Decentralized Finance (DeFi) has revolutionized the cryptocurrency market and left a significant impact on the global economy. There are numerous ways to earn passive income through various decentralized protocols. Proof of Stake (PoS) blockchains like Ethereum are secured through staking protocols, allowing network participants to run validator nodes using their staked funds. However, the primary challenge of traditional staking is that staked tokens cannot be traded or used as collateral in other DeFi ecosystems to earn additional yields. Liquid staking aims to solve this liquidity issue by providing extra token minting that represents staked assets.

How does this actually work? This post delves into liquid staking, its benefits for current DeFi users, and how it generates interest for investment.

Staking refers to the process of locking up a native asset of a blockchain that uses the Proof-of-Stake consensus mechanism for a certain period to help maintain the blockchain's operations and earn corresponding rewards. Traditional staking requires users to deposit their funds into a custodial account operated by a smart contract.

Liquid Staking refers to the process through which users obtain liquidity from their staked assets. This process begins when an investor stakes a certain token (e.g., ETH) into a protocol. This protocol stakes on behalf of the user on a specific blockchain (e.g., Ethereum) and mints derivative tokens of the underlying asset (in this case, ETH) on a 1:1 basis, which we refer to as Liquid Staking Tokens (LST). After staking their tokens, the staking rewards will accumulate into their liquid staking tokens, similar to how liquidity tokens (LP tokens) are received after providing liquidity in a decentralized exchange (DEX).

It is noteworthy that these liquid staking tokens can be exchanged for other tokens or used as collateral in DeFi to borrow other crypto assets. In other words, investors can unlock additional income streams besides earning staking rewards! These liquid staking tokens allow investors to redeem the original tokens (in this case, ETH) instantly, without waiting for the unstaking period. Additionally, when investors stake a token to mint its liquid staking token, they can choose from the validators provided by the protocol used.

