Staking is a popular mechanism in blockchain, allowing token holders to participate in network security maintenance with minimal barriers and gain token rewards.

Why Participate in Polkadot Staking?

This ties into the DOT inflation system, which inflates the supply of DOT based on the global staking rate to ensure the security of the Polkadot network. With economic incentives structured by the inflation system, maintaining a staking ratio of 50% results in an annual inflation rate of 10%. If token holders do not utilize their DOT for staking, the value of their DOT will be progressively eroded by inflation.

Participating in Polkadot staking offers several key benefits:

- Attractive Returns: With an annual yield of up to 16.8%, this represents a compelling passive on-chain protocol incentive, particularly in the current macroeconomic climate, securing stable income for long-term holders.

- Easy Participation: Approaches like liquid staking provide DOT holders with a practical methods to engage, streamlining the process.

- Enhancing Network Security: Many are motivated to stake as a way to contribute to the maintenance of Polkadot's network security and support its broader ecosystem.

- Long-term Potential: As the Polkadot network expands, engaging in DOT staking becomes a strategic option for establishing and growing one's position.

Five Polkadot Staking Methods

- Running a Validator: This requires a dedicated computer, connected to the internet full-time and requires knowledge of the relevant technical operations. The required amount of DOT to become an active validator is dynamic, currently at least around 3 million DOT.

- Direct Nomination: Nominators need to "nominate" up to 16 validators they trust by staking their DOT under them. To receive nomination rewards, a minimum bonding amount is needed, which is also dynamic, currently about 250 DOT.

- Operating a Nomination Pool: Multiple small nominators can form a nomination pool, stake their DOTs together, and collectively nominate a set of chosen validators. Operating a nomination pool requires selecting validators, and starting one currently requires 500 DOT.

- Joining a Nomination Pool: Joining a nomination pool is the simplest form of staking, eliminating the need to choose validators personally, and requires only 1 DOT to participate and earn staking rewards.

- Liquid Staking: Liquid staking platforms like Bifrost not only facilitate small-scale staking but also resolve the liquidity challenges posed by locked tokens. Their approach includes issuing liquid staking tokens to stakers, which serve as vouchers of their staked funds and accrued earnings.

