Since its launch, Bifrost has garnered a substantial user base. Many participants on X who use Bifrost as their staking solution have shared their staking experiences, offering the most authentic insights and perspectives.

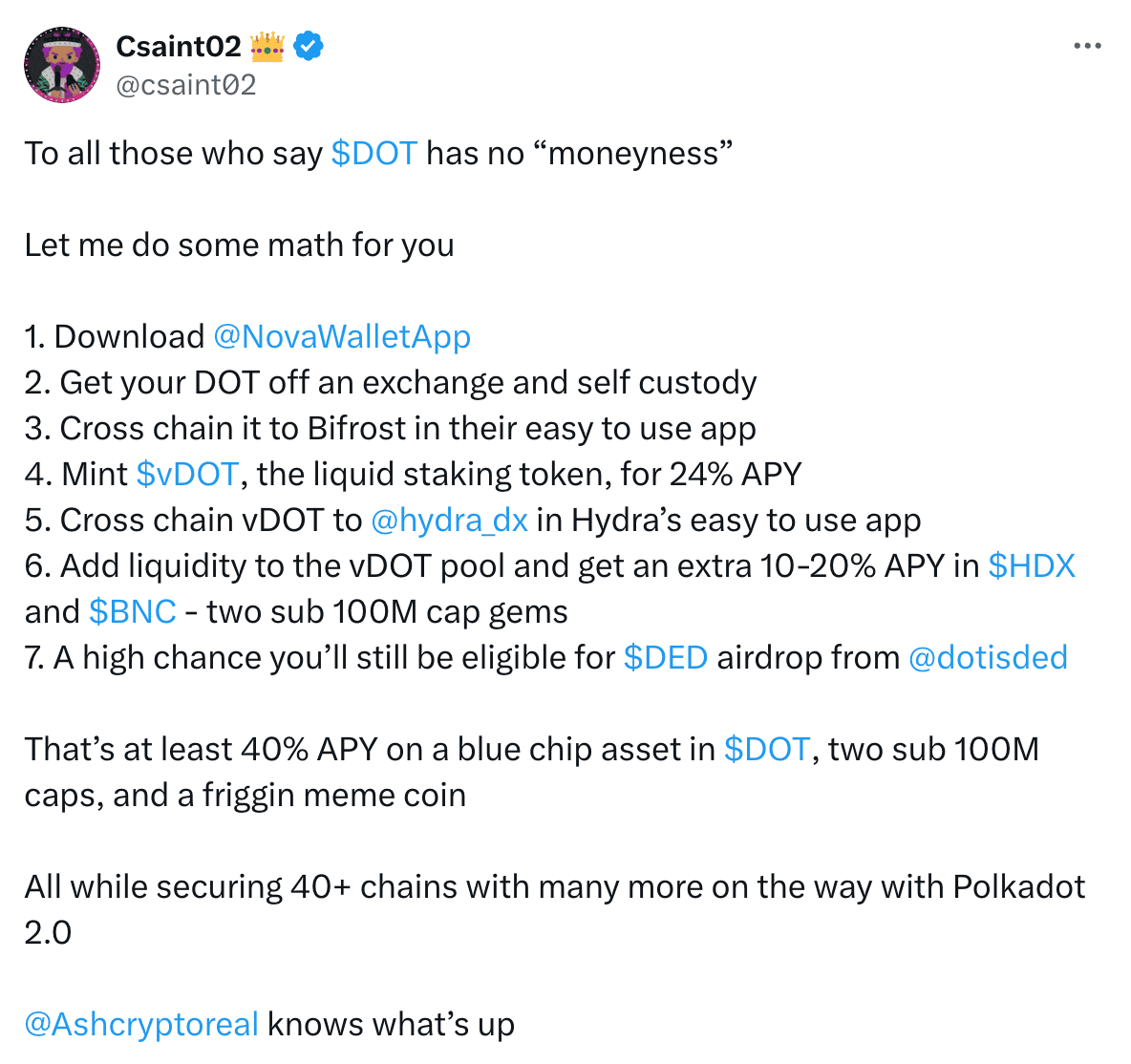

Some users have reported using vDOT to engage with other DeFi platforms, achieving annualized yields of over 40% on DOT. For DOT holders, this strategy is among the most lucrative. By liquid staking your DOT on Bifrost, you receive vDOT, which can be used in different DeFi protocols, enabling users to secure higher returns and benefit from airdrop rewards.

This user provides the optimal solution and providing suggestions where users can utilize their vDOT tokens.

Another user, after comparing staking services on Polkadot, highly recommends Bifrost. The primary reason is Bifrost allows for quick redemption without the 28-day waiting period. This makes it the ideal choice for users who prefer not to hold DOT long-term but still want to stake, especially during favorable market conditions.

Such endorsements are plentiful; in fact, Bifrost's $100 million Total Value Locked (TVL) is backed by the endorsement of nearly 10,000 staking users.