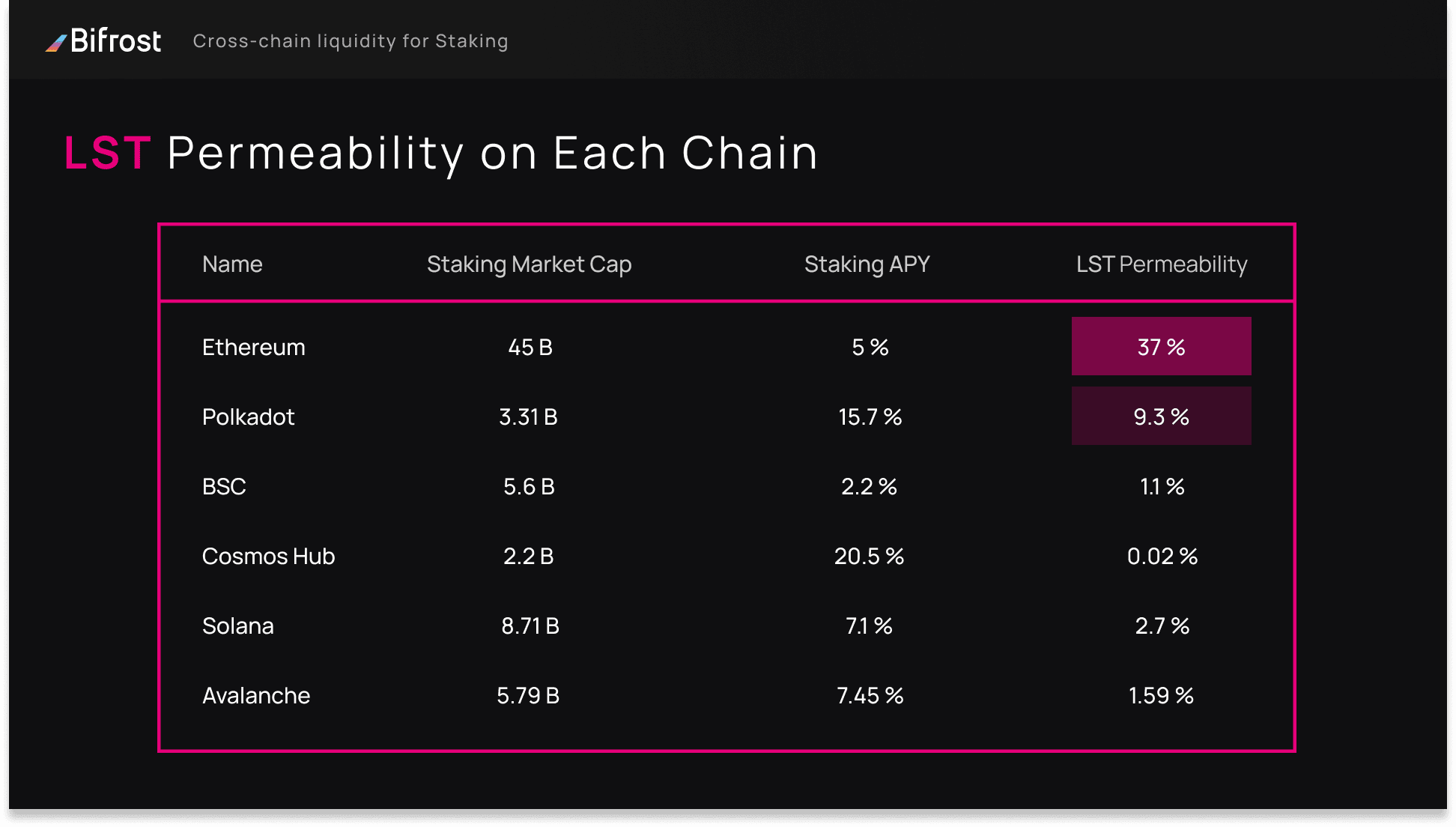

Current blockchain networks that implement the PoS mechanism include Ethereum Beacon Chain, Polkadot, Cosmos, Solana, Tezos, Algorand, and others.

Liquid Staking is a staking solution that users can obtain liquidity from their staked assets. This process begins when an investor stakes a certain token (e.g., ETH) into a protocol. This protocol stakes on behalf of the user on a specific blockchain (e.g., Ethereum) and mints derivative tokens of the underlying asset (in this case, ETH) on a 1:1 basis, which we refer to as Liquid Staking Tokens (LST). After staking their tokens, the staking rewards will accumulate into their liquid staking tokens, similar to how liquidity tokens (LP tokens) are received after providing liquidity in a decentralized exchange (DEX).

