Liquid Staking Tokens (LSTs) are tokens issued by staking service providers as DeFi products that represent native tokens on Proof-of-Stake blockchains. Liquid staking tokens allow people to earn rewards while being able to trade or leverage these tokens, providing greater liquidity.

Since Ethereum shifted from PoW to PoS mechanisms, validator nodes must stake an agreed upon amount of tokens in order to participate and earn block rewards and staking incentives; this process may not be easy or accessible for ordinary users who seek participation.

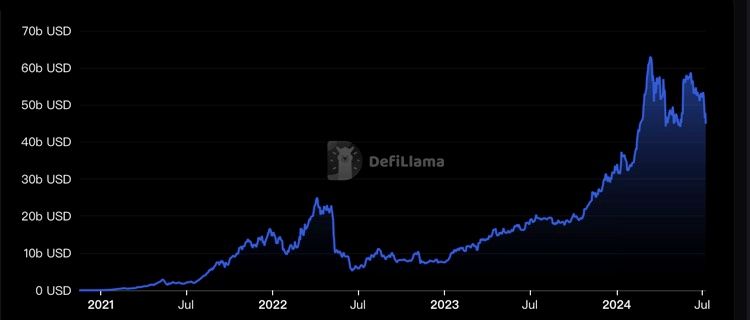

The Ethereum Shanghai (Shapella) upgrade, which enabled staking withdrawals, marked the beginning of the rise of Liquid Staking Tokens (LST). LSTs provide ordinary users with new opportunities for token earnings while unlocking liquidity of staked assets - leading to various DeFi strategies including Restaking protocols as well as rapid expansion and broad participation within DeFi ecosystem.

When tokens are staked, they are typically locked up for a period, making them unavailable for trading or withdrawal. However, Liquid Staking Tokens (LST) change this dynamic by allowing users to stake assets and unstake them without affecting the initial deposit. The deposit is locked on the liquid staking platform, and a tokenized version of that crypto asset (a liquid token) is issued to the user. These liquid tokens hold the same value as the user’s deposit and are pegged one-to-one to the original staked assets.

These tokens have various names to easily distinguish them. For instance, when depositing 1 vETH as a liquid token which can later be traded or used as collateral on various DeFi platforms.

To redeem staked ETH, all that's necessary to unlock it is returning or exchanging vETH back for real ETH on DEX and then your initial deposit amount will be unlocked.

This mechanism enables users to profit from trading liquid tokens while still earning stake rewards from their initial deposit.

