In 2025, the crypto industry did not arrive at an easy answer.

While ETFs continued to channel institutional capital into the market, the year was equally defined by heightened volatility, closer regulatory scrutiny, and an unprecedented demand for sustainability. Liquid staking has moved beyond being a yield tool—it has evolved into an infrastructure layer that connects multi-chain liquidity, governance, and DeFi returns.

If one word were to define Bifrost’s 2025, it would be “DELIVERY”

We delivered on the promise of the new tokenomics “bbBNC”, aligning the interests of the community and the protocol more closely than ever before. We delivered on our yield layer vision, extending vToken accessibility to Ethereum and its Layer2 networks. And we delivered on our commitment to long-term product iteration, closing the year with the release of vETH 3.0—establishing the technical foundation for the next phase of growth.

What follows is a review of Bifrost’s key milestones and achievements throughout the year.

Numbers tell the most honest story.

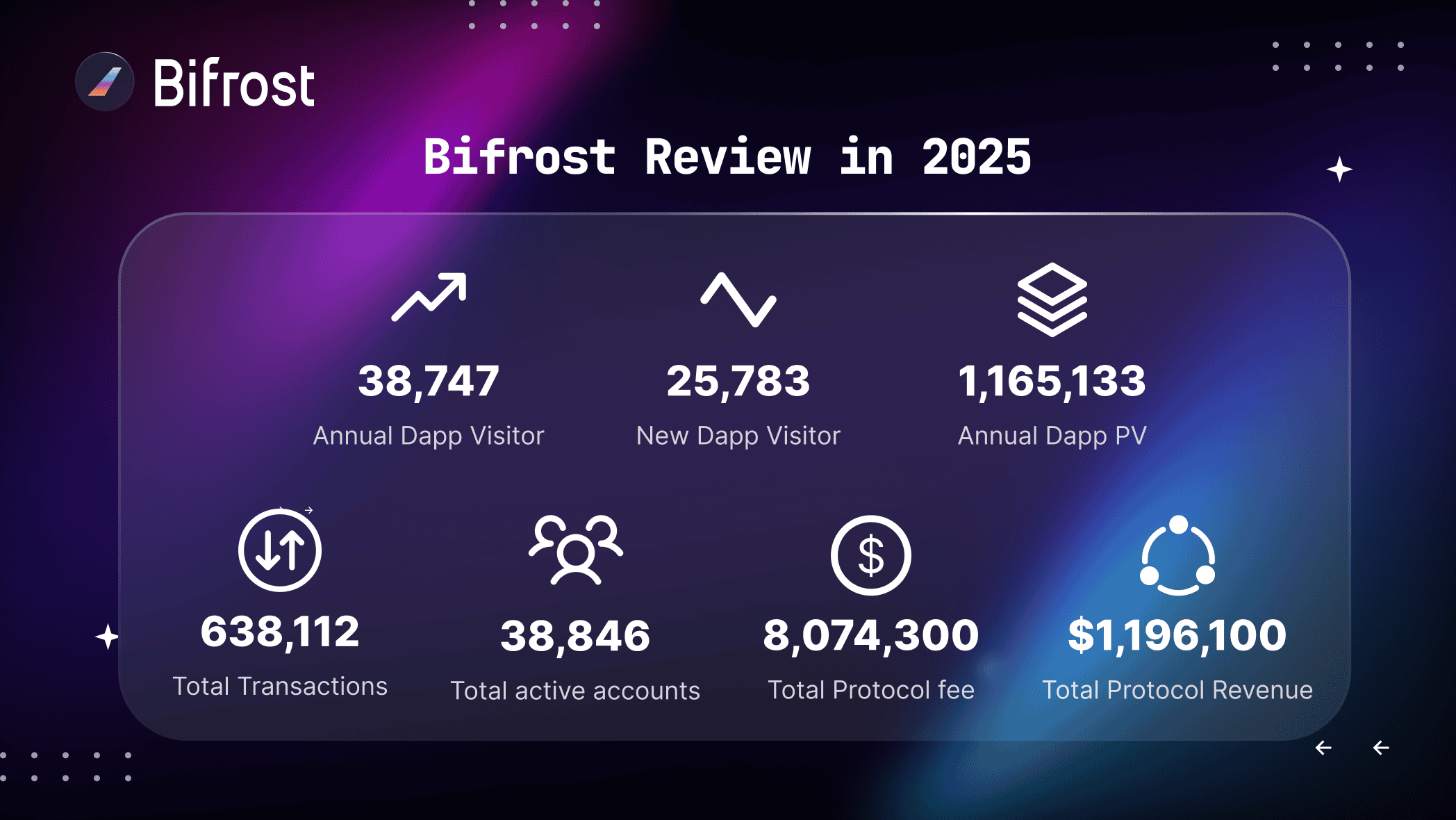

In 2025, Bifrost generated over $8.07 million in total protocol revenue, with gross profit reaching $1.2 million. This marked a clear transition into a more mature phase, driven by sustainable protocol profitability.

On-chain activity remained strong throughout the year. Total transactions exceeded 634,000, with nearly 39,000 active addresses. The Bifrost dApp recorded more than 1.16 million cumulative page views and close to 39,000 unique users, indicating the emergence of a stable and recurring user base.

Community growth also stayed healthy. By year-end, total community membership reached 138,000, with over 27,000 vToken-holding addresses and more than 130,000 BNC holders.

Despite increased market volatility in the second half of the year, minting volumes across multiple vTokens continued to grow significantly—reflecting improved liquidity retention and stronger product stickiness across the protocol.

This represents the most important narrative shift for Bifrost in 2025.

Historically, many DeFi governance tokens have struggled with a fundamental problem: beyond voting rights, holders had little exposure to the economic upside of protocol growth. bbBNC was designed to break this pattern.

