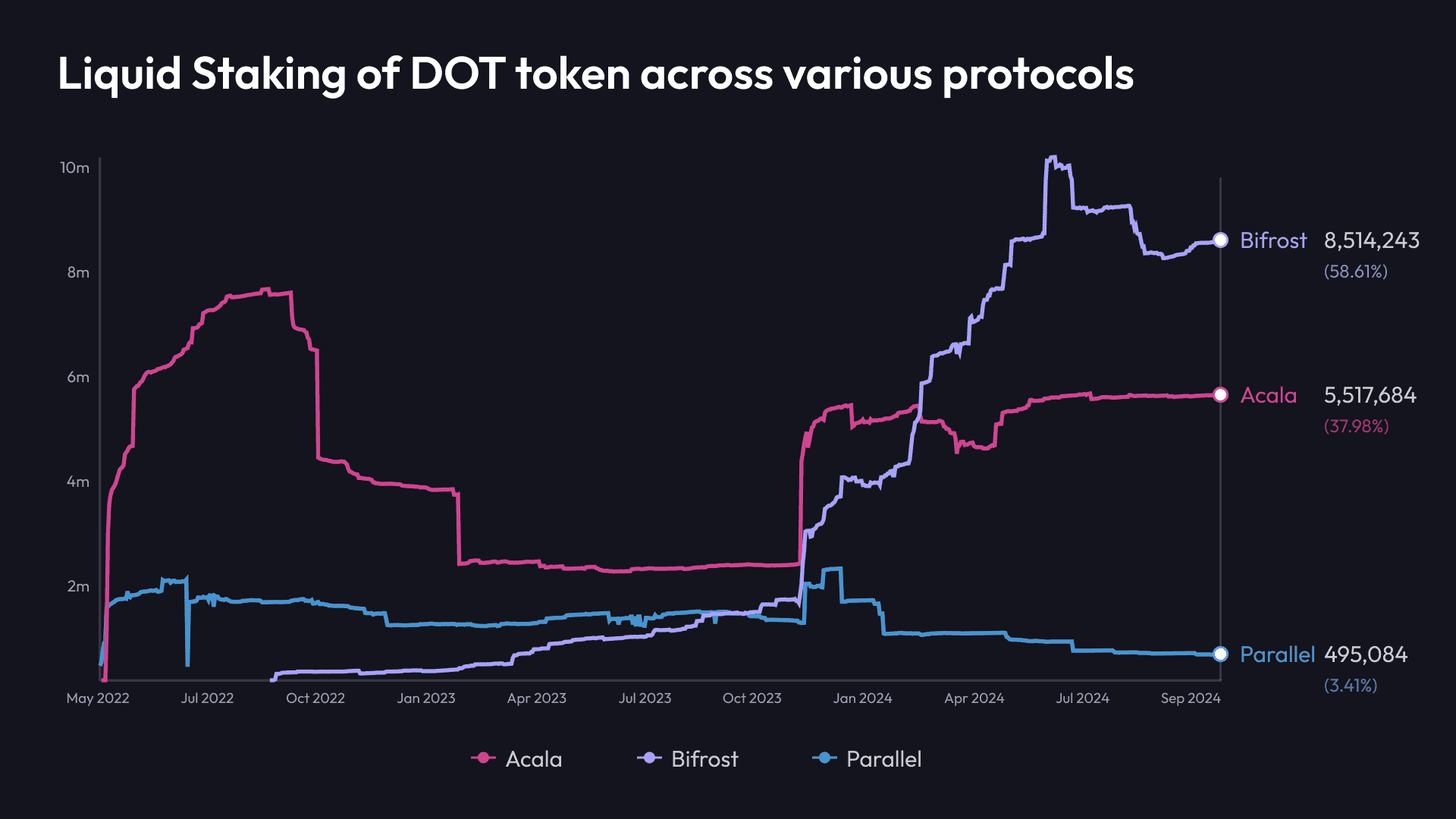

Bifrost is a liquid staking appchain tailored for all blockchains. Launched in 2019, Bifrost has grown to be the largest LST protocol in the Polkadot ecosystem. Bifrost has issued 9 LSTs including the likes of vDOT, vKSM, vASTR, vGLMR, vMOVR, and vBNC, as well as heterogeneous chain LSTs like vETH and vMANTA.

