On July 18th, Jonas, a research scientist at the Web3 Foundation, posted on the Polkadot forum suggesting reducing the annual inflation rate of DOT from 10% to 8%, with 15% fixed inflows to the treasury. This is to address Polkadot's budget crisis and attempt to further revitalise DOT staking and Liquid Staking.

Interestingly, since Ethereum's Shanghai upgrade in April 2023, the market has held high expectations for Liquid Staking in ecosystems like Polkadot, Cosmos, Sui, and Aptos. However, compared to the flourishing ETH/SOL Liquid Staking Token (LST)/Liquid Restaking Token (LRT) track, other blockchains' staking tracks seem tepid, lacking strong momentum.

At this critical moment, Polkadot has launched a reform targeting the inflation rate. Could this be an attempt to force the staking track to develop new variables, and will Polkadot's Liquid Staking track break through during this challenging time?

As is well known, Proof of Stake (PoS) chains rely on native token staking to ensure security. Therefore, to incentivize network-wide participation in staking to maintain network security, some PoS chains offer annual staking rewards in double digits or higher, facing high inflation pressure.

Polkadot, Cosmos, Sui, and Aptos generally have much higher staking rates compared to ETH. Under high inflation, if token holders do not actively participate in staking, their shares will be gradually diluted by other stakers.

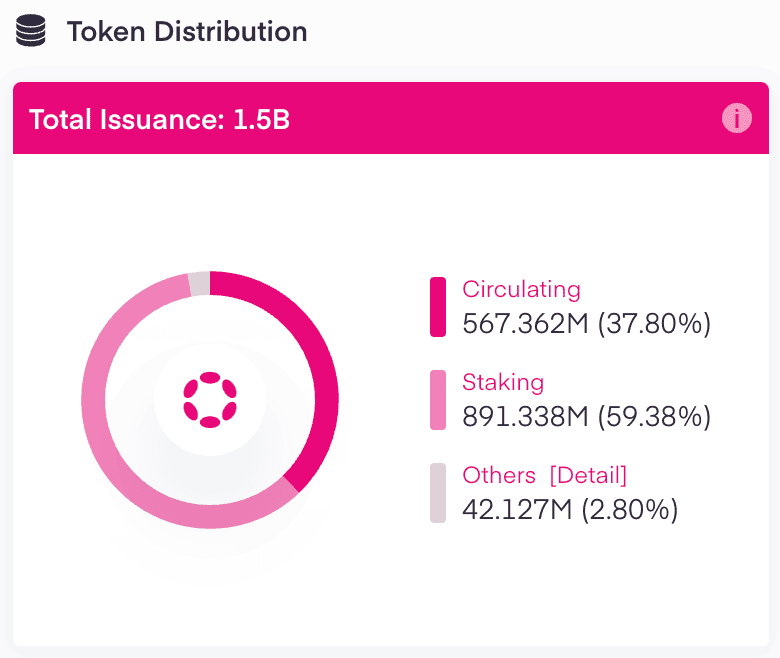

According to Staking Rewards data, compared to Ethereum's approximately 28.58% staking rate, other major PoS chains have staking rates above 50%—Sui at 78.77%, Aptos at 77.44%, Cardano at 62.6%, Polkadot at 58.8%, and Avalanche at 54.89%.

In terms of absolute staking volume, apart from Solana's unique position with 3-5 billions, providing the foundation for the further development of the LST track.

However, the paradox is that in the current PoS ecosystem, chains like Polkadot face a "high staking rate but extremely low LST penetration" anomaly:

DOT has 891 millions staked tokens, valued at over 35.6 million.

This means DOT's LST share (Bifrost) accounts for only 1% of the total staked DOT volume, with most token holders opting for native staking and nomination pools instead of liquid staking.

Assuming Bifrost's market share remains unchanged, and if liquid staking penetration in Polkadot reaches anywhere around 10%, it would mean Bifrost's DOT TVL surpasses 55 million DOT, valued over 350 million USD. This scale is sufficient to stimulate the development of DeFi primitives on top of LSTs.

