Introduction

Liquid staking has grown since its introduction in 2020 with the Lido Protocol on Ethereum, to become the largest sector within DeFi with a total value locked (TVL) of over $32 billion, serving as a fundamental primitive for on-chain DeFi use cases. Liquid staking is usually combined with other DeFi activities, such as lending and borrowing, which can multiply the earnings users can get. Bifrost has been a leading liquid staking appchain leveraging the Polkadot tech stack, with a main emphasis on its Liquid Staking Tokens (LSTs), particularly vDOT, the largest DOT LST.

In this article, we aim to explore how Bifrost LSTs, particularly vDOT, enhance capital efficiency by merging staking rewards with the utility of a yield-bearing token, directly showcasing the power of yield-bearing collateral and illustrating the moneyness of LSTs. This brings us to the core issue that liquid staking seeks to resolve: the staking dilemma.

Staking Dilemma

As most crypto users know, liquid staking was primarily invented to address multiple issues. First of all, staked tokens are locked during the unbonding period, and users don't earn any rewards if they decide to unbond. There is also a risk of punishment if the active validator is found misbehaving, which could lead to slashing. Most importantly, there's a present lack of liquidity where tokens cannot be used for any on-chain actions because they are simply locked.

Liquid staking aims to fix these issues, balancing the circulation of tokens with the security of PoS chains, allowing users to earn both staking rewards and DeFi yield simultaneously, if they choose to do so. This context is particularly relevant when considering the developments in specific blockchain ecosystems like Polkadot.

Polkadot Staking

On July 18th, researchers from Web3 Foundation suggested reducing DOT's inflation rate from 10% to 8%, with 15% fixed treasury inflows to tackle Polkadot's budget issues and boost staking. This proposal aligns with the rising expectations for Liquid Staking after Ethereum's Shanghai upgrade, although other chains like Polkadot lag in this area despite high staking rates.

Polkadot's high staking rate (58.8%) contrasts with the low penetration of Liquid Staking Tokens (LSTs), where only a small fraction of staked DOT is in LST form. This is due to high native staking rewards offering little incentive for further yield through LSTs, unlike Ethereum where additional yield opportunities exist.

A community discussion in July supported lowering the inflation rate to balance security and development interests. Reducing it to 5% could initially reduce staking income but might significantly benefit Polkadot long-term by fostering a more vibrant liquid staking ecosystem. This could lead to greater innovation and user engagement in LSTs, potentially driving more on-chain activity and growth in DeFi.