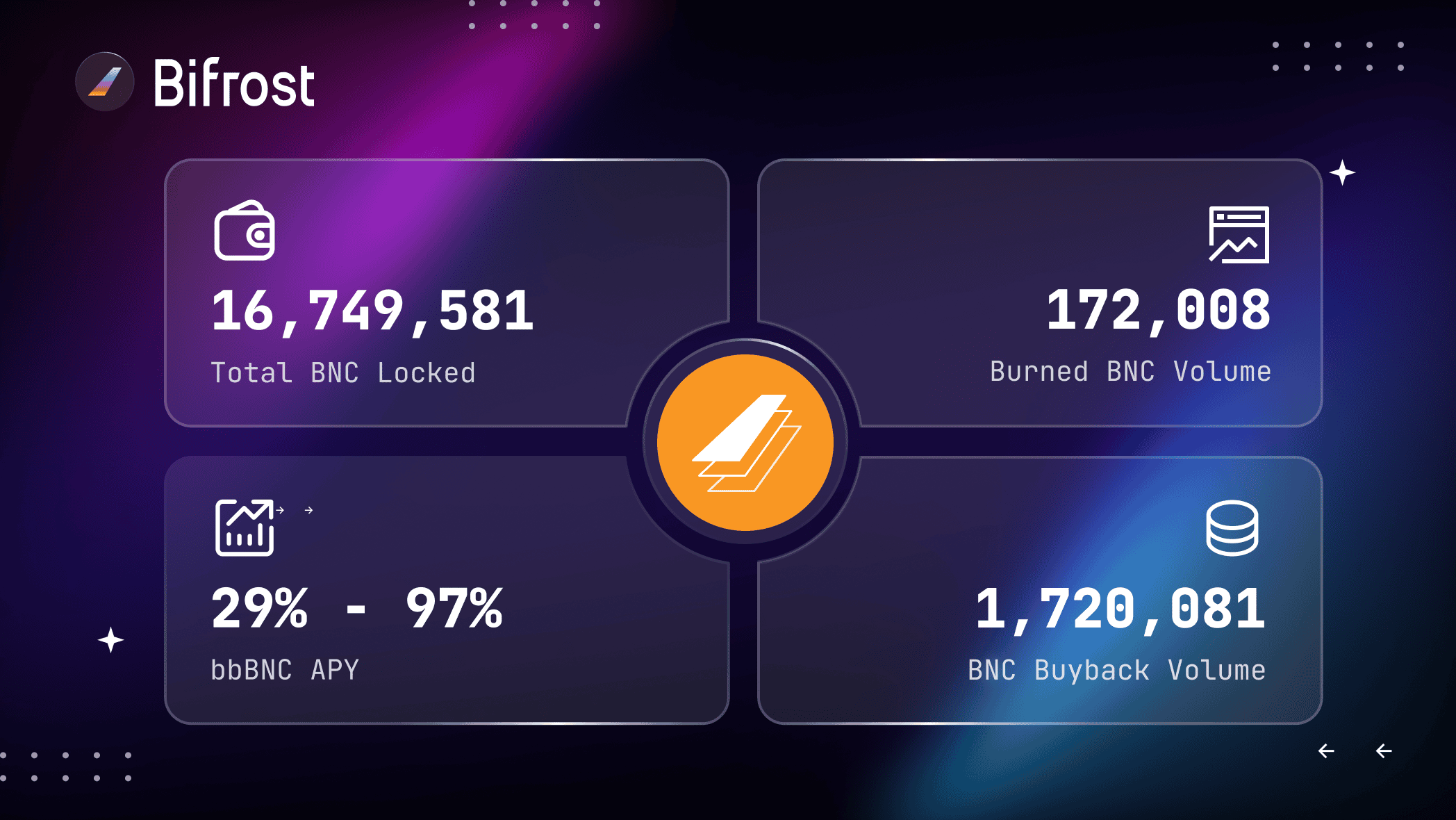

Built on an enhanced veToken model, bbBNC directs 100% of protocol profits toward BNC buybacks, with 90% distributed directly to bbBNC holders.

Market response exceeded expectations. BNC locked rapidly surpassed 16 million tokens, accounting for over 20% of total supply. By year-end, the protocol had cumulatively repurchased more than 1.72 million BNC, of which 172,000 BNC were permanently burned.

We believe that only when protocol success is meaningfully aligned with community interests can a truly durable ecosystem be built.

In 2025, multiple vTokens under the Bifrost umbrella achieved substantial growth, reaffirming sustained demand for liquid staking across multi-chain environments.