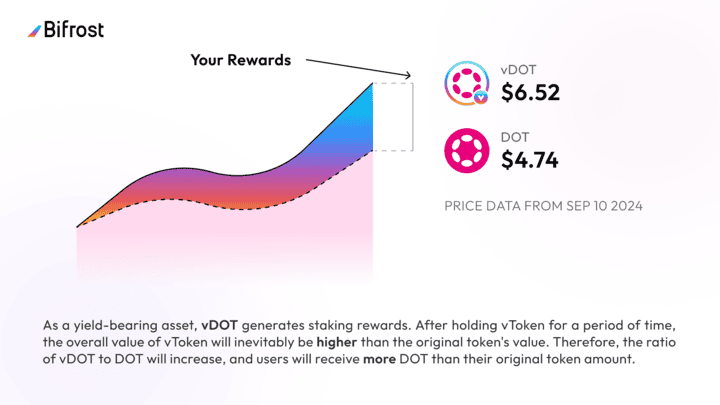

vTokens are Liquid Staking Tokens minted through Bifrost Protocol. Users can stake tokens to receive vTokens, which are essentially equivalent to staking native token and compounding staking rewards, enabling them to earn staking rewards while maintaining liquidity and securing networks.

As of now, Bifrost has become the leading Liquid staking solution in the Polkadot ecosystem, accounting for over 60% market share of the Polkadot LST landscape, with a TVL exceeding $100 million. This success is backed by the trust and support of stakers.

Many people choose vTokens as their primary staking choice because of Bifrost’s system security:

Bifrost Protocol operates in a fully decentralized manner, eliminating custodial risks. Additionally, Bifrost has established a BNC Treasury Vault to cover potential slashing losses, ensuring that, in the event of a slashing, compensation will first be drawn from the vault, protecting users’ earnings.

While security is fundamental, vTokens are also popular for features that some competing products lack, including voting power, a wide range of application scenarios, and one-click yield boosting.