Bifrost & vTokens

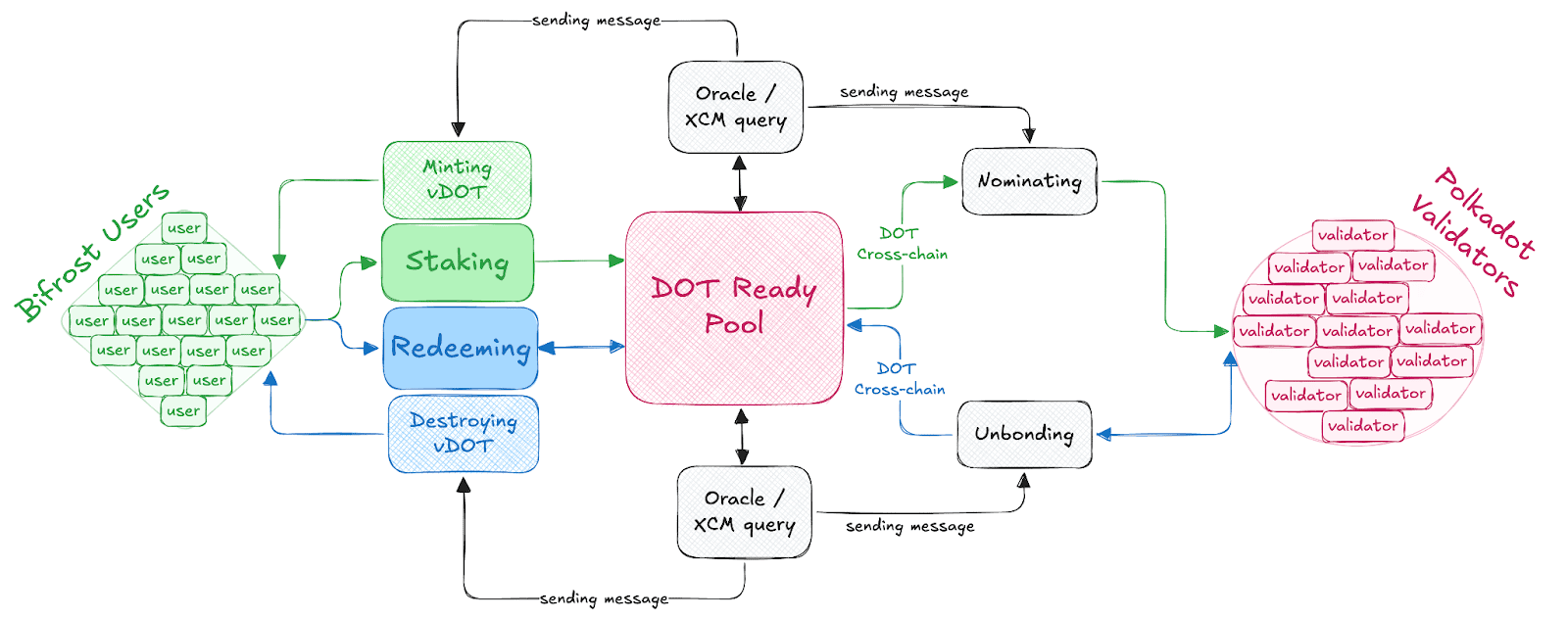

Talking about liquid staking on Polkadot, vTokens are Liquid Staking Tokens issued via Bifrost Liquid Staking protocol . By staking tokens, users receive vTokens, which function similarly to staking the native token while also compounding staking rewards. This allows users to earn staking rewards, keep their assets liquid, and contribute to the security of networks. Users can imagine LSTs as receipt vouchers of their tokens that they have put into staking and can be used in DeFi.

So far, Bifrost has launched nine LSTs, such as vDOT, vKSM, vASTR, vGLMR, vMOVR, vMANTA, and vBNC, as liquid vouchers for staked tokens within the Polkadot Ecosystem, along with vETH from Ethereum. By being a dedicated liquid staking appchain and leveraging decentralized, trustless interoperability protocol, Bifrost can issue LSTs for chains other than Polkadot, improving the composability and liquidity of such assets. Among these, vDOT stands out as a prime example of Bifrost's liquid staking innovations.

vDOT

vDOT, which is a liquid staking token for DOT, the native token of Polkadot. Users can deposit DOT into Bifrost Staking Liquidity Protocol (SLP) to receive vDOT, which can be traded or redeemed for DOT. Holding vDOT is equivalent to maintaining a DOT staking position, with rewards increasing vDOT's market value.

Staking rewards enhance vDOT's price without manual intervention. vDOT represents staked DOT on the Polkadot Relay Chain, with its value increasing from staking rewards without changing token quantity. vDOT operates as a non-rebasing token, whereby the value of vDOT appreciates linearly relative to the DOT token due to the accumulation of staking rewards. The longer the holding period, the greater the appreciation in value. Unlike Polkadot's 28-day wait, vDOT offers the potential for quicker redemption through matching minting and redemption queues. Moreover, vDOT integrates with EVM, WASM, and Substrate-compatible parachains via HRMP channels for broader utility.

However, vDOT not only allows it to remain liquid while earning staking rewards with locked DOT, but users can also achieve a much higher APY than the initial one with its 1-click product "LoopStake," aka leverage looping.