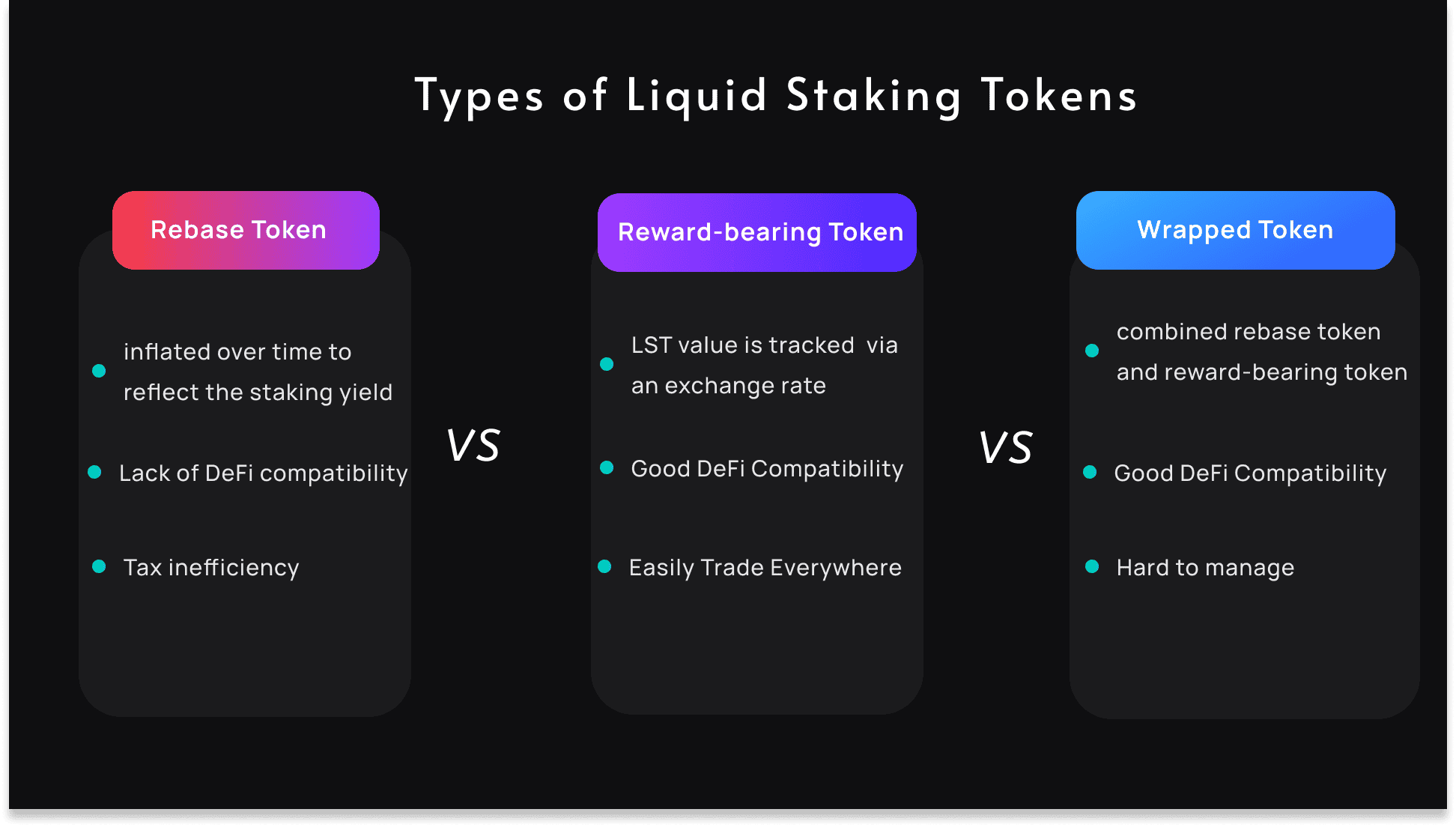

Most liquid staking protocols use one of three token models when conducting liquid stakes:

These tokens automatically adjust their balance based on deposits and rewards received through deposits and rewards deposited, known as rebasing; typically occurring daily. Examples of rebase tokens are Lido's stETH and Bifrost's vETH which both belong to this category of LST; both aim to offer user-friendly experiences by increasing your LST balance with every staked activity undertaken by its holders.

These tokens increase in value and rewards over time as the exchange rate between the native token and the liquid staking token will change. The number of LSTs remains the same, but their exchange rate varies. This single-token model is convenient but more complex than rebase tokens. Holders benefit from the increase in rewards, with examples including rETH, cbETH, swETH, and vETH.

Some LSTs feature wrapped versions, which prevent automatic balance adjustments from taking place and become reward-bearing tokens instead. In comparison to rebase tokens, balance adjustments for wrapped tokens such as Lido's wstETH become increasingly popular due to higher transaction volumes and the absence of any rebase effects on exchange rates. Rewards are integrated directly into exchange rates; rewards integrated directly into their exchange rates make these LSTs especially well suited for DeFi and trading operations.

For stETH holders, rewards are directly paid into their wallet, potentially subjecting them to income tax as income is generated directly in this manner. Conversely, in case of rETH token holders, rewards accumulate through token value appreciation until finally sold and taxed accordingly upon sale of token.

Users looking to gain stETH or rETH can either deposit their Ethereum on Lido or Rocketpool websites or exchange it at DEXs such as Uniswap.

Promotes and Encourages Staking Activities

LST provides a unique solution by creating tokenized derivatives of staked assets, increasing staking activities as stakers can rest easy knowing they will receive derivative tokens that can be used for lending and trading whenever they stake assets - creating more secure networks overall.

Multiple Sources of Income

With LST, stakeholders can entrust funds or assets on a platform and continue using tokenized versions or derivative tokens as collateral against crypto-backed loans at higher interest rates to boost ROI returns.

Slashing

Slashing is used to monitor validator misconduct (such as double-signing and validator downtime ) through validators (nodes or individuals that process and validate transactions on the blockchain ). When violations of rules such as double signing occur, or when someone violates them unknowingly through misuse, an amount of tokens belonging to each validator involved are taken off them regardless of intent - for any misconduct found, regardless of intent.

Smart Contract Risk

Another risk associated with blockchain technology is smart contract risk. While we generally consider blockchain to be secure, vulnerabilities sometimes do exist that attackers could exploit to access and misuse user funds and assets.

Loss of Liquid Staking Tokens

Users that lose tokenized assets or liquid staking tokens during transactions or trades could unknowingly staked funds that can never be recovered without making another deposit of equivalent size to recover these staked funds.

Understanding both the advantages and risks associated with LST are integral for users seeking to optimize returns while developing an efficient staking plan.