The era of narrative-driven hype is behind us. Crypto is entering a new phase — one centered around revenue-generating fundamentals. In this cycle, what matters isn’t token presales or speculative airdrops — it’s real, recurring protocol revenue. Sustainable profit is becoming the lifeblood of serious crypto protocols, replacing short-term fundraising and Ponzi-fueled growth models.

On the investment side, both primary and secondary markets are shifting. VCs are now targeting verticals with clear monetization paths: DeFi, CeFi, RWA and stablecoins. Meanwhile, on the open market, projects like Hyperliquid, pump.fun, and AAVE — all of which generate revenue and commit to buyback strategies — are commanding valuation premiums. The message is clear: protocols that produce yield and return value to holders are winning. We're witnessing a transition away from casino-like speculation toward ecosystems that function more like revenue-generating businesses.

Profitability, however, isn’t the end game. The real question is how protocols return value to token holders. Unlike equities, crypto tokens have no built-in dividend rights; whether holders share in profits depends entirely on tokenomics design. In many protocols, the token is disconnected from revenue, leaving holders unable to capture value.

But generating revenue is just step one. The critical question for any tokenized protocol is: how do you return that value to token holders in a way that’s fair, transparent, and aligned?

Unlike traditional equities, crypto tokens have no built-in dividend rights; whether holders share in profits depends entirely on tokenomics design. In many protocols, the token is disconnected from revenue sharing with holders.

There are two approaches to fix this:

Historically, most DeFi buybacks are governance-triggered. Teams submit proposals, buy tokens on the open market, then either burn them or transfer them to the treasury. The idea is to reduce supply and create value for remaining holders. But this system is flawed — rewards are inconsistent, unpredictable, and often gamed. It breeds short-termism and weakens long-term community alignment. Tokenholders end up speculating on governance outcomes instead of trusting in systematic value distribution.