LoopStake

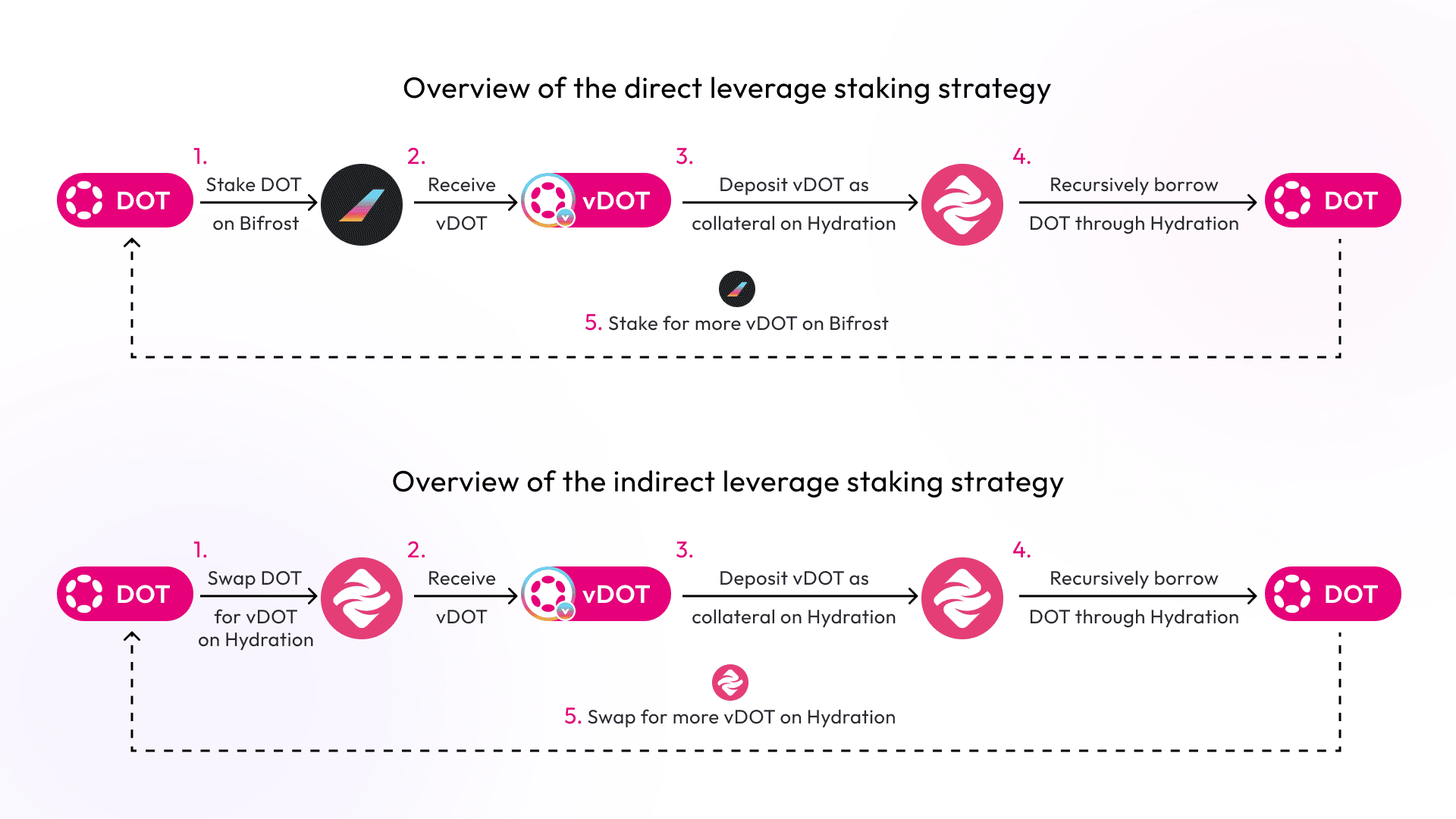

LoopStake is a product which abstracts the popular leverage looping strategy in DeFi into a one-click product where users increase their staking yield by borrowing against their liquid staking assets. This allows for the potential to earn more than if they were only using their initial investment. You can also call it leveraged staking.

For instance, in a DOT leveraged staking scenario, a user would supply vDOT to borrow DOT. Setting a 2x leverage means the user could earn double the staking rewards on their initial stake.

Bifrost's approach to leveraged staking is different: it only facilitates exchanges between vDOT and DOT. This setup ensures that Bifrost's lending market is dedicated to supporting leveraged staking for vDOT, maintaining a stable liquidity flow between vDOT and DOT, rather than providing general token borrowing services.

