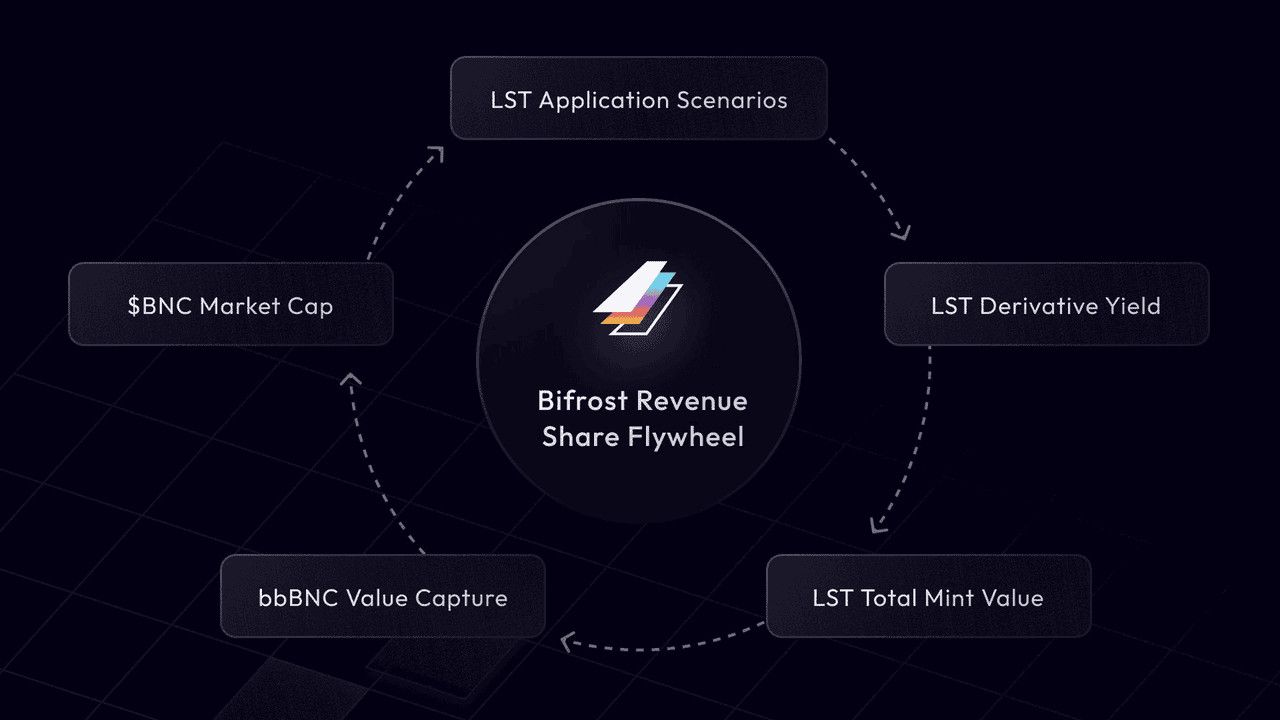

If the revenue sharing model functions as intended, the resulting flywheel effect can be visualized as follows:

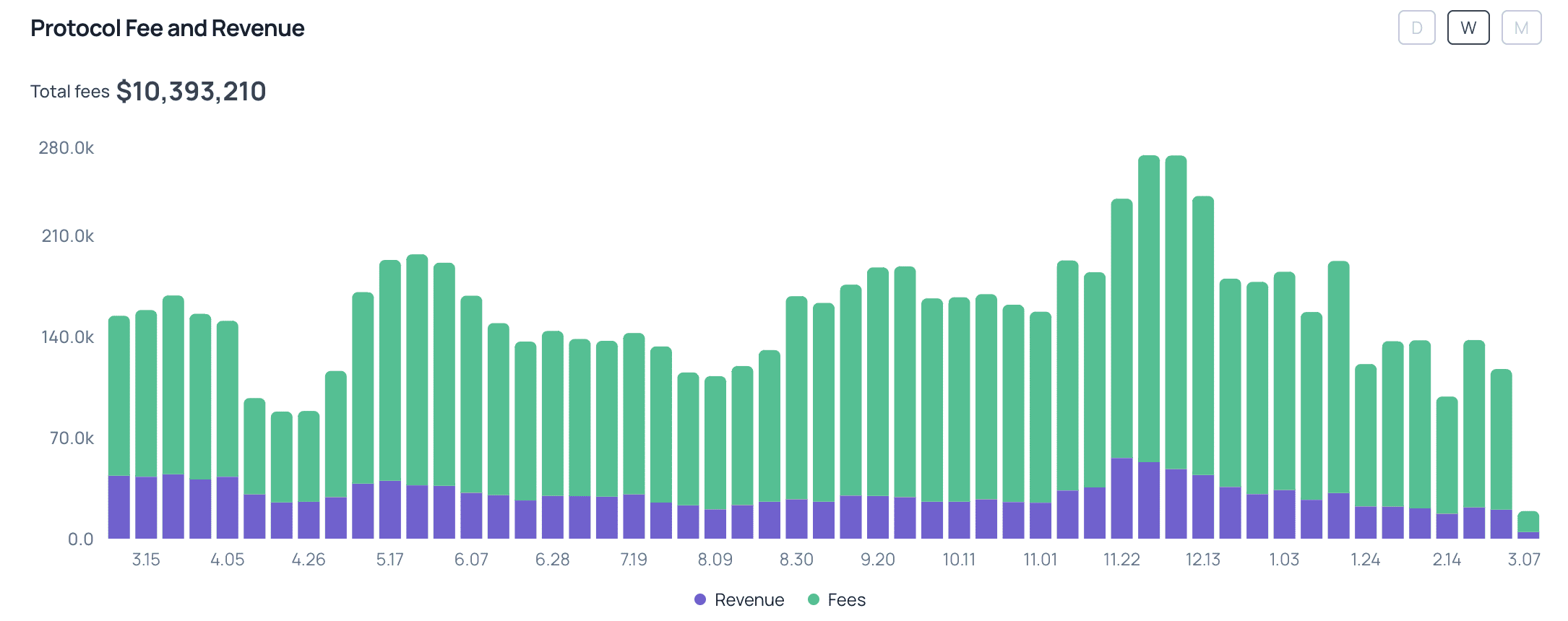

A concrete example of Bifrost's revenue potential, based solely on vToken staking commissions, projects an annual income of approximately 1.69 million annually.

With approximately 80 million BNC tokens in total supply and a circulating supply of around 44 million, BNC’s current market capitalization stands at 15 million. As of now, about 10 million BNC is staked, translating to approximately 5 million vBNC in circulation.

Bifrost’s revenue sources include:

Looking ahead, Bifrost is collaborating with Hyperbridge and Snowbridge to launch a Polkadot liquidity incentive program, allocating 800,000 DOT to enhance liquidity across Arbitrum, Base, BNB Chain, and Ethereum.

With its innovative chain abstraction model, growing vToken adoption, and refined Tokenomics 2.0, Bifrost remains a leading player in the Liquid Staking sector. While its vDOT currently holds 6.7 billion market cap. With a strong foundation and cross-ecosystem capabilities, Bifrost is poised for continued growth.