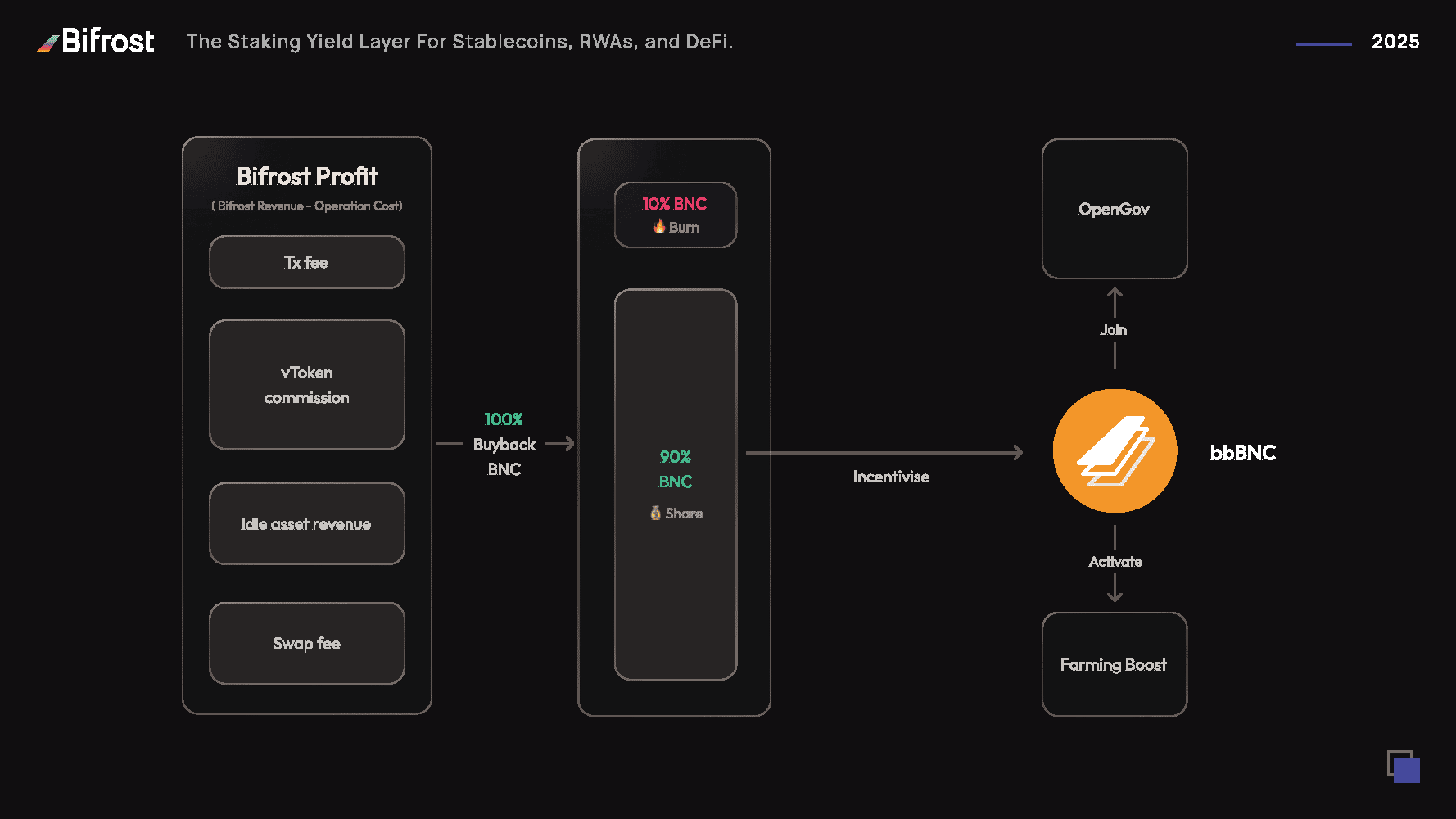

Bifrost is flipping the script with its Tokenomics 2.0 upgrade, introducing scheduled, non-discretionary buybacks. Each month, the protocol allocates its treasury revenue to automatically buy back BNC on the open market. Purchased tokens are then split: 10% are burned, and 90% are distributed to bbBNC holders.

The burn mechanism creates long-term deflationary pressure. The bbBNC distribution turns protocol revenue into direct dividends for long-term supporters. This isn’t just a passive incentive — it’s a structural flywheel designed to reward conviction and commitment.