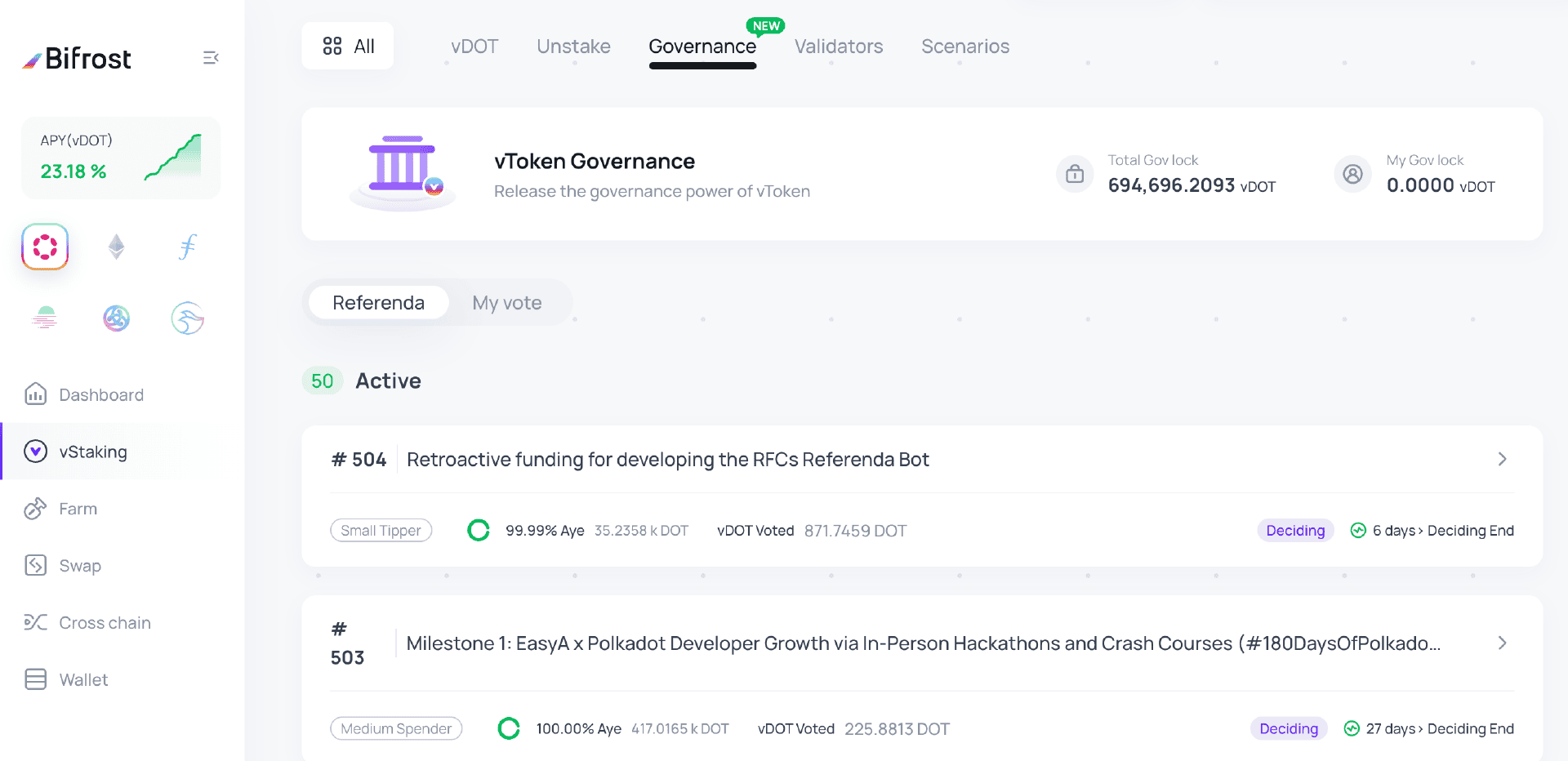

vDOT and vKSM holders can participate in OpenGov governance. For stakers, governance rights always remain in their control and are not transferred to the Bifrost Protocol.

Since Kusama and Polkadot transitioned from "Tricameral" system to the new OpenGov model, treasury funding requests now require a public vote, and participating in these votes requires staking DOT/KSM to gain greater voting weight. With direct financial interests at stake, DOT/KSM holders are highly motivated to engage in governance voting.

However, if LSTs do not support governance voting, a dilemma arises for DOT/KSM holders. Bifrost pioneered a governance mapping module that enables vDOT/vKSM holders to participate in governance. Users simply need to open the Bifrost Dapp, go to the vDOT/vKSM Governance page, and they can directly use their vDOT/vKSM in OpenGov governance voting.

The underlying mechanism is as follows: when vDOT/vKSM holders use their tokens to participate in voting, the Governance module leverages the staked DOT/KSM in the pool to cast mapped votes.

For users already interested in participating in governance, staking to receive vDOT/vKSM and then using these tokens for governance allows them to earn additional staking rewards. It’s a win-win situation.

All LSTs aim to unlock liquidity, allowing users to enjoy both staking rewards and retain liquidity. However, the core question lies in how users can actually make use of this unlocked liquidity.

For vTokens, this question can be simplified as: What purposes can vTokens serve?