Yield

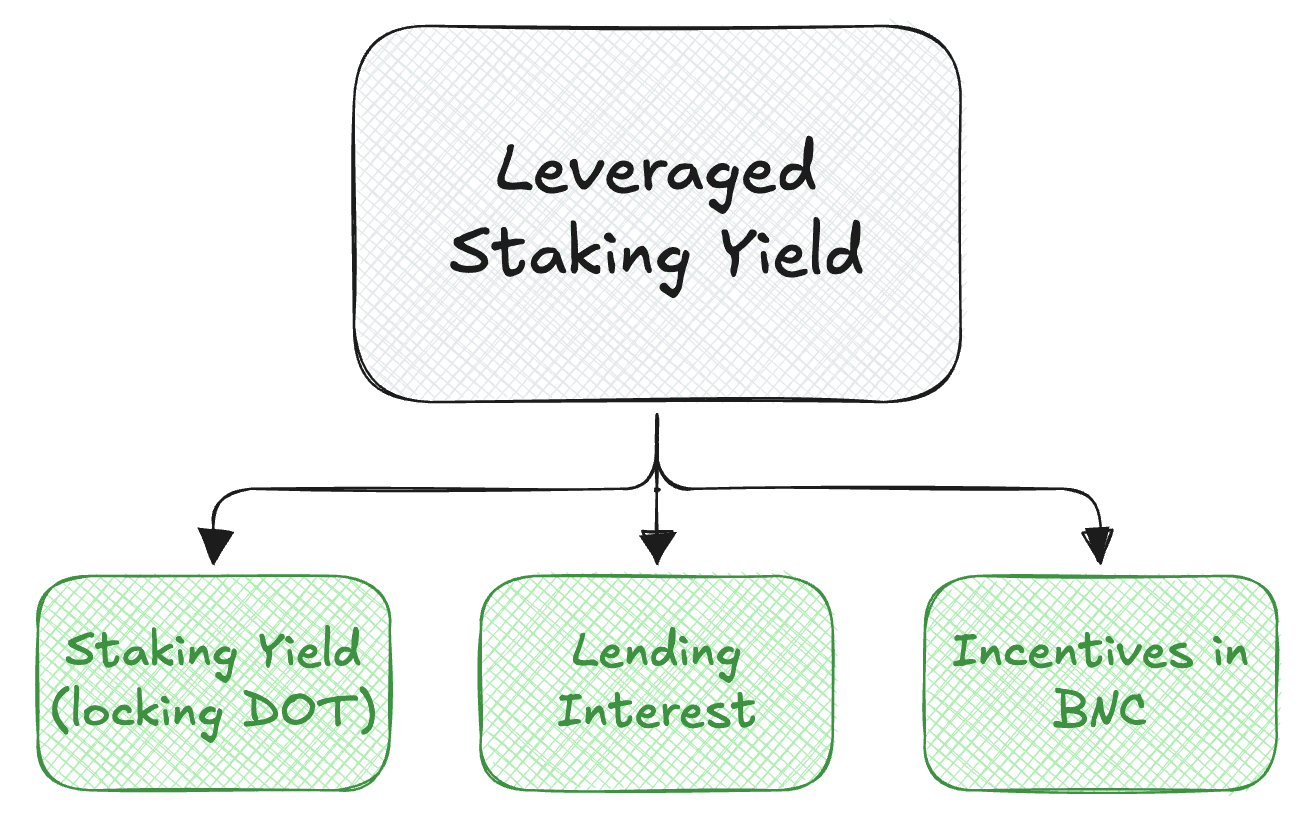

Leveraged staking yield is derived from three key sources:

- Staking yield comes from the inherent yield of vDOT (after staking DOT via Bifrost SLP).

- Yield in the form of lending interest arises when the supply for lending matches the demand for borrowing, where borrowing rates generally exceed lending rates.

- The Bifrost protocol can incentivize participation in lending and borrowing markets with BNC, its native asset, by using governance decisions to allocate protocol-generated revenue for BNC incentives. In some cases, lending interest might approach or surpass borrowing interest, potentially leading to higher profits from leveraged staking compared to typical interest scenarios.

Imagine User A has 1,000 vDOT. They decided to use leveraged staking with 5x leverage, where 1 vDOT = 1.2 DOT; vDOT APY is 15% and the DOT Borrowing Rate is 10%.

User A deposits 1,000 vDOT for leveraged staking with 5x leverage. Since each vDOT is worth 1.2 DOT, 1,000 vDOT * 1.2 * 5 = 6,000 DOT in total exposure. They borrow 4,800 DOT (6,000 total exposure - 1,200 DOT from their deposit).

In that case, Loan to Value (LTV) is equal to 80% (Debt / Collateral = 4,800 / 6,000 = 80%). From staking, User A earns 6,000 DOT * 15% APY = 900 DOT, while borrowing costs are 4,800 DOT * 10% Borrowing Rate = 480 DOT.