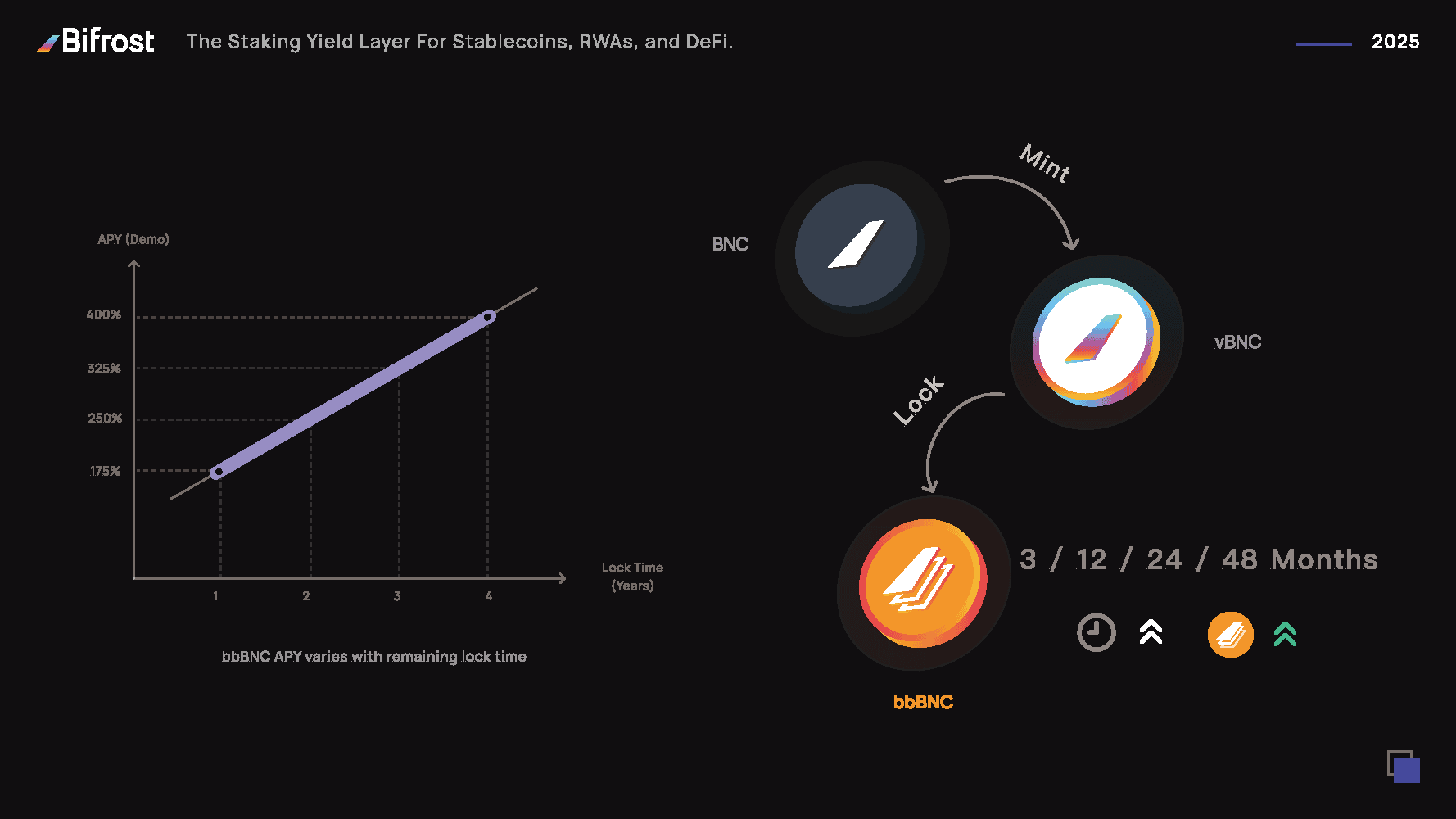

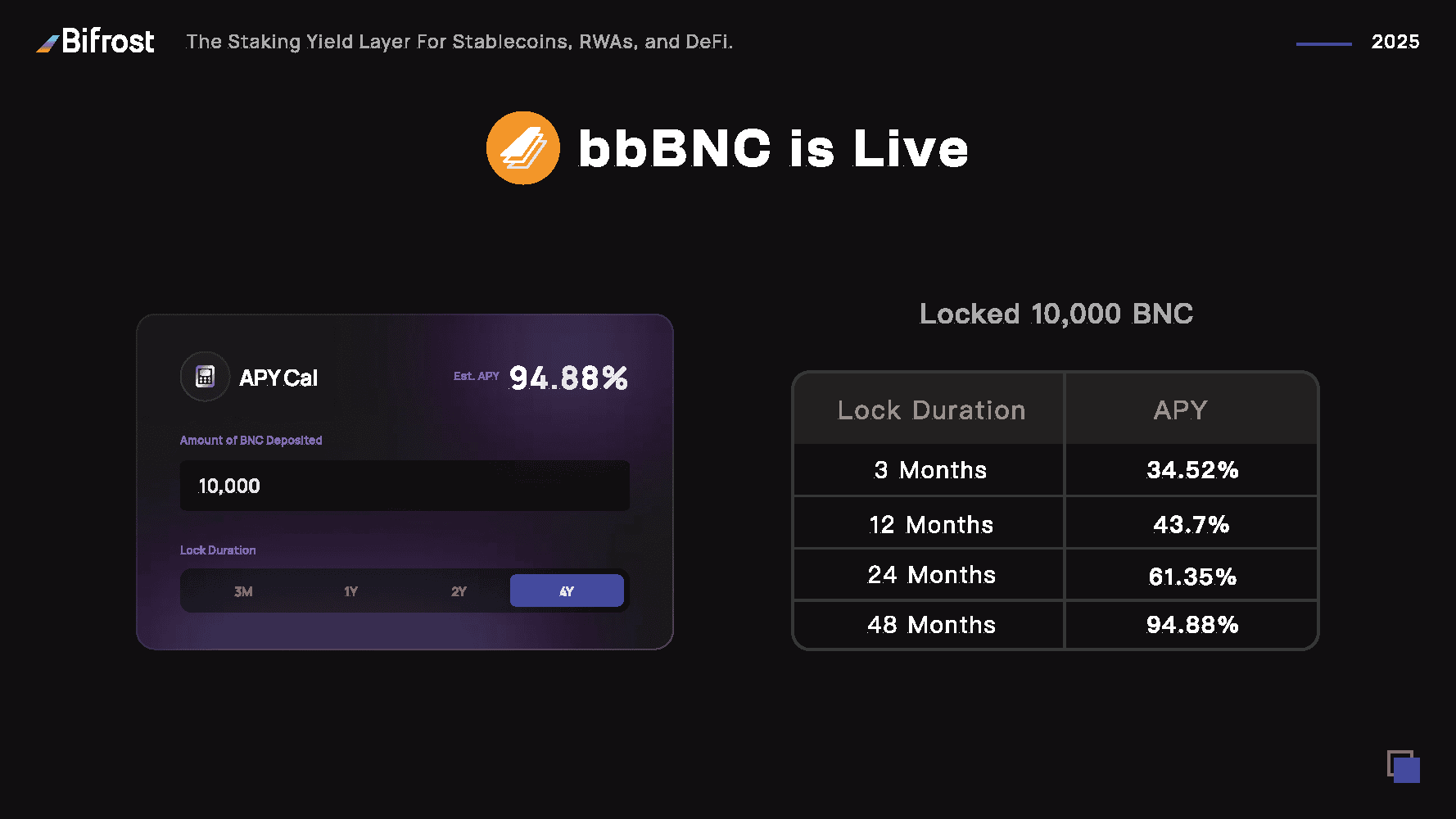

bbBNC is a yield-bearing voucher that users receive by locking vBNC. The number of bbBNC tokens received depends on both the amount locked and the duration — the longer and larger the lock, the more bbBNC you receive. Lockups can be as long as four years, and bbBNC decays linearly as the unlock date approaches, much like veCRV.

This design filters for long-term alignment. Only those willing to commit capital over time receive a meaningful share of protocol profits. In return, bbBNC holders are granted exclusive access to revenue distributions — a model that draws clear inspiration from Curve’s ve-token mechanics.

It’s a smart evolution of token economics: shifting from speculation to stake-based governance and yield. It ensures value is captured by those who actively support and secure the protocol, not just passive tokenholders or short-term traders.