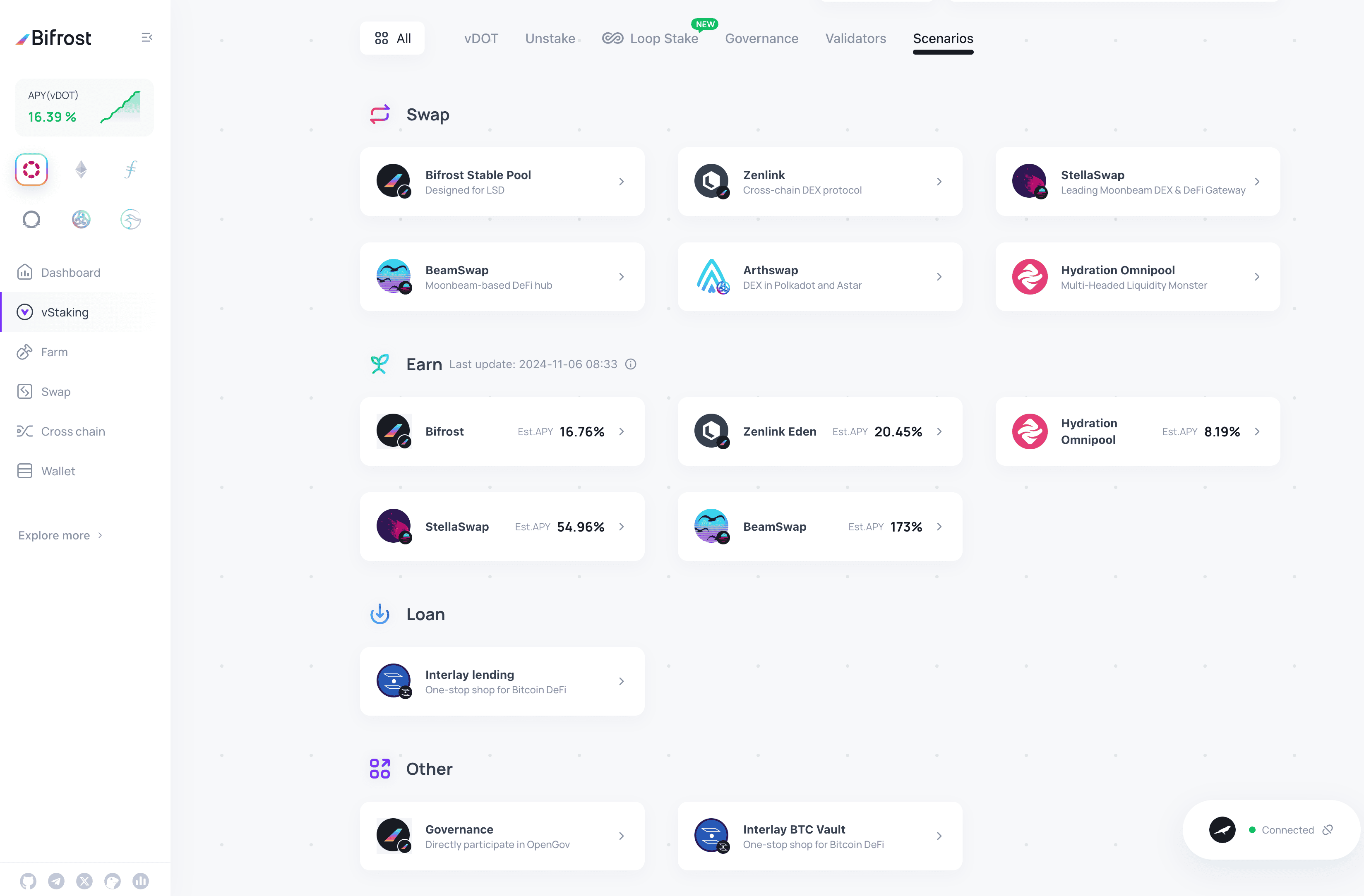

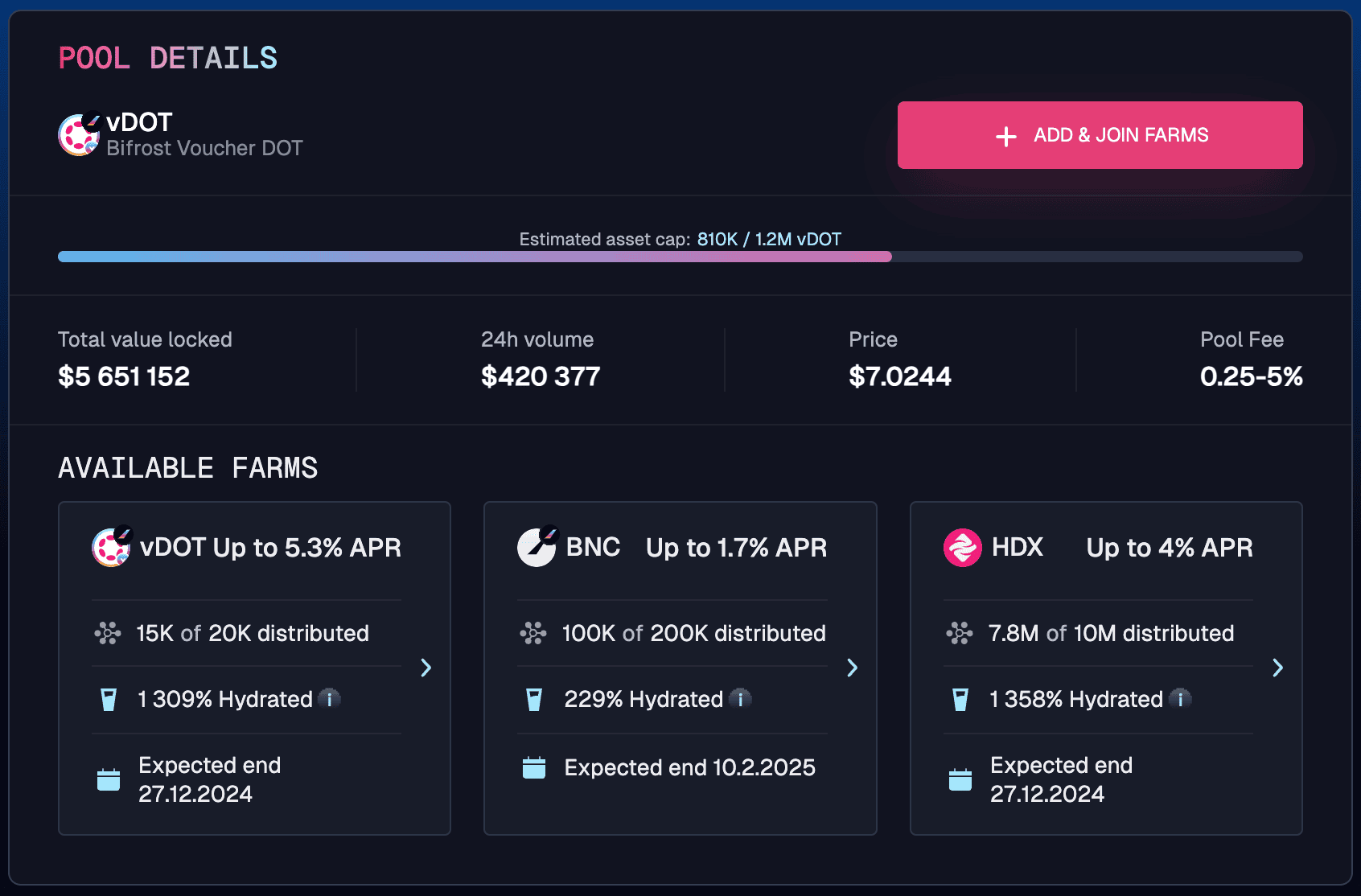

In the Bifrost Dapp, we provide an aggregated display of various use cases for vTokens. Let’s take vDOT as an example to illustrate this.

vDOT can be swapped for DOT at any time, and we have established robust liquidity to support this. The official pool holds over 340K DOT and more than 596K vDOT, with a total value nearing $4.8 million. The vDOT/DOT pool employs a stable pool market-making mechanism similar to Balancer, ensuring minimal price impact from trades.