This situation of high staking rates and low LST penetration is not unique. Other PoS chains mentioned also face similar issues. The main reason is that the native staking annual yields of new PoS chains are already high enough, but other use cases within the ecosystem are very limited, offering few opportunities and low yields. Even if users hold LST assets, they have limited options for additional yields, reducing the incentive to participate in liquid staking. In contrast, Ethereum's situation is different, with rich DeFi primitives and composability, LST holders can achieve additional yields through various opportunities. Moreover, with Ethereum's native staking rate only 3-4%, even a 4% additional yield doubles the original yield, providing more motivation for users to use LSTs.

Earlier on in July, several Polkadot ecosystem builders opened up a community-wide discussion regarding the adjustment of the DOT inflation rate and its potential impact on the overall Polkadot network security and DOT staking rate, sharing their perspectives on how to reduce net inflationary pressures.

Interestingly, all attendees, including Web3 Foundation research scientist Jonas, Web3 Foundation technical educator Filippo, ChaosDAO co-founder Alice_und_Bob, Mark Cachia founder of Scytale Digital, and Fellowship member Kian, largely support reducing the DOT inflation rate to balance network security, investor interests, and project development needs.

As for the specific inflation rate reduction and what kind of dynamic assessment and adjustment mechanism to adopt, everyone has their views.

A good tl;dr was made by 0xGoku in this thread, many aspects have to be taken into consideration:

Overall, if the maximum DOT inflation rate could be successfully reduced to 5% (i.e., halved), and a flexible parametric mechanism established to adjust the inflation rate according to actual conditions, it might result in some immediate loss of direct income for staking users, particularly large holders. However, from a long-term perspective, this is undoubtedly a significant positive for the entire Polkadot community.

Once liquid staking solutions and products building on top of them can deliver significant yield improvements, users’ perception towards LSTs will undergo a significant shift - in terms of diversifying and holding LSTs to have exposure to greater yield scenarios.

Thus, if DOT inflation could indeed be halved, it would not only likely promote the prosperity of the Polkadot liquid staking ecosystem but also bring more vitality and innovation to the entire ecosystem, greatly enhancing users' willingness to use LSTs and driving the development and expansion of solutions building on top of liquid staking, to driving more on chain activity and growth.

The idea of reducing the inflation rate will undoubtedly create a "crowding-out effect" on Polkadot's staking/LST ecosystem:

As native yields decrease, users will actively turn to LSTs to seek additional yield opportunities, helping to increase LST penetration, promote more efficient capital allocation, and potentially drive more diverse and rich financial services in the entire Polkadot ecosystem.

However, reducing the inflation rate may temporarily affect investor confidence, causing some funds to flow out. Thus, the Liquid Staking products within the ecosystem need to be strong enough in terms of yield and security.