At the end, User A earned 420 DOT with an APY equal to 420 DOT / 1,200 DOT (initial deposit) = 35%. So, by using leveraged staking, User A turns a 25% APY into an 35% net APY, significantly boosting their returns but also increasing their risk due to the borrowed amount. Moreover, one notable advantage of this system is the mitigation of liquidation risk.

No Liquidation Risk

In Bifrost's LoopStake product, loans are restricted to transactions between related token pairs. For instance, in the vDOT LoopStake, users can only mortgage vDOT to borrow DOT. Given that the market prices of these tokens tend to be stable relative to each other, any rise or fall in DOT's price is typically mirrored by vDOT.

Under extreme market conditions, if vDOT's price diverges significantly from DOT, and since Loop Stake only accepts vDOT as collateral, the LTV for all borrowers might exceed the liquidation threshold. Despite this, positions would not be liquidated; instead, they would remain open, simply waiting for vDOT's price to realign with its expected ratio to DOT.

Staking is not the only method to earn rewards in the crypto space; there's also a significant sector known as Money Markets, which enhance the capital efficiency of assets like vDOT. LSTs have become incredibly popular within DeFi's second largest sector, lending. They are particularly valued for their use as yield-bearing collateral, significantly enhancing the utility and flexibility of assets in lending protocols. This leads us directly into the mechanics of these markets.

Money Markets

Money markets in DeFi refer to permissionless lending and borrowing of digital assets. Users deposit crypto to earn interest, while borrowers must provide collateral. These markets use dynamic interest rate models that adjust based on liquidity.

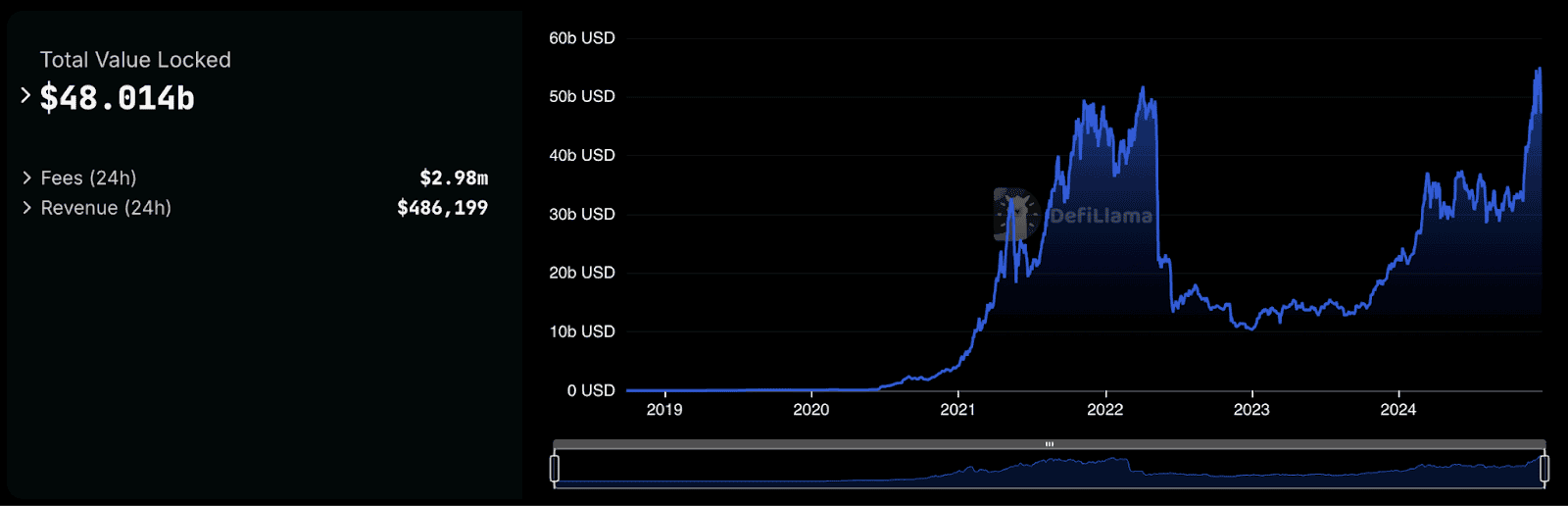

Money markets enable users to earn yield on idle assets and unlock liquidity without selling, enhancing capital efficiency. Borrowing against tokens is key, distinguishing "blue chip" crypto assets. This provides cheap leverage for users, aids high-net-worth individuals in tax planning, and allows token-rich but cash-poor teams to borrow against holdings for runway. The total value locked (TVL) across lending protocols in crypto today is over $48 billion.