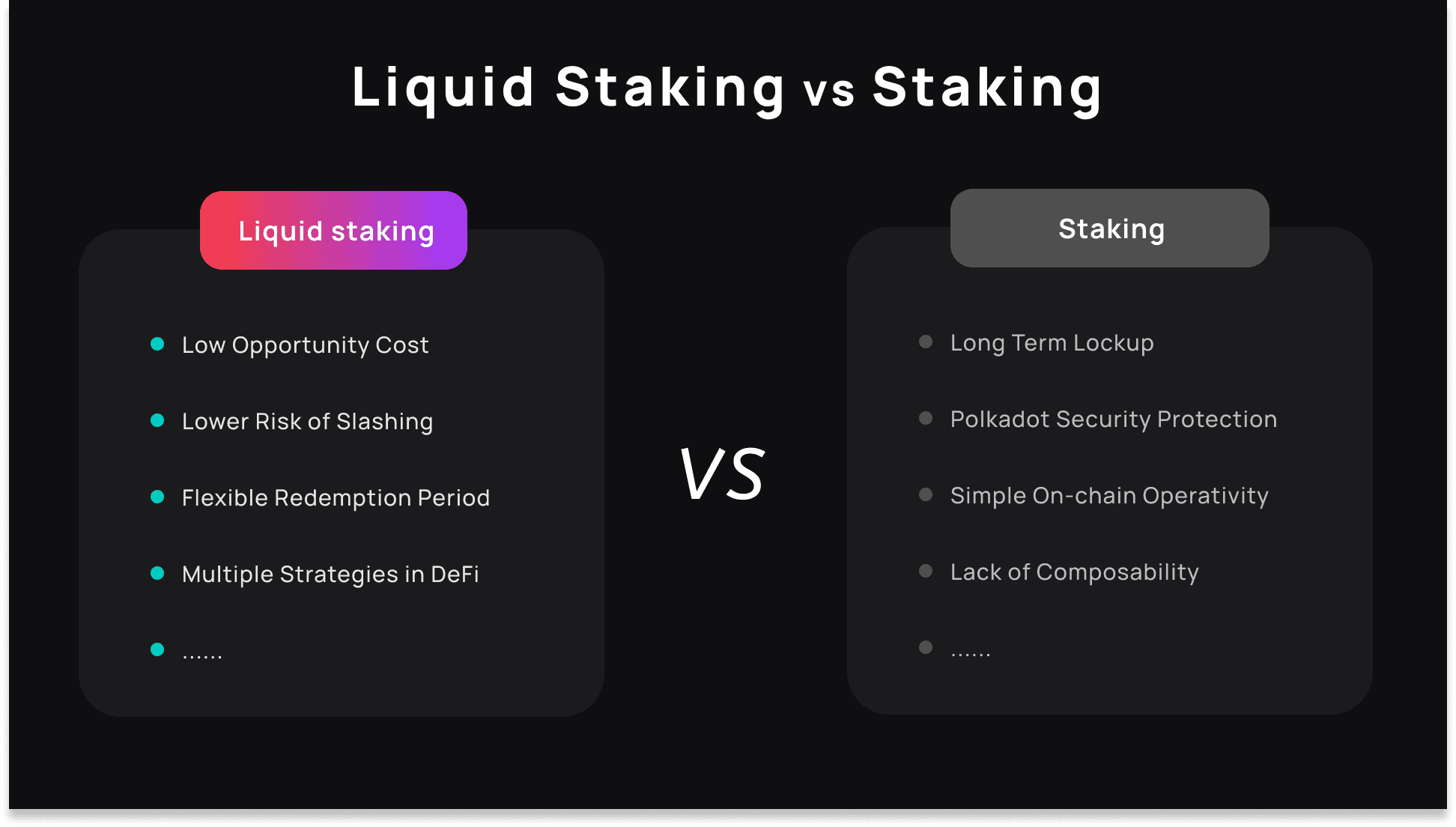

Staking pools allow users to combine several small stakes into one large stake using smart contracts, which provide each token holder with corresponding liquid tokens representing their share in the staking pool. This mechanism eliminates the barriers to becoming a staker. Liquid staking goes a step further, enabling stakers to earn dual benefits. On one hand, they profit from their staked tokens, and on the other, they earn from financial activities like trading, lending, or other transactions using the liquid tokens without affecting their original staking position.

Using Bifrost as a case study helps us understand how liquid staking works. Bifrost is a cross-chain liquid staking protocol that provide liquid staking offers on Ethereum, Kusama and Polkadot.