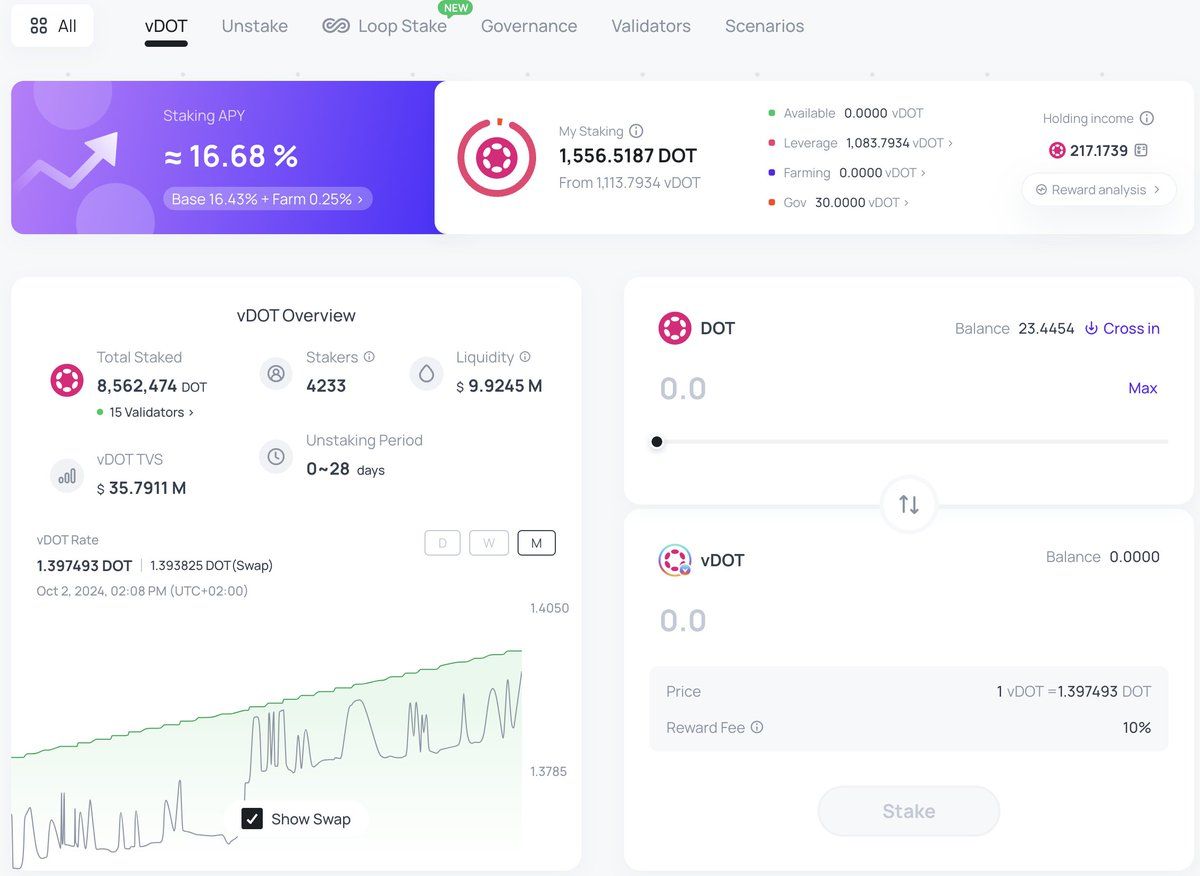

For example, Bifrost has shown impressive performance in three dimensions: richer composable yields, multi-layered security guarantees, and comprehensive governance rights inheritance (governance inheritance, airdrop inheritance).