The crypto money market's core business model generates revenue through lending, borrowing, and collateralized debt positions (CDPs). The primary income comes from the interest rate spread between what depositors earn and borrowers pay. Additional revenue usually includes liquidation fees, but as we have discussed before, there is no liquidation risk on Bifrost.

vDOT can already be used across numerous dApps to earn rewards and contribute to the Polkadot ecosystem. However, staking rewards are not the only way to earn yield; another option that can be combined with liquid staking is yield-bearing collateralization. Here, we delve into how vDOT functions as yield-bearing collateral.

vDOT as Yield-Bearing Collateral

Yield-bearing collateral boosts returns, reduces risk, and improves liquidity in money markets by allowing assets to earn income while serving as collateral. This makes lending more attractive and can lower borrowing costs. Its growth has expanded DeFi, introduced new financial products, stabilized markets, and attracted diverse investors, though it requires careful risk management.

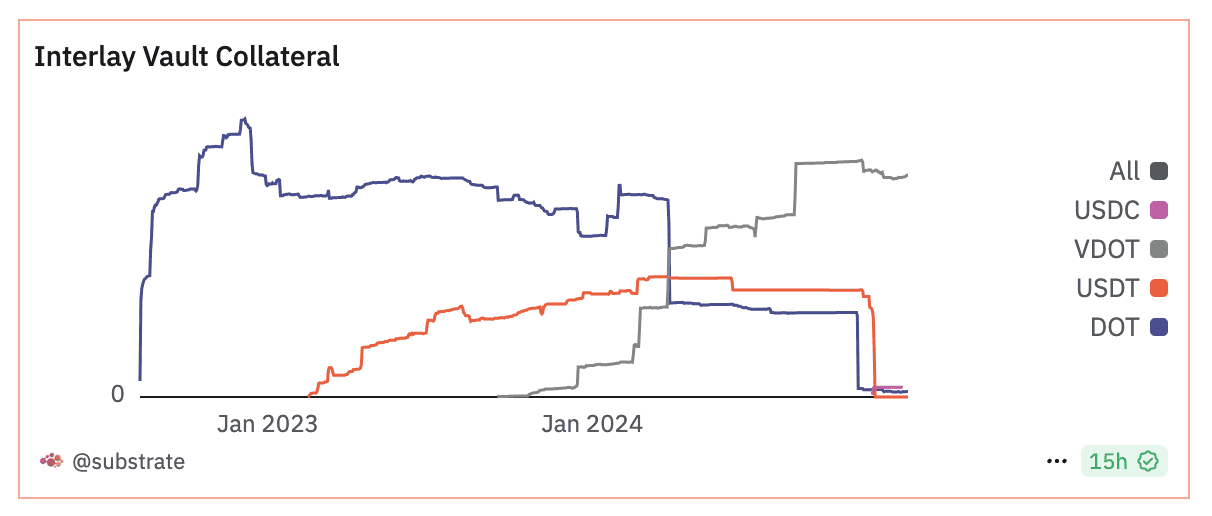

vDOT serves as yield-bearing collateral, allowing users to earn staking rewards while using it in DeFi activities such as securing iBTC vaults. These vaults on Interlay enable trustless Bitcoin usage in DeFi through overcollateralization. vDOT is currently the largest collateral type in Interlay's iBTC vaults, with approximately 700,000 vDOT placed in these vaults.

In contrast, within the Interlay Lending Money Market, users can also leverage vDOT as collateral to borrow other assets like DOT or iBTC. By borrowing DOT, users can stake it again to generate additional vDOT. If they choose to borrow iBTC, it opens opportunities for broader yield-bearing activities within the DeFi ecosystem. This brings us to another platform where vDOT can enhance its utility.