DOT-vDOT stableswap pool on Bifrost

DOT-vDOT stableswap pool on Bifrost

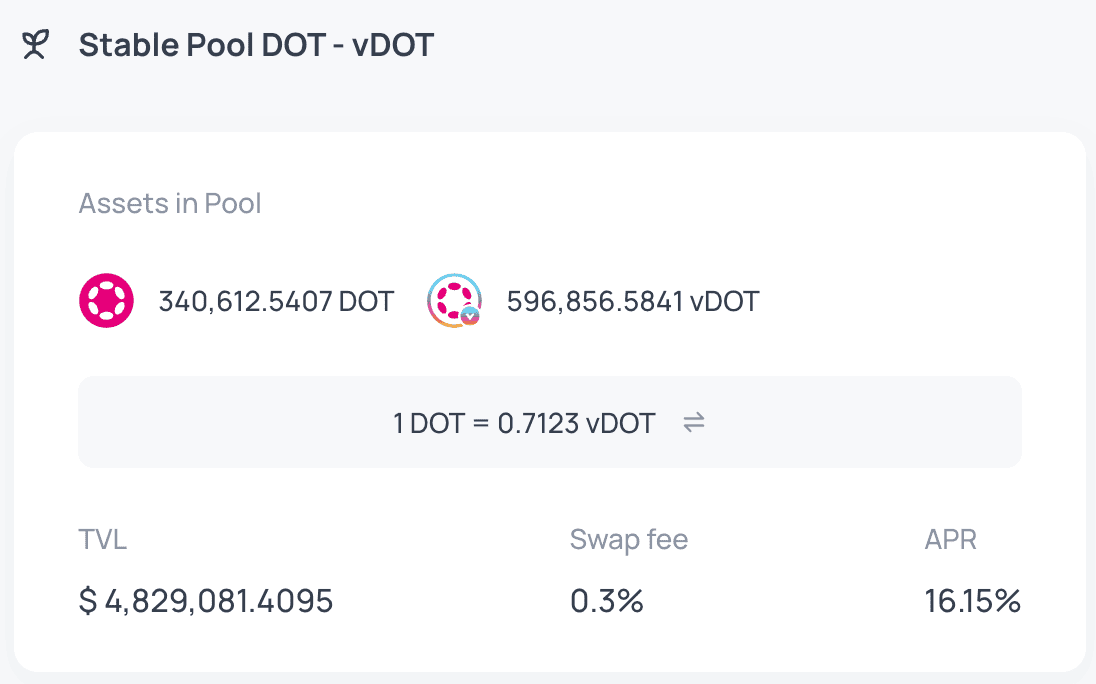

In addition to the official pool, we have also allocated liquidity on Moonbeam (Stellaswap) and Hydration to meet swap demands on these chains. The combined liquidity on these external chains is approximately $5.6 million. This ample liquidity ensures that vDOT holders do not face any risk of missed trading opportunities due to holding vDOT, allowing them to seamlessly swap back to DOT at any time and further exchange for any other desired asset.

vDOT in Hydration’s omnipool

vDOT itself is an interest-bearing asset, carrying staking rewards from staked DOT, but these are not the only benefits for vDOT holders. vDOT can also generate additional compounded yield when used in supported DeFi protocols.

You can pair vDOT to form LP tokens and provide liquidity in the official pool or other third-party pools to earn LP rewards. Since the price volatility of the vDOT/DOT pair is relatively low, there’s little risk of impermanent loss.

With Interlay Lending, you can use vDOT as collateral to borrow other assets, such as DOT or iBTC. If you borrow DOT, you can stake it again for vDOT, repeating the process for interest rate arbitrage. If you borrow iBTC, it can be used in broader yield-bearing scenarios. Soon vDOT will also become available in the Hydration’s brand new money market (Aave based).