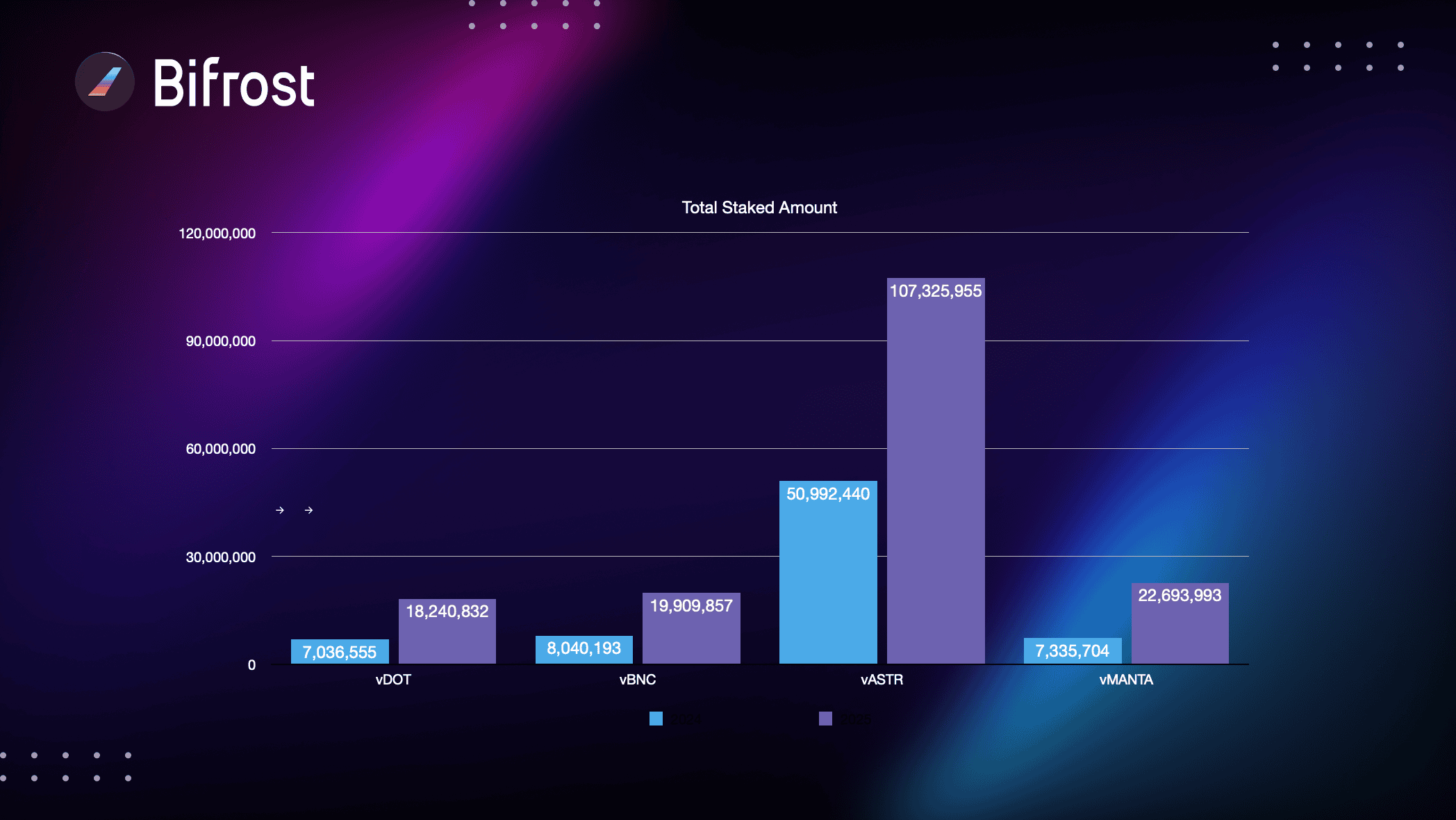

vDOT remained the core growth engine. Minted supply increased from approximately 7 million at the beginning of the year to 18 million by year-end—representing over 157% growth, with peak issuance surpassing 24 million. vDOT continues to lead the Polkadot ecosystem as its most liquid staking asset.

vBNC growth was closely tied to the launch of the bbBNC economic model. As more users opted to lock BNC for protocol revenue participation, demand for vBNC rose in parallel, with minted supply approaching 20 million by year-end.

vASTR maintained steady momentum, doubling from 50 million to 100 million over the course of the year. Continued expansion within the Astar ecosystem provided a solid demand foundation.

vMANTA experienced breakout growth following the release of vMANTA 2.0. Minted supply rose from 8 million to 22 million, an increase of nearly 175%. Instant minting and improved cross-chain UX were the primary drivers behind this acceleration.

On December 18, Bifrost officially launched vETH 3.0—its most significant step into the Ethereum ecosystem to date.