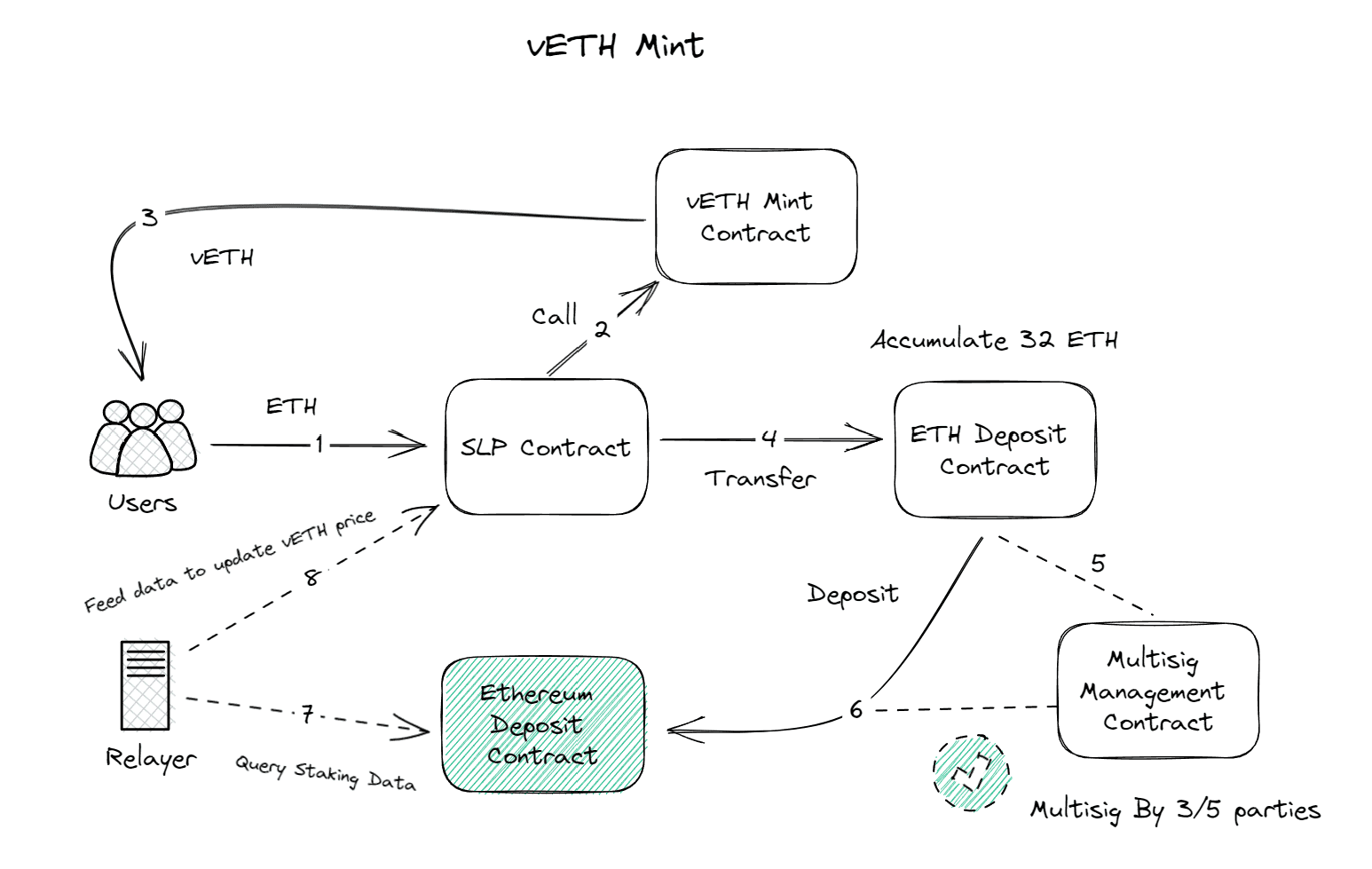

Users who deposit assets into Bifrost have their tokens staked on the blockchain through the protocol. Bifrost allows ETH holders to stake a small portion of the minimum threshold (32 ETH) to earn block rewards. After depositing funds into Bifrost staking pool smart contract, users receive voucher ETH (vETH), an ERC-20 compatible token that is minted upon deposit and burned upon withdrawal.

The protocol distributes the staked ETH to validators (node operators) and subsequently deposits it into the Ethereum Beacon Chain for validation. These funds are then protected by smart contracts, which the validators cannot access. ETH deposited through the Bifrost protocol is divided into sets of 32 ETH among active node operators on the network.

These operators use public validation keys to validate transactions involving users' staked assets. This mechanism allows users' staked assets to be distributed across multiple validators, reducing the risk associated with single points of failure and single-validator staking.

For all users participating in PoS staking, the advantages of liquid staking include:

Capital Efficiency: Tokens locked in staking custodial accounts (e.g., ETH) can be used as collateral in DeFi through liquid staking tokens, thereby expanding yield opportunities.