Hydration

Hydration is a DeFi appchain on Polkadot. It currently is the largest liquidity hub on Polkadot, enabling swaps, liquidity pools, DCA functionalities, and lending and borrowing.

vDOT can also be used as yield-bearing collateral on Hydration. vDOT is the third largest asset within Hydration’s omnipool, and it is now enabled to be used as yield-bearing collateral on Hydration's money market. It also increases capital efficiency, manages risk by countering volatility, enables arbitrage, provides liquidity, diversifies strategies, potentially reduces borrowing costs, and expands participation in DeFi activities on Polkadot.

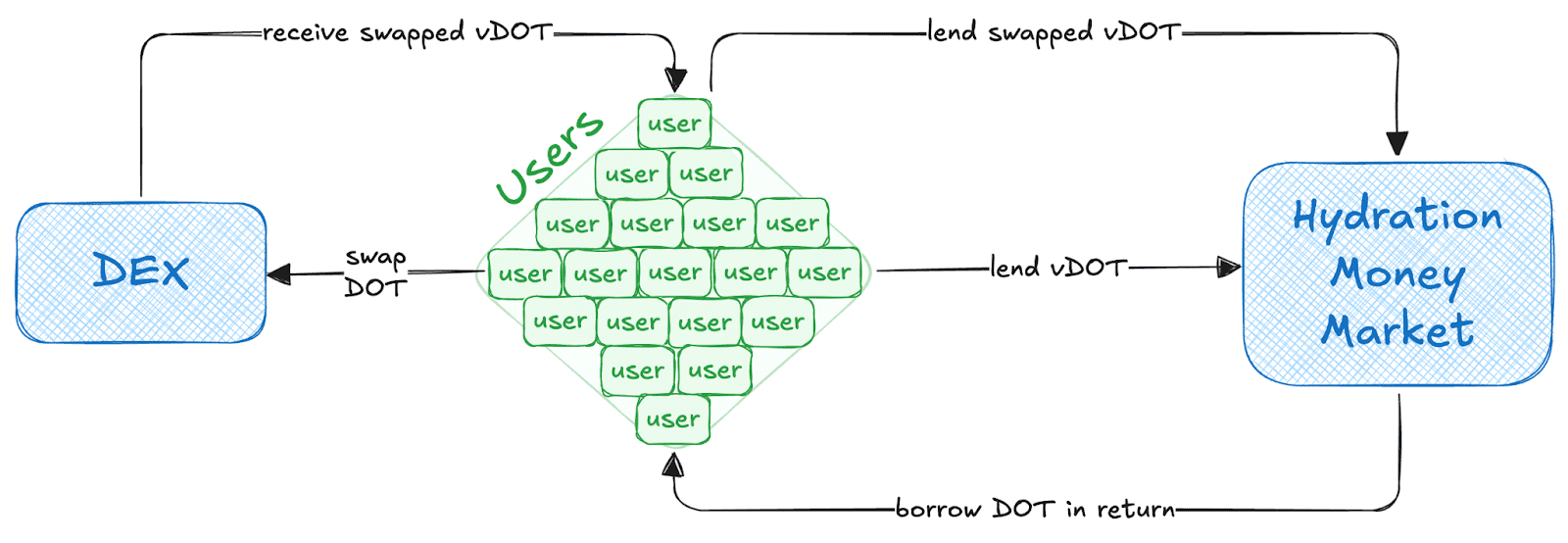

Users can use vDOT as yield-bearing collateral on Hydration to earn even more yield. Here's how it works:

- User deposits vDOT as collateral on Hydration.

- User borrows DOT through Hydration against vDOT.

- User swaps DOT for more vDOT.

- User deposits the swapped vDOT as collateral on Hydration.

- Repeat.

The integration of vTokens with Hydration Money Markets presents substantial opportunities for Bifrost. This partnership utilizes vTokens to enhance liquidity and Total Value Locked (TVL) on the Hydration platform, establishing Bifrost as a key player in liquid staking within the Polkadot ecosystem. Through this collaboration, revenue is generated from transaction fees and DeFi activities as asset utilization on Hydration increases.

This revenue can be strategically used either to buy back BNC or to redistribute it through mechanisms like bbBNC, fostering a sustainable economic model for both Hydration and Bifrost. A flywheel effect is initiated where increased engagement with vTokens on Hydration leads to higher liquidity, attracts more users and projects, and, in turn, boosts revenue.