With over $100 billion staked, Ethereum represents the largest value pool in DeFi. vETH 3.0 rethinks liquidity architecture from the ground up, delivering on the vision of “one LST, natively usable everywhere.” Users can mint vETH directly on Ethereum mainnet, Base, Arbitrum, Optimism, and Bifrost-Polkadot, without complex bridging workflows.

vETH 3.0 marks Bifrost’s formal entry into the competition for omnichain LST infrastructure. Next, Bifrost will support direct conversions from stETH and rETH into vETH, enabling seamless migration for existing LST holders. Deeper integration with Hydration is also underway, leveraging Omnipool and gigaETH strategies to unlock broader DeFi use cases for vETH holders.

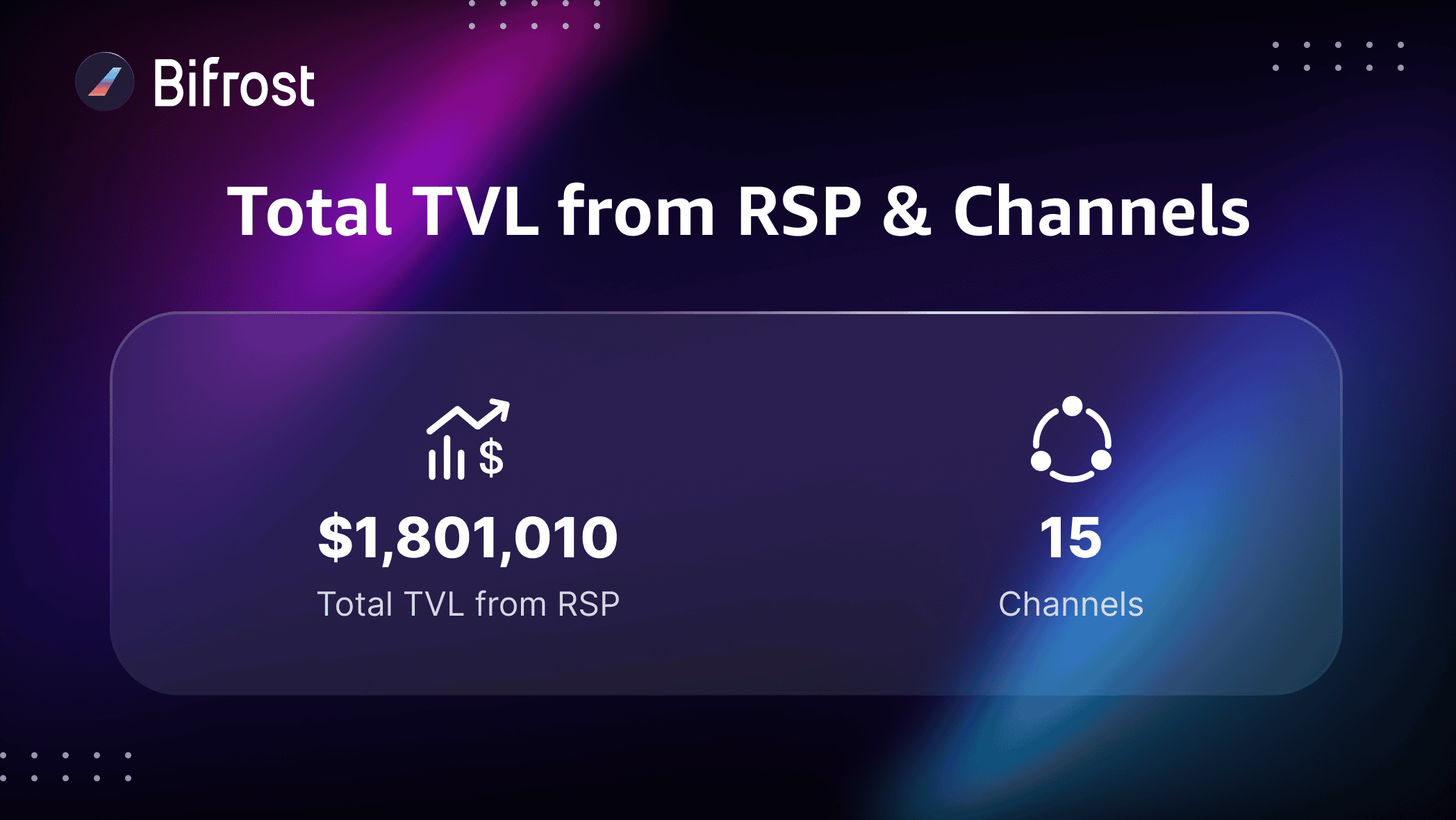

The vToken Reward Share Program has become a key driver of Bifrost’s TVL growth. Its premise is simple: partners who help grow Bifrost should continue to share in the protocol’s success.