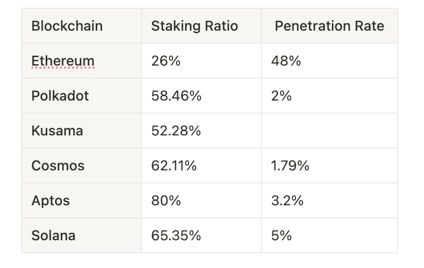

Most teams are focused on the development opportunities for LST on Ethereum, given that ETH's staking rate is only 26%, which offers significant room for growth compared to other public chains where staking rates often reach 60%. However, what most overlook is the penetration rate of LST, i.e., the proportion of staking through the LST protocol among all staking activities.

On Ethereum, LST boasts a penetration rate as high as 48%, whereas on most other public chains, this rate is less than 5%.

Data Source: Staking Rewards

The penetration rate is calculated based on the TVL of major staking projects. The data for Kusama is uncertain.

The primary reason for this phenomenon is the relatively inactive DeFi ecosystems on public chains other than Ethereum. LST assets lack diverse use cases, reducing the incentive for users to mint LST. This is also why Bifrost focuses on expanding application scenarios for vTokens, to provide as many use cases and user incentives as possible.

Besides PoS networks, there exist staking scenarios within DePIN networks as well. In a sense, we can understand PoS networks as a specific case of DePIN networks, offering generalized computing services. Narrowly defined, DePIN networks refer to specialized IoT networks providing storage, bandwidth, energy, communication, and dedicated computing services.

As an important use case of blockchain technology, the development of DePIN networks is crucial. DePINs explore new productive relations that better suit the productivity developments of the information age in human society. In this trend, Bifrost aims to integrate hardware networks with finance, allowing hardware resources to become assets in DeFi with enhanced liquidity, thereby creating new value.

Bifrost has taken the first step by launching vFIL. LST for DePIN will be a significant direction for Bifrost's expansion.

For a detailed exploration of Bifrost's perspective on LST for DePIN, you can find more in this article: LST & Hardware Networks: Bifrost Opens A New Era of Liquid Staking.

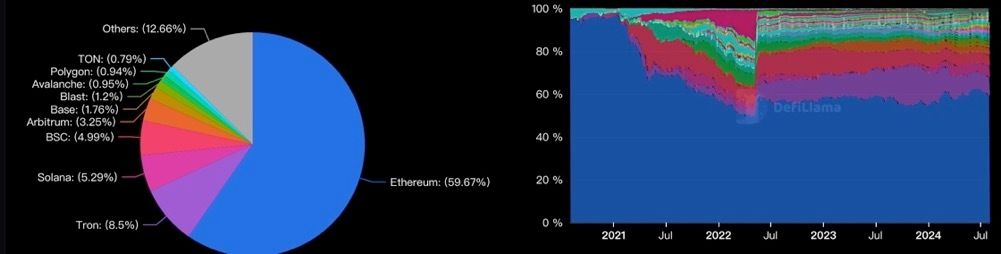

Today's crypto world is a chaotic landscape composed of multiple chains. Once, Ethereum dominated the majority of liquidity and DeFi applications in the crypto world, but now its TVL share has dropped to below 60% and continues to decline.

Some EVM-compatible chains and new public chains are steadily eroding market share. Faced with this situation, Ethereum is undergoing self-evolution to enhance performance and ecosystem scalability, including the Constantinople upgrade and support for various Layer2 solutions. In response, Bifrost has a fundamental insight: the future of the crypto world will continue to evolve towards a multi-chain landscape, where DeFi protocols should adopt new paradigms.

While the multi-chain competition drives blockchain innovation and adoption, it also segregates applications, assets, liquidity, and users across different chains. Although cross-chain bridges facilitate migration between chains, they do not reintegrate these elements into a cohesive whole, which a full-chain architecture can achieve.

In a full-chain architecture, Bifrost deploys its main protocol on the Bifrost Polkadot chain and lightweight modules supporting remote access on other chains. This setup enables remote minting, redemption, and exchange scenarios. In simpler terms, Bifrost utilizes the Bifrost Polkadot chain as a modular settlement layer for full-chain LST, using a unified main protocol to manage cross-chain interactions and operations remotely across multiple chains.

The full-chain architecture also grants Bifrost better cross-chain composability. Similar to how Loop Stake allows remote calls to multi-chain lending pools, Bifrost's compositional yield strategies will not be limited to single-chain strategies but can fully leverage the entire DeFi ecosystem to create cross-chain compositional strategies.

In a full-chain architecture:

We can use "chain abstraction" to describe this state. As the crypto industry evolves, "chain abstraction" will undoubtedly be the ultimate goal of the multi-chain landscape. Although it requires coordinated efforts across the industry, pioneers like Bifrost will reap the dividends of this evolution.

Bifrost has accumulated years of experience in protocol maturity and security.

In anticipating trends and taking proactive actions, Bifrost consistently leads the way. While currently, most of Bifrost's resources and TVL come from the Polkadot ecosystem, leveraging a full-chain architecture, Bifrost is expanding its LST business uniquely and pioneering cross-chain usage scenarios for vTokens.

With innovations like Ethereum's LSTFi model and improvements in cross-chain infrastructure, new public chains will experience rapid growth in penetration and DeFi integration rates.