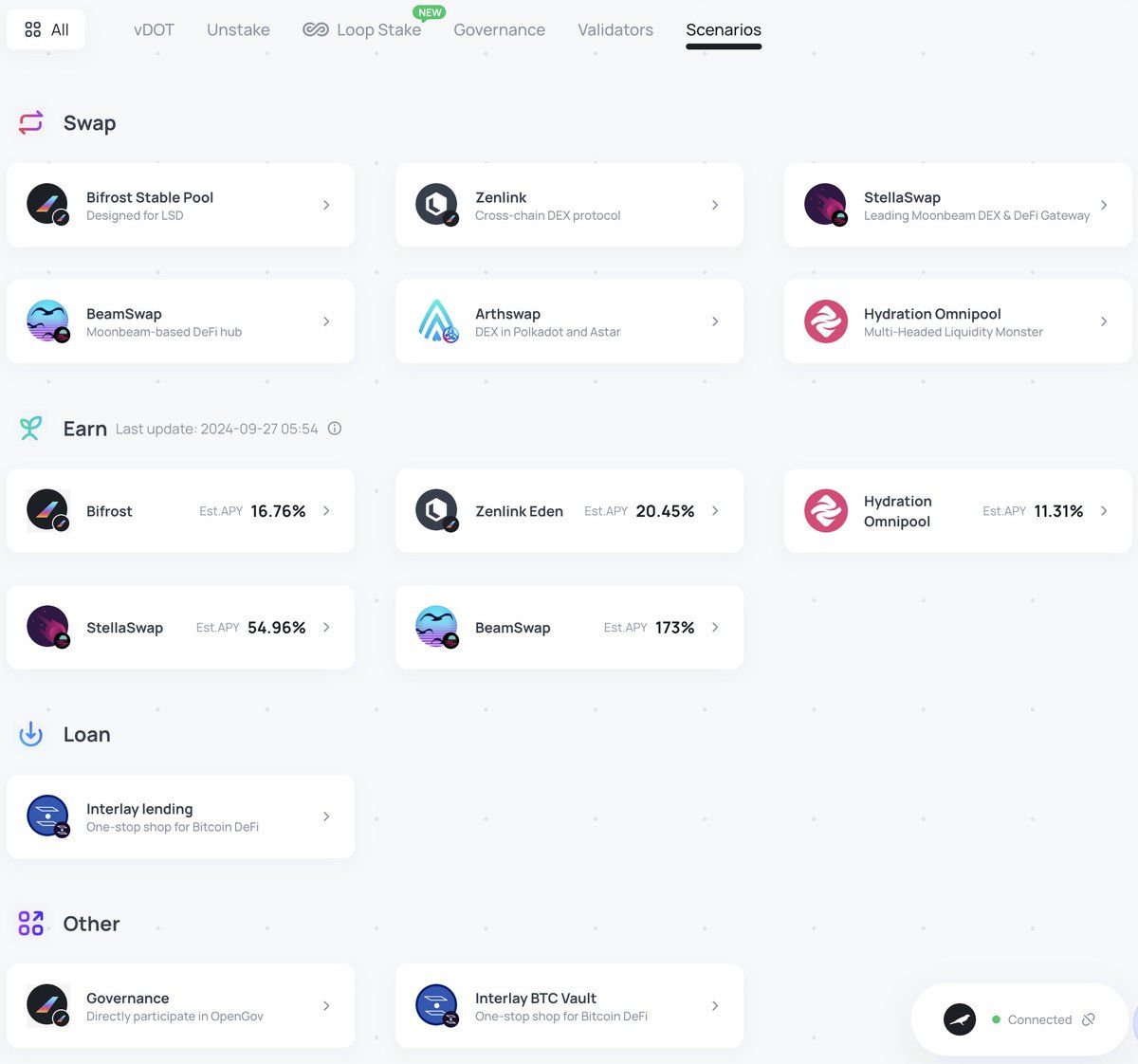

Bifrost is expanding application scenarios around vDOT on a regular basis. Besides generating staking yields, vDOT can also be used in lending protocols, DEX, and farming protocols in DeFi to generate multiple yields.