In 2025, the number of RSP partners expanded to 15, collectively driving over $1.8 million in effective TVL. Subscan and WUD emerged as standout contributors.

Bifrost’s growth does not rely solely on internal marketing spend. Through ecosystem-level collaboration, partners become both co-builders and beneficiaries of long-term value creation.

In 2025, Bifrost successfully completed the Liquid Wave airdrop campaign, the largest community incentive initiative in the protocol’s history.

The campaign page recorded over 100,000 visits, with 37,131 addresses participating. TVL driven through the campaign exceeded $3.17 million, and more than 135 million WAVE points were distributed.

Liquid Wave represented a deep engagement experiment with the community. Through a points-based system and phased tasks, users were introduced to the value of vTokens, experienced the convenience of liquid staking firsthand, and became long-term participants in the Bifrost ecosystem.

For a liquid staking protocol managing tens of millions of dollars in assets, security is paramount. In 2025, Bifrost completed several critical upgrades across its technical and security stack.

At the protocol level, the Runtime 20000/21000 upgrade series significantly improved performance and stability. AssetHub migration support was completed in preparation for the Polkadot 2.0 era. Deep integration with Hyperbridge established robust cross-chain communication channels, laying the groundwork for multi-chain vToken expansion.

On the security front, Bifrost partnered with Immunefi, maintaining a bug bounty program with rewards of up to $500,000.

Throughout 2025, Bifrost established deep partnerships across the ecosystem.

DeFi Singularity was one of the year’s most impactful collaborative initiatives. Through joint incentives with Hyperbridge, the campaign successfully attracted over $4,000,000 in cross-chain TVL, extending vDOT yield opportunities from Polkadot into Ethereum, Base, and beyond.

On the developer side, Bifrost partnered with OneBlock and PaperMoon to host a global hackathon with a total prize pool of $12,000.