Increased Blockchain Security: Since investors don't have to choose between participating in staking and using tokens to capture DeFi yield opportunities, there is little reason not to stake their tokens. In the medium to long term, this leads to higher security and stability for PoS blockchains.

Enhanced Liquidity: For some PoS protocols (e.g., Ethereum Beacon Chain), the staking rate (the percentage of the total token supply participating in staking) may be higher, potentially resulting in lower liquidity of tokens available for trading. This can negatively impact price discovery. In contrast, liquid staking tokens (e.g., stETH) allow investors to increase trading volume, ensuring efficient price discovery without compromising blockchain security.

Cross-Chain Interoperability: Simply put, liquid staking tokens are derivative contracts. Theoretically, they can be chain-agnostic and circulate between different blockchain protocols.

Broader Use Cases: Liquid staking tokens allow investors to participate in PoS blockchain staking without dealing with complex operations such as re-staking after unstaking, waiting periods for unstaking, reward extraction, and delegation technical details.

Liquid staking presents two main types of risks: financial risks and governance risks.

Liquidity Risk: Instant redemption of liquid staking tokens (e.g., stETH) means that the protocol providing liquid staking services must maintain a certain amount of idle tokens (e.g., ETH) to meet investors' early withdrawal requests. If the market suddenly experiences turmoil, this could lead to a "bank run" scenario, potentially causing liquidity issues for some liquid staking protocols.

Systemic Risk: Since liquid staking tokens may be used across multiple blockchain networks, a failure in one chain could have negative spillover effects on the liquid staking tokens on other chains, potentially triggering a systemic crisis.

Centralization of Staking: Liquid staking tokens require a certain level of trading/lending activity to fully capture their yield potential. Therefore, liquid staking protocols might be limited in number to gather as much liquidity as possible to sustain their issued liquid staking tokens. As these protocols are responsible for delegating tokens to PoS validators, excessive concentration of liquid staking could lead to centralization issues in staking.

Slashing Risk: If PoS validators go offline or engage in double-signing, their staking rewards will be slashed. Investors who have delegated their tokens to liquid staking protocols are also exposed to this risk. This could reduce the number of underlying assets supporting the liquid staking tokens, posing potential risks during the redemption of liquid staking tokens.

Validator Misbehavior: In theory, validators could "short" their own liquid staking tokens to profit from the decline in the value of these tokens.

Liquid Staking Tokens (LST) are a type of cryptocurrency token that represents staked assets on a blockchain network, primarily used in Proof-of-Stake (PoS) systems. In PoS systems, users can lock their tokens as collateral to support network operations and earn rewards. However, traditional staking involves a lock-up period during which the staked tokens cannot be freely used or traded. LSTs aim to address this issue. Users can use LSTs as a tokenized form of staked assets. During the staking period, LSTs not only provide liquidity but can also be used flexibly.

Crypto users who deposit Ethereum (ETH),Polkadot (DOT), and Kusama (KSM) tokens into Bifrost’s smart contract pool will receive vETH, vDOT, and vKSM, respectively. These vTokens can be used to earn DeFi yields in liquidity pools or trade on decentralized exchanges (DEX), and many other use cases.

Staking rewards come from on-chain validation, where stakeholders actively participate in network construction and contribute to network security and decentralization, thereby earning rewards. The annualized yield fluctuates daily, and the actual annualized yield is based on the results of daily snapshots.

Choose a Liquid Staking Provider: Select a platform that offers liquid staking services, such Lido, Rocket Pool, Ankr and Bifrost.

Deposit Crypto Assets: Deposit the desired amount into the liquid staking platform. The platform will stake tokens on your behalf, and you will receive liquid staking tokens (e.g., vETH) in return.

Earn Staking Rewards: By holding liquid staking tokens, you participate in Proof-of-Stake consensus mechanism and earn staking rewards. Track your staked Ethereum and staking rewards.

Withdraw Your LST: You can withdraw your staked assets at any time, though there may be delays depending on the platform. Convert your liquid tokens back to the native token on the liquid staking platform, then initiate a withdrawal to your wallet.