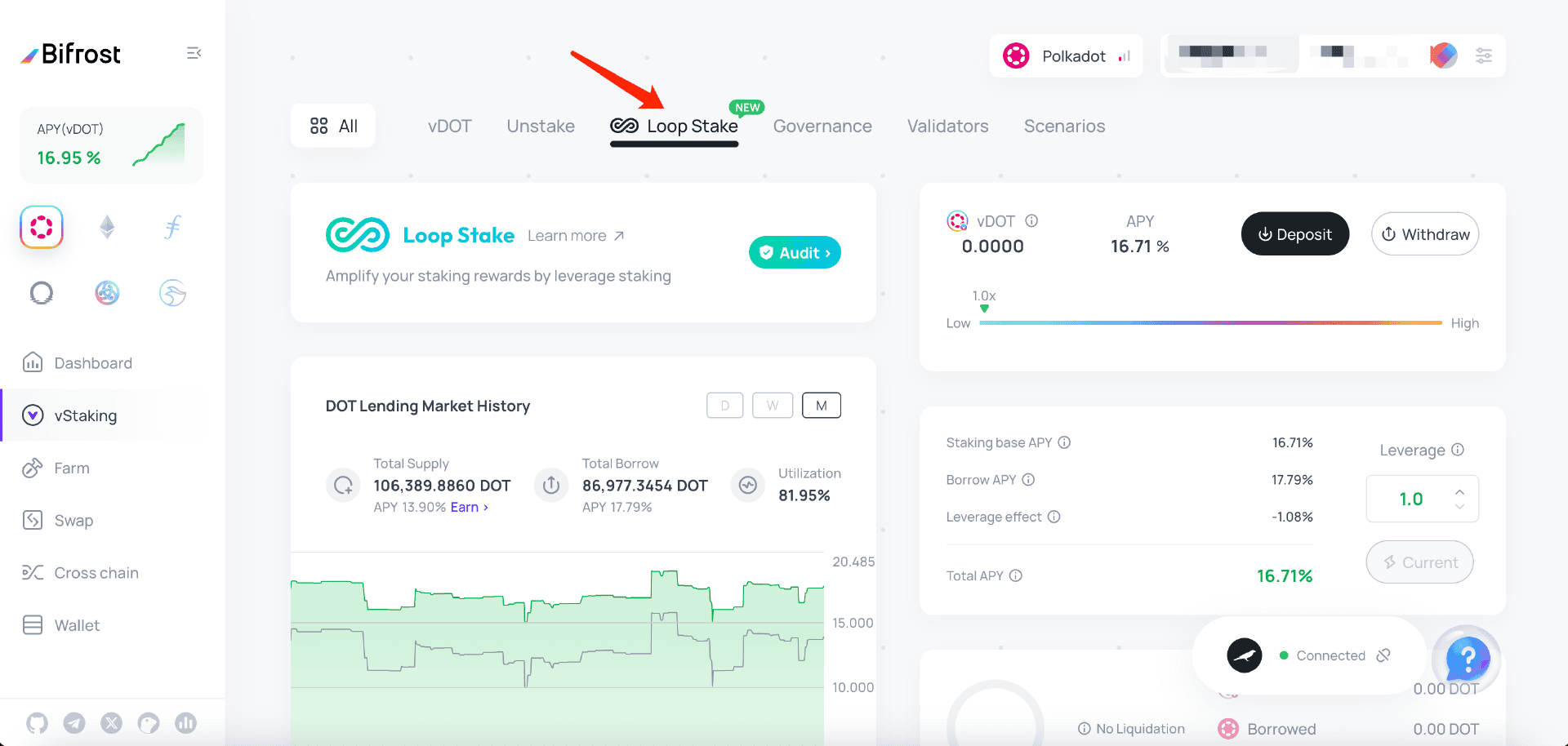

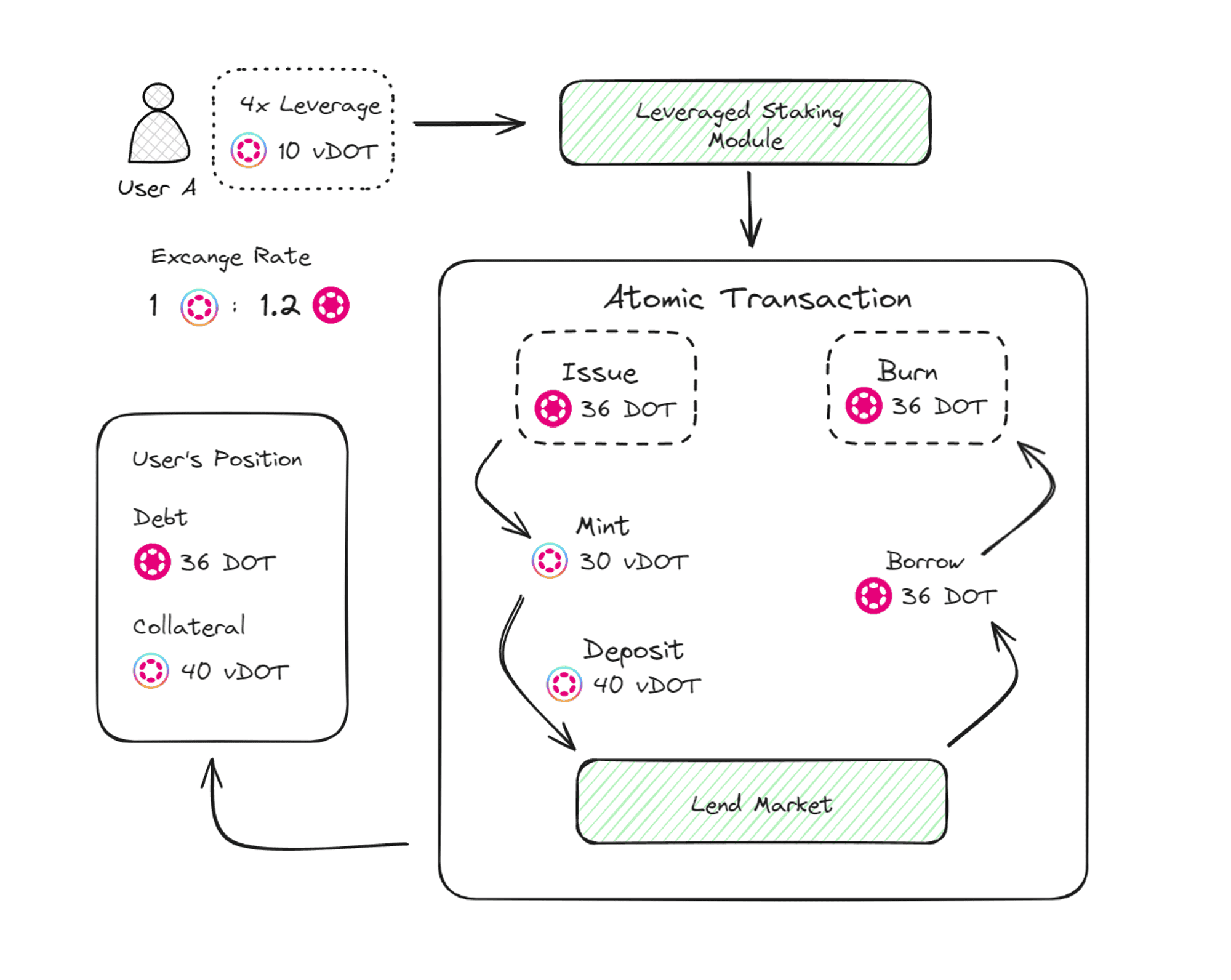

Additionally, Bifrost has launched Loop Stake, a leveraged staking tool tailored for Polkadot assets. Users can access the vToken management interface through Bifrost Dapp to enjoy a smooth one-click leveraged staking experience. At launch, Loop Stake supports leveraged staking for DOT and KSM, with plans to gradually expand to more parachain assets.

Loop Stake allows users to customize and control their leverage ratio based on their risk preferences and complete leveraged staking with a single click, supporting up to 4x leverage. Behind the scenes, Loop Stake uses flash loans to create leverage directly for users without the need for repeated borrowing cycles, minimizing gas consumption.

We explored several key features of vTokens that make them popular among stakers, including governance inheritance, diverse application scenarios, and leveraged staking.

In one word:

Everything native tokens can do and offer, vTokens and their holders can too.

For native token holders, liquid staking with Bifrost is a better choice because vTokens can accumulate the staking rewards while maintain liquidity.

What’s more, Bifrost will continue to enhance the benefits of vTokens and expand vDOT’s application scenarios. As more applications emerge, users will be able to choose from a range of combined strategies based on their risk preferences, unlocking multiple streams of returns and further amplifying the rewards and utility of vTokens.

Currently, Bifrost Liquid Wave campaign is in full swing. The campaign consists of three phases: LST Campers, BNC Explorers, and bbBNC Riders. We are now in the LST Campers phase, where minting vTokens will earn you WAVE. Holding WAVE will allow you to share a 150,000 BNC prize pool after the campaign ends. At the end of the entire Liquid Wave series, WAVE can be exchanged for bbBNC, entitling holders to ongoing profit sharing from the Bifrost Protocol.

Over 100,000 users have already joined Bifrost Liquid Wave campaign, Join Now: https://wave.bifrost.io/.