Staking allows us to secure rewards by locking up a specified amount of tokens, but its benefits extend far beyond simple financial gain; they allow us to actively take part in ecosystem governance decisions by actively taking part in its decision-making processes and helping shape its development and security. In this article, we'll learn what is Polkadot staking and why should we stake.

Nominated Proof of Stake (NPoS)

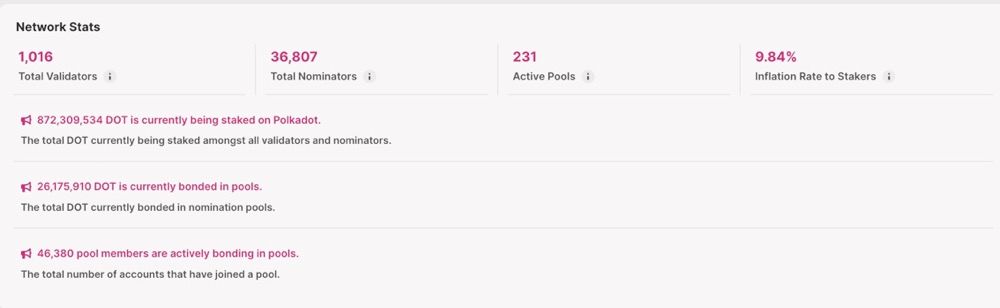

Polkadot blockchain was launched by Gavin Wood in 2016. Polkadot employs the Nominated Proof of Stake (NPoS) mechanism, consisting of two roles - "validators," who operate nodes; and "nominators," who nominate validators to operate their machines on behalf of others and can still earn rewards through this system. Nominators can also join a nominator pool to further reduce barriers to participation and streamline operational procedures. Polkadot uses Network Proof of Stake (NPoS) technology which requires only 10 validators per parachain; so with 100 parachains there will only ever need 1000 validators total! Currently the Polkadot network boasts 297 validators but they hope to reach this target goal during its mature stage; Polkadot's "Thousand Validators Initiative" seeks to reach this goal and increase number.

Polkadot currently holds 874 million DOT staked at an approximate stake rate of 58%; there are 36,800 nominators with the historical staking yield post commission deduction being 14.86% with an inflation rate of 9.83%.

PoS chains typically see increasing participation and therefore higher stake rates with greater participation increasing the staking rate, creating more secure networks. Polkadot's ideal staking rate should be 50%; however, actual rates have typically ranged between 55%-60% over time.

DOT Unstaking Period

Polkadot's current lock-up period for staked DOT is 28 days, meaning staked coins can only be unbound after this amount of time has elapsed. While this extends security of the protocol and makes staking less attractive due to reduced flexibility and higher opportunity costs. With RFC 97 proposal's approval by Fellowship, unbonding time will be shortened from 28 days to 2 days; necessary code or design changes have already been merged into github; implementation by developers will begin shortly thereafter.

Four Staking Methods on Polkadot

Polkadot natively supports four methods of staking that range in terms of capital requirements: running a validator, direct nomination, operating a nomination pool and joining one (with minimum participation requirement of only 1 DOT).

- Running A Validator: Running a Validator requires accessing the internet on a full-time basis from a dedicated computer, along with knowledge of technical operations related to validator management. In order to qualify as an active validator set either personally or nominatively stake DOT; currently this amount stands at at least 3 million DOT

- Becoming A Nominator: must nominate up to 16 validators they trust by staking DOT under them, then divide network rewards equally between themselves and them (current average commission is around 2%) while giving each validator their share (network rewards are split at 60% each); validators pay their commission (current average is 2%) directly while nominators incur financial penalties should any nominated validator engage in misconduct such as going offline; nomination rewards require bonding amounts that fluctuate, currently around 250 DOT.

- Running a Pool: Nominating pool is a recently introduced feature designed to reduce entry barriers for nominators, providing multiple small nominators an avenue of nominations at once and share rewards and penalties proportionate to how much of their staked shares they own in total. Operating one requires selecting validators as part of your group, with starting an operational nomination pool currently costing 500 DOT.

- Joining a Nominating Pool: Joining a nominating pool is one of the simplest forms of staking; this requires only 1 DOT to participate and gain rewards through it.

Polkadot offers more native staking options with only 1 DOT required as the minimum stake required, further lowering financial and technical entry barriers and encouraging wider participation, thus strengthening decentralization and security on its network.

Liquid Staking on Polkadot

Due to the lock-up period required by staking, staked funds become unavailable for use; hence liquidity staking has emerged as an alternative solution. Liquidity Staking Tokens (LSTs) provide users with opportunities to earn staking rewards while keeping funds liquid thereby improving capital utilization and utilization rates.

By placing tokens into a liquidity staking protocol, users can generate derivative tokens that serve the same purposes as original ones (participating in DeFi) while earning rewards as part of liquidity staking's ecosystem-boosting qualities. Therefore, its presence stimulates economic activity within PoS chains by giving users simultaneous benefits from both activities; hence liquidity staking is an integral component.

Bifrost is currently the top liquid staking platform on Polkadot, having introduced the liquid staking token vDOT for use. At present, 8.45 million DOT have been staked with a total value locked of $39.41 million representing all assets staked.

vDOT can generate yields through staking yields as well as lend and farm protocols within DeFi to create multiple streams of income.

Bifrost recently introduced Loop Stake, an advanced leverage staking product specifically tailored towards digital tokens such as DOT that allows users to set and manage leverage according to individual risk profiles. Since releasing it for public testing in April 2018 this has already attracted 120,000 DOT in supply as well as nearly 100,000 in borrowing demand demonstrating initial market success at scale and activity levels.

Polkadot OpenGov governance requires strong stakeholder representation for successful operation; vDOT can ensure this right remains with them.

Polkadot currently boasts 874 Million DOTS staked, which compares favorably with Ethereum in terms of penetration rate of liquidity staking market within its ecosystem. Polkadot offers significant potential growth potential when it comes to liquidity staking market within its ecosystem.