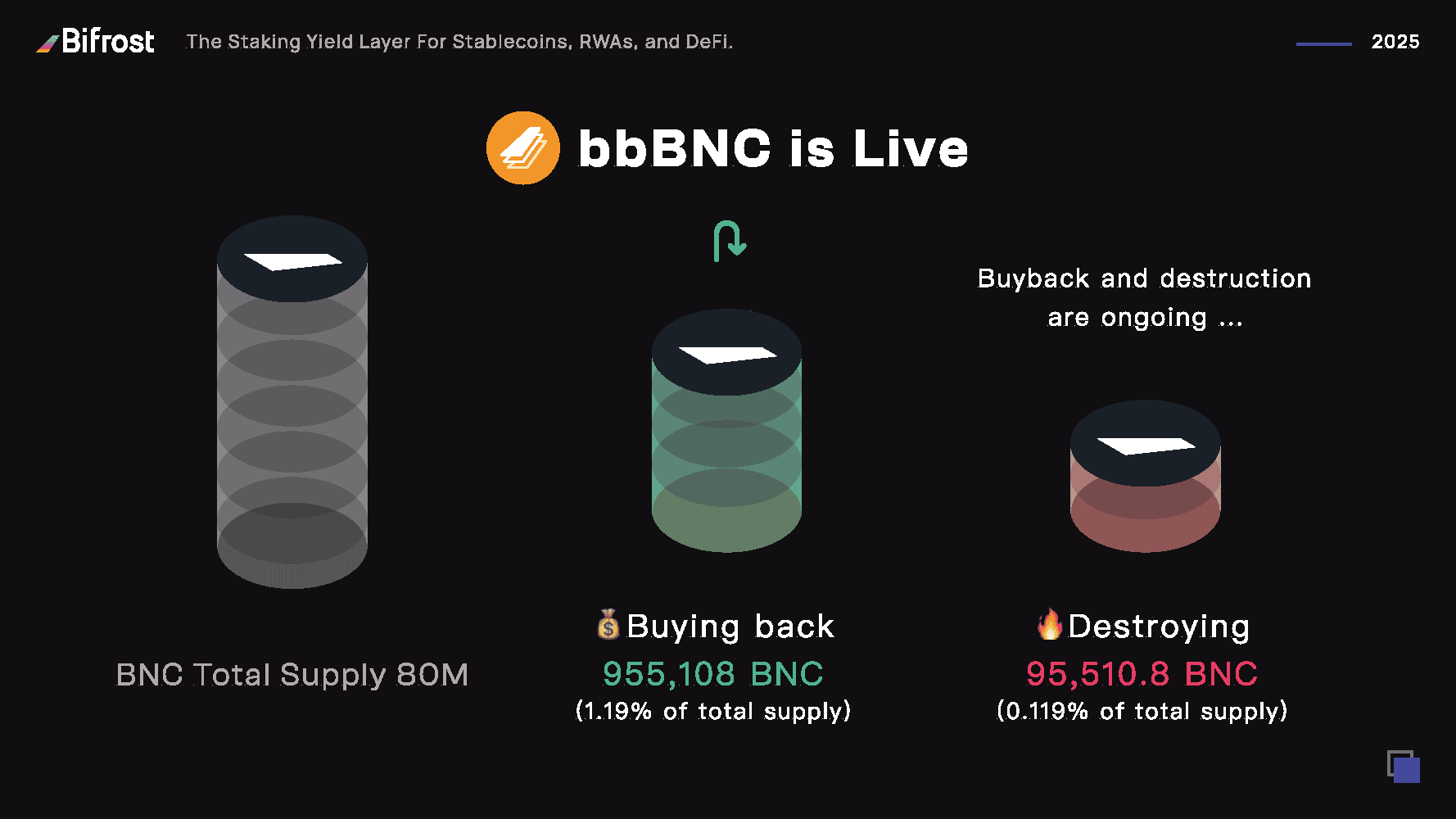

Bifrost’s buyback engine went live on November 1. Since then, the protocol has repurchased 955,108 BNC from the open market — roughly 1.25% of circulating supply — and earmarked these tokens for distribution. All buyback records are transparently recorded on-chain and tied to specific governance proposals, reinforcing trust through verifiable execution.

bbBNC minting and reward claims also went live on the same day. Users can lock their BNC or vBNC, receive bbBNC, and immediately start claiming their share of the revenue pool at bbBNC landing page. If you were early to mint, you’re already earning a cut of the pending distribution.

In crypto, and especially DeFi, "revenue" typically refers to gross protocol income — fees generated before incentives. Market capitalization, meanwhile, measures the value of circulating tokens. A common framework used across TradFi and DeFi alike is the MarketCap-to-Revenue (M/R) multiple, which helps assess how efficiently a token is priced relative to its income-generating power.

Instead of using traditional “circulating supply cap,” we anchor the valuation using "unlocked supply cap". Since tokens staked for governance or validator operations — while not freely tradable — are actively contributing to the network and should be counted in the economic base. Unlocked supply, not just liquid supply, reflects the actual utility footprint of the token.

Now we can get a read on how $BNC is priced versus its fundamentals.

This puts its M/R ratio at 5.6x. For comparison, most top DeFi protocols trade at 8x or above. Lido, for example, is at 9.8x according to DefiLlama. By this metric, BNC is significantly undervalued — despite offering recurring revenue, enforced buybacks, and real yield.

Crypto is maturing — and with it, the rules of the game are changing. We’re moving past the era of pure speculation, where narratives fueled short-term pumps. The new frontier is cash flow: protocols that generate real revenue, share it transparently, and align with long-term participants.

Bifrost’s model creates a tightly-coupled growth loop: PoS staking generates rewards → rewards fund monthly buybacks → buybacks drive yield to bbBNC holders → yield attracts long-term supporters → supporters help grow the ecosystem → ecosystem growth drives more revenue.

With ~$100M in TVL and its flagship product vDOT seeing 242% minting growth and 82.2% holder growth in 2025 alone, Bifrost is gaining serious traction. The protocol is preparing to launch vETH 3.0 (an omni-chain liquid staking solution for EVM chains), a native stablecoin vault, and a next-gen vToken suite — expanding its yield layer across multiple ecosystems.

“Narratives and Speculation” is the past, “Revenue and Application” will be the future.