How to Maximize Your DOT Staking Yield

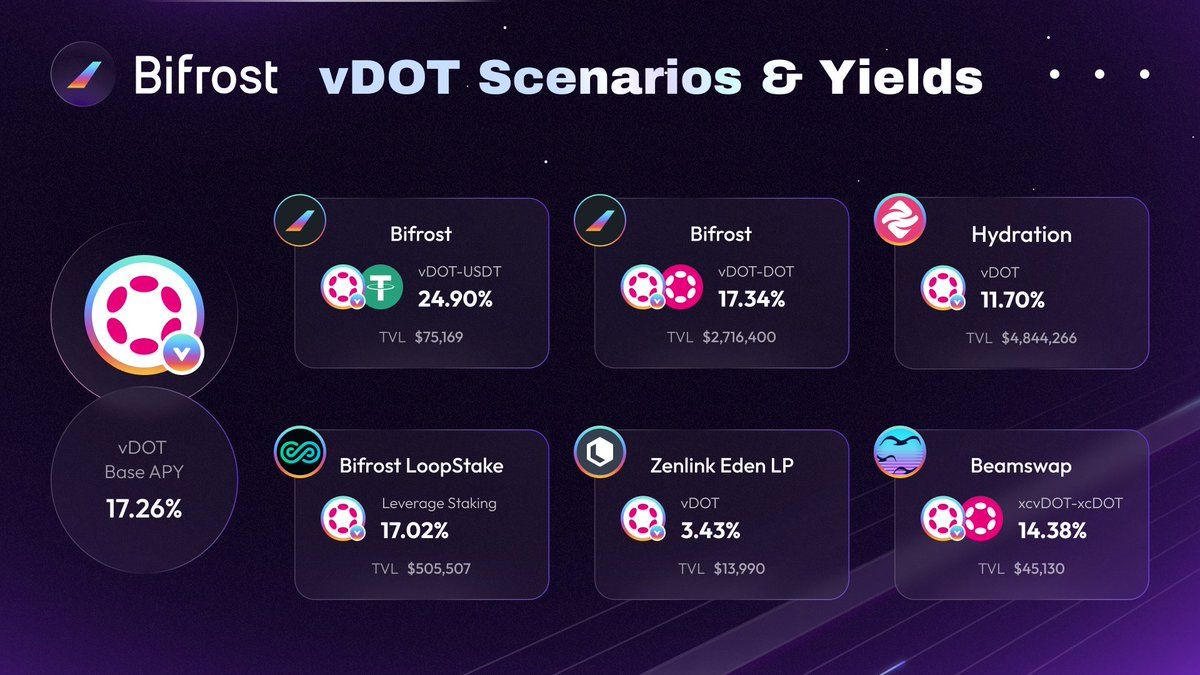

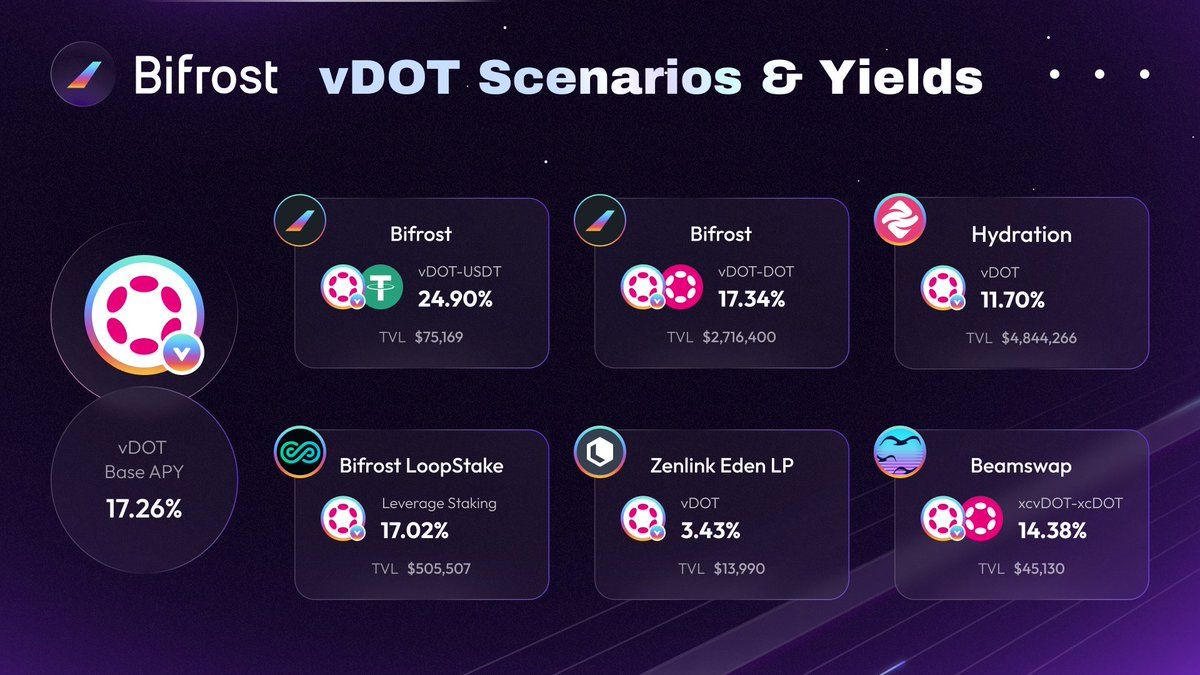

Presently, Bifrost is the leading DOT liquid staking platform and its liquid staking token, vDOT, not only provides higher annual returns but is also versatile across various DeFi applications.

You can get vDOT on Bifrost App

Farming on Hydration

You can deposit vDOT into Hydration farming pool, you can earn HDX and BNC rewards, thee APR can be up to 10% besides the 17% liquid staking APY.

Provide Liquidity

You can earn additional incentives by depositing your LSTs in liquidity pools on Beamswap, Zenlink Eden and more.

Risks: Although liquidity provision is lucrative, it can also be a risky proposition, especially if prices diverge dramatically between the tokens of the pair. This strategy may also result in lower rewards due to the high number of participants.

2024 / 09 / 04 03:00

2024 / 09 / 04 03:00 Bifrost

Bifrost