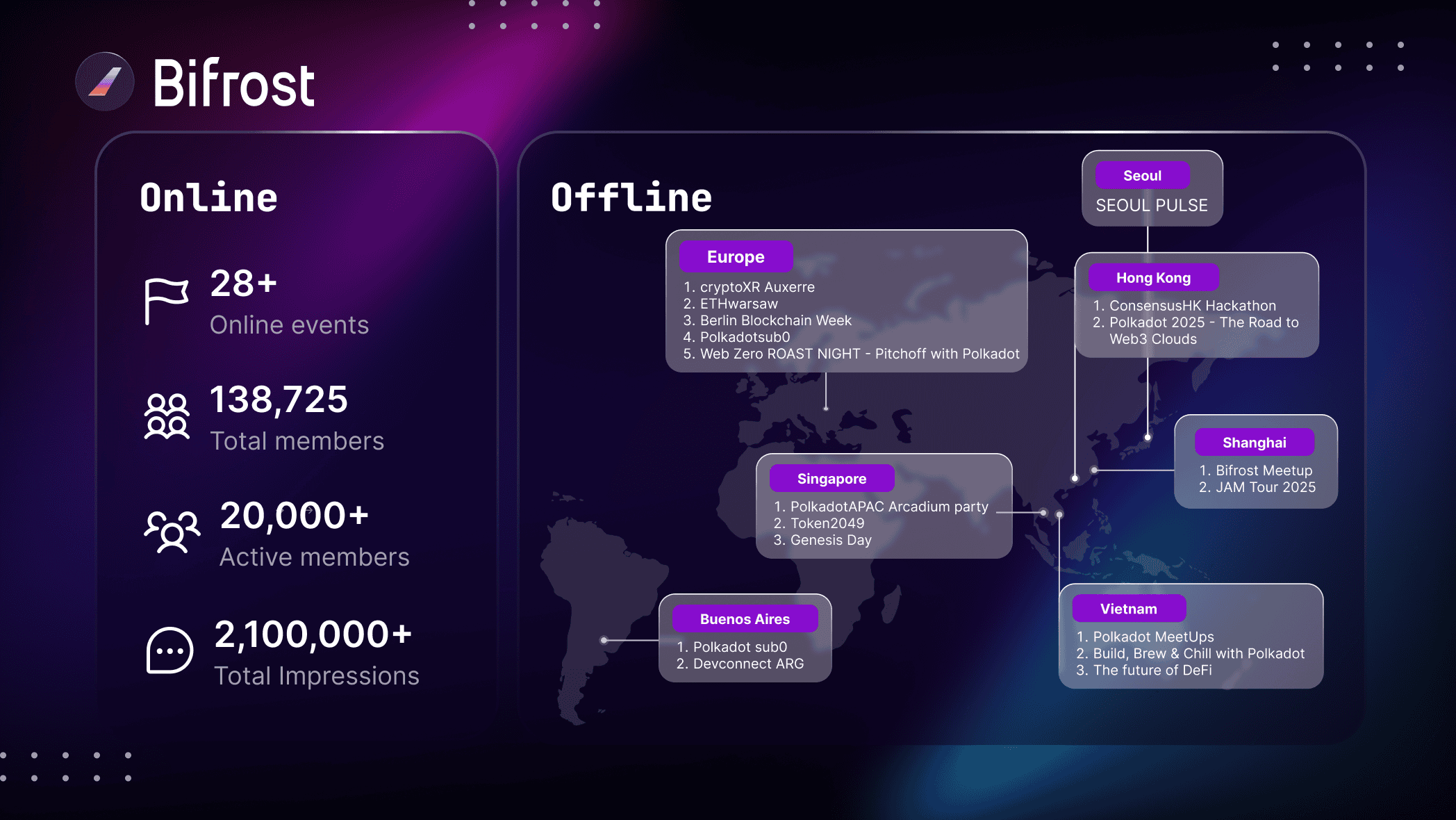

In 2025, the Bifrost team traveled to 10 cities worldwide, participating in 27 events.

From Token2049 in Singapore to Korea Blockchain Week in Seoul, from Hong Kong to Buenos Aires, we remained committed to engaging with the community both online and offline—sharing vToken updates, discussing DeFi trends, and showcasing the latest liquid staking innovations.

These events were not merely about visibility. They served as vital channels for listening, feedback, and iteration. Many of Bifrost’s most important product decisions originated from these face-to-face conversations.

If “delivery” defines 2025, it refers not to a single outcome, but to a capability.

This year, Bifrost chose to do the hard things well: turning tokenomics into real buybacks and revenue distribution, transforming omnichain ambition into verifiable cross-chain functionality, and distilling product iteration into reusable, long-term technical frameworks.

We deliberately chose a path without shortcuts—stabilizing infrastructure first and grounding growth in genuine demand. These choices may not always generate the loudest headlines, but they determine whether a protocol remains resilient under pressure.

In 2026, we build forward from this foundation: stronger systems, a more diverse product suite, deeper collaboration, and staking yield solutions for stablecoins, DeFi, and real-world assets.

In a rapidly evolving crypto landscape, steady progress requires continuous exploration and persistent innovation. What carries us through each phase is a deep commitment to the industry—and the long-term trust of our community.

The period at the end of 2025 is also the starting point of 2026. We will continue to turn every promise into the next verifiable delivery.

All data in this report is current as of December 30, 2025.