Ethereum staking has become one of the most secure and reliable yield-generating strategies in crypto. As the second-largest blockchain, Ethereum’s staking market has surpassed $100 billion, making it the single largest value sink in the DeFi landscape. For ETH holders, staking not only provides sustainable yield, but also represents a direct contribution to network security and the long-term growth of the Ethereum ecosystem.

However, today’s Ethereum staking market faces a structural challenge: fragmented liquidity.

High gas fees on Ethereum mainnet have pushed users toward Layer 2 networks such as Arbitrum, Base, and Optimism. Yet most liquid staking protocols still require staking ETH on mainnet. This creates friction—cross-chain complexity, unnecessary time delays, and higher costs. As a result, Liquid Staking Tokens (LSTs) remain far less seamless to use across chains than native ETH itself.

This is why Bifrost launches vETH 3.0.

vETH 3.0 is Bifrost's next-generation omnichain liquid staking solution for Ethereum. Rather than simple cross-chain bridging, it represents a fundamental architectural design that enables users to mint and use vETH directly on any supported network—truly delivering on the vision of "one LST, universal across all chains."

Core Features

The technical implementation of vETH 3.0 is built on three parts:

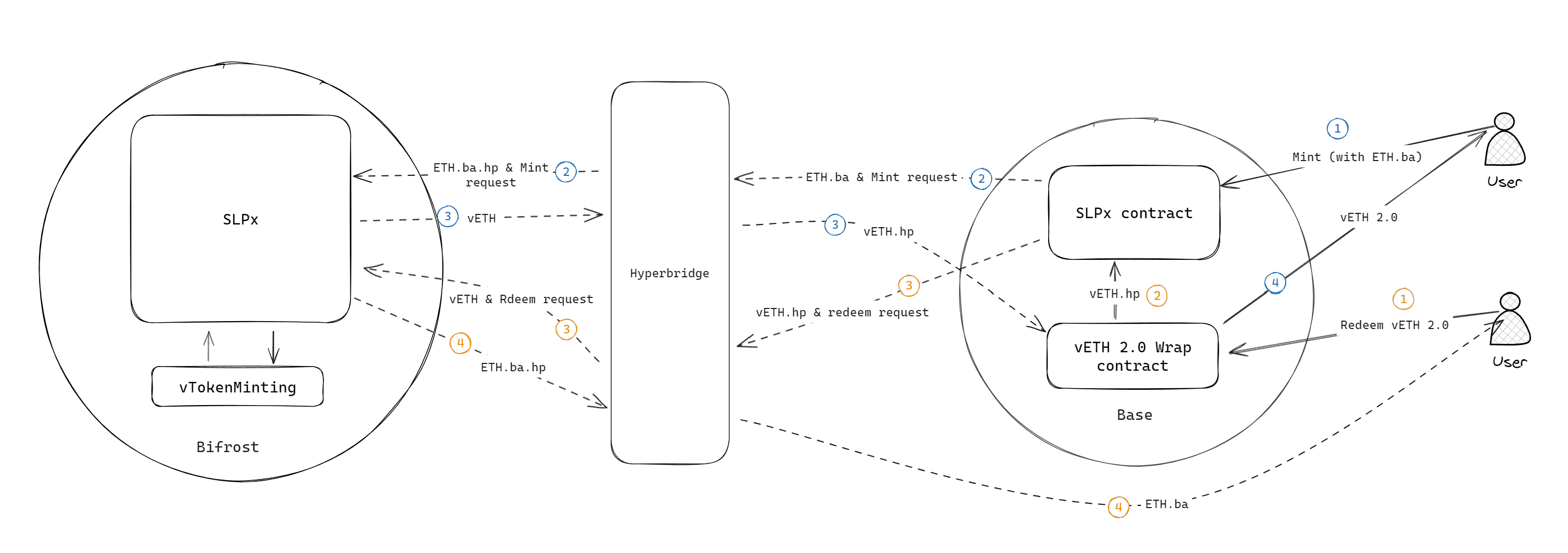

SLPx 2.0 serves as the core contract layer of vETH 3.0, handling minting and redemption requests from different networks. When users initiate minting on Base or Arbitrum, the SLPx contract securely transmits ETH to the Bifrost network for unified management through decentralized cross-chain protocols such as Snowbridge and Hyperbridge, while simultaneously returning vETH to the user.

The key advantage of this design: users enjoy a consistent experience on any supported chain, while the underlying cross-chain complexity is fully abstracted away.

vETH 3.0 adheres to the ERC-4626 Standard—the unified interface specification for yield-bearing assets in the Ethereum ecosystem. ERC-4626 defines standardized methods for deposits, withdrawals, and share calculations, enabling vETH to integrate seamlessly with any DeFi protocol that supports this standard.

This means lending protocols can directly accept vETH as collateral, while DEXs and aggregators can automatically recognize vETH's yield-bearing properties and incorporate it into more sophisticated strategy compositions.

The security of staked assets depends on validator quality. vETH 3.0 utilizes SSV Network (Secret Shared Validator) as its underlying validator infrastructure. SSV works by splitting validator keys into multiple shares distributed across independently operated nodes—a leading Distributed Validator Technology (DVT) solution in the Ethereum ecosystem.

Currently, SSV Network secures over 4 million ETH (approximately $18 billion) and is trusted by industry giants including Kraken and Lido, making it a battle-tested and proven solution.

Minting vETH takes just a few minutes:

To coincide with the launch of vETH 3.0, a one-month incentive program will be live soon on the Bifrost–Polkadot chain. By depositing vETH into the single-asset farming pool, users can earn vDOT rewards.

vDOT rewards accrue in real time and can be claimed at any time.

Ethereum staking should not be constrained by network boundaries. vETH 3.0 represents the next evolution in liquid staking—a decentralized, omnichain ETH staking solution.

The launch of vETH 3.0 is just the beginning. Looking ahead, Bifrost will enable direct conversion of stETH and rETH to vETH, providing existing LST holders with a seamless migration path. Additionally, deeper integration with Hydration is underway, with plans to unlock more DeFi opportunities for vETH holders through Omnipool and gigaETH strategies.