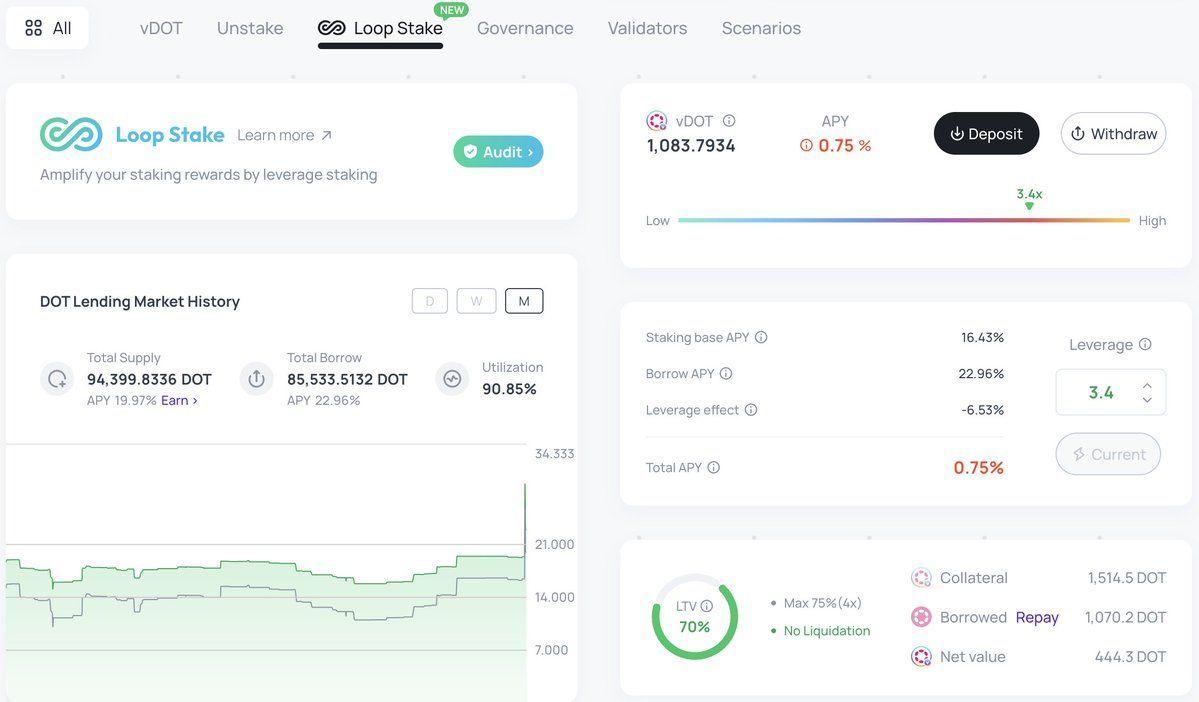

Bifrost has launched a leveraged staking product called "Loop Stake" for vDOT and vKSM, allowing users to set and manage leverage based on their risk preferences and complete leveraged staking with vDOT and others in one click. This significantly attracts users, as liquid staking on Bifrost becomes a flexible and leveraged investment.

Currently, Loop Stake has attracted over 94,000 DOT supplies and nearly 85,000 DOT borrowing demands, achieving initial results.

Ordinary users can also leverage vDOT’s composability across chains to directly use Bifrost Parachain services and liquidity on other Polkadot parachains and more heterogeneous chains. Bifrost actively collaborates with other projects and ecosystems within the Polkadot ecosystem to enhance vDOT's impact and application range, providing more value to users in the ecosystem, examples of this have been, vDOT being the largest collateral asset on Interlays lending market and for securing their decentralised trustless iBTC vaults as well as vDOT popular usage on Hydration Yield DCA feature allowing users to DCA their DOT staking rewards into other ecosystem assets.

Security is the lifeline of Liquid Staking products. vDOT has established multi-layered security mechanisms to effectively prevent various potential risks and attacks:

At the base level, it relies on Polkadot's shared security as a parachain, with security and anti-reorganization protection provided directly by the relay chain. Bifrost Polkadot chain now has over 32 collator nodes, ensuring network availability and making transactions hard to censor.

Bifrost uses XCMP (cross-chain message passing protocol) for cross-chain security protection to ensure trustless, secure and accurate message transmission during cross-chain interactions.

Given that staking assets essentially serve as node collateral, there is a Slash risk for node misbehavior. To minimize Slash losses, Bifrost evaluates validator nodes' yields, leverage (self-staking ratio), and historical credit. In case of Slash risk, it switches nodes immediately to prevent loss escalation. An insurance pool, vToken Vault, is also set aside to cover user losses with 5% of protocol revenue.

Bifrost undergoes strict security audits by professional thirty party security teams (Common Prefix, Slowmist, Oak Security) to scrutinize SLP's code, mechanisms, and operating environment, promptly identifying and fixing potential vulnerabilities.

ETH doesn't have governance token attributes, so the governance rights and airdrop inheritance for LSTs have received little attention. However, for PoS chains like Polkadot and Cosmos, which have governance attributes, LST governance rights and potential airdrops eligibility are critical.

Bifrost adopts a "governance inheritance" mechanism, allowing vDOT to participate in Polkadot OpenGov governance. This way, governance rights remain with the stakers and are not transferred to the Bifrost protocol.

Users who want to participate in governance can liquid stake and use their Bifrost LSTs "vTokens" in governance, balancing decentralized governance and staking yields. During this period, if there are ecosystem project airdrops for DOT stakers, vDOT holders can inherit airdrop eligibility, just like DOT holders: e.g., vDOT holders have received airdrops of Polkadot ecosystem meme tokens DED (even if the DED team sent the tokens on the wrong address).

This addresses user concerns, further encouraging staking and governance participation. Users who might hesitate to stake due to fear of losing governance rights and airdrop opportunities are now more willing to stake with such guarantees.

The prosperity of PoS chain ecosystems like Polkadot depends on the thriving Liquid Staking track. LST is a strategic support and key leverage point for PoS chains to build DeFi niche assets, and create on-chain prosperity, activity and growth :

LSTs like vDOT can effectively activate the liquidity of staked assets and introduce a new type of DeFi assets with inherent yield attributes, invigorating the on-chain ecosystem with diverse product forms based on yield rights.

While Ethereum's LST ecosystem continues to evolve, chains like Polkadot are also seeking breakthroughs. As Polkadot begins to implement internal reforms like reducing inflation rates, leading participants like Bifrost might touch key transformation points, triggering a positive flywheel effect.