The synergy between Hydration and Bifrost is demonstrated by the use of vTokens, which can be further developed with new features and enhancements. By consolidating vToken operations within Bifrost's Polkadot parachain, the management of Hydration's liquidity pools is simplified. Introducing new vToken types for underrepresented chains can expand Hydration's offerings. Additionally, new developments in DeFi products specifically tailored for Hydration enhance its functionality and attractiveness.

Hydration serves as the hub for users to engage in Polkadot's DeFi carry trade, where they can maintain spot exposure to DOT while amplifying their staking returns with each cycle of the vDOT/DOT loop. With this in mind, let's consider the future prospects for this integration.

Looking Forward

SLPx

SLPx extends Bifrost's SLP, simplifying vToken integration across blockchains. Developers use minimal code for minting, redeeming, and swapping vTokens via remote calls on the Bifrost-Polkadot chain. This "SLPx Chain Abstraction" allows users to manage cross-chain operations through one contract, bypassing complexities like path-finding and gas fees, aiming for a more interconnected DeFi ecosystem.

In the best scenario for vDOT with SLPx, the module would be adopted across all major blockchains, making vDOT universally accessible and liquid, establishing it as the standard for liquid staking derivatives. With SLPx, vDOT would enjoy unified liquidity across chains, reducing slippage and enhancing trading, becoming integral to DeFi for its deep liquidity. The ease of managing vDOT would unlock vast yield farming opportunities, allowing users to leverage staking rewards with DeFi yields for high returns.

This could lead to mass adoption by both retail and institutional investors, integrating vDOT into investment portfolios and traditional finance. The security and stability of vDOT would be enhanced across chains, while also playing a significant role in governance, creating a decentralized, cross-chain governance landscape.

Hyperbridge and Snowbridge

Hyperbridge is a scalable, trustless, decentralized interoperability protocol, developed by Polytope Labs, using a parachain to connect various networks including Ethereum and Layer 2s.

Snowbridge is a trustless bridge linking Polkadot with Ethereum for asset and data transfer, utilizing the Bridge Hub parachain and governed by Polkadot's OpenGov, supporting ERC20 token transfers and smart contract interactions.

Bridges like Hyperbridge and Snowbridge significantly enhance vDOT's utility and Bifrost’s vTokens by allowing it to operate across multiple blockchains, extending its use in DeFi beyond just the Polkadot ecosystem.

The bridges open new avenues for yield generation, including farming, lending, and arbitrage via SLPx (an extension module developed based on SLP, serving as a developer toolkit that enables the minting of vTokens on any chain), potentially expand the scope for vTokens, establishing them as fundamental financial components across various blockchain networks, which may consequently lead to higher returns for lenders.

They also increase vDOT's liquidity, allowing it to flow freely across ecosystems, which minimizes the risk of liquidity issues. The broader access provided by these bridges could also expand the market for vDOT, possibly increasing its demand and thus its value. Looking ahead, this could set the stage for an optimistic future for vDOT.

Optimistic case for vDOT

In an extremely optimistic scenario for vDOT, it could become the universal standard for yield-bearing collateral in the Polkadot Ecosystem with a chance to expand to various blockchains, used in lending, as the main collateral for stablecoins, and in complex yield strategies.

Financial institutions might integrate vDOT into their yield generation strategies or diversify their investment portfolios through DeFi platforms tailored for institutional use. vDOT has set the standard for liquid staking, defining how these derivatives should work by offering liquidity while staking on Polkadot.

vDOT could be at the heart of innovative financial products, like insurance backed by yield or used in synthetic asset markets for pricing or collateral. As Polkadot's ecosystem grows, vDOT's utility would increase, becoming integral with each new project or parachain. New protocols might use vDOT for cross-chain yield aggregation, automatically reinvesting or compounding yields from various staking and DeFi activities across different blockchains, enhancing its role in passive income strategies.

Wrapping Up

vDOT has transformed the staking landscape in Polkadot, benefits of composability and liquidity with enhanced yield strategies through products such as LoopStake and its strategic integrations with Hydration. Its role extends beyond simple staking, acting as a versatile collateral in DeFi for lending, borrowing, and yield farming on platforms like Interlay and Hydration. With the advent of trustless communication protocols like HyperBridge and SnowBridge, vDOT and vTokens' utility could expand across multiple chains, potentially becoming a standard for yield-bearing collateral. This evolution suggests a future where vDOT not only boosts returns within Polkadot but also influences broader DeFi innovation, setting new standards for liquid staking tokens.