The paradigm of tokenomics in Web3 centers on optimizing incentive alignment and governance frameworks to achieve network effects within decentralized economic systems. Currently, projects that generate sustainable revenue in Web3 are mainly concentrated in Layer 1 blockchains and DeFi.

DeFi protocols typically involve lending, liquidity provision, and trading. The main goal of their Tokenomics is to incentivize users to provide liquidity, engage in lending and trading activities, and reward participants with interest, incentives, and yield.

Critical to DeFi protocol sustainability is the how to create a flywheel, particularly solutions addressing:

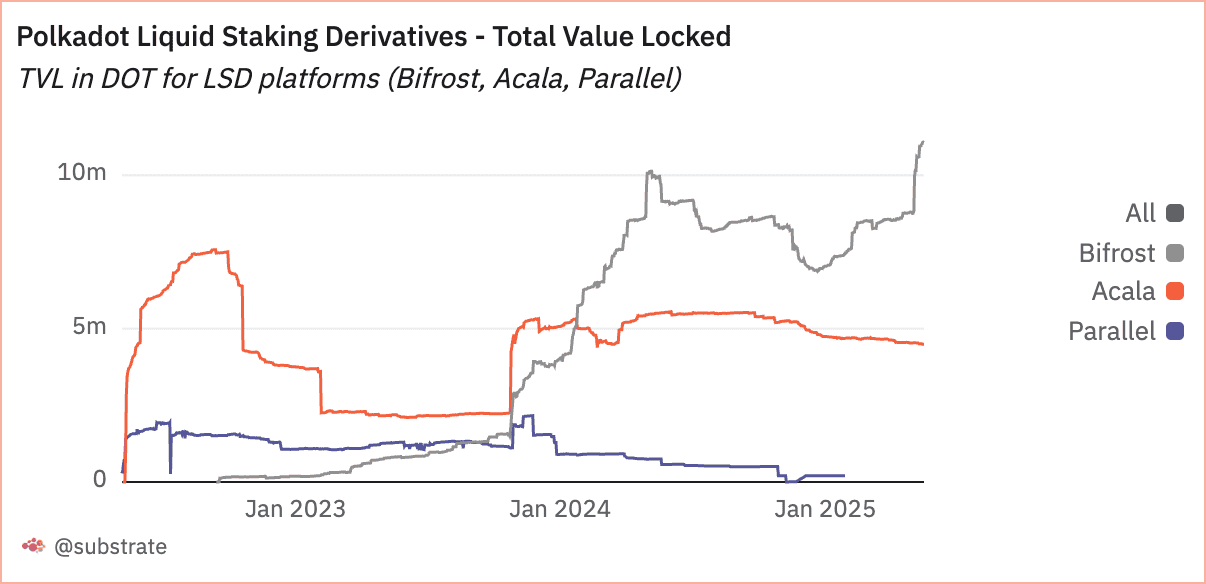

As a protocol focused on liquid staking tokens (LSTs), Bifrost currently covers around ~68% of the LST market within the Polkadot ecosystem and is gradually expanding into cross-chain use cases. Around its vToken minting and cross-chain liquidity architecture, Bifrost is about to launch Tokenomics 2.0, transitioning from a governance-focused model to a buyback and revenue-sharing mechanism.

DeFi tokenomics generally has two categories. The first is governance-driven: holding tokens grants rights to participate in protocol governance. The second is fee switch: tokens generate ongoing revenue, which is either burned or redistributed through buybacks and staking yields.

Back in 2021, most DeFi tokens were governance-only. For example, $UNI was mainly used to manage the treasury and protocol fees, but offered limited tangible value to holders and failed to reward early LPs and users who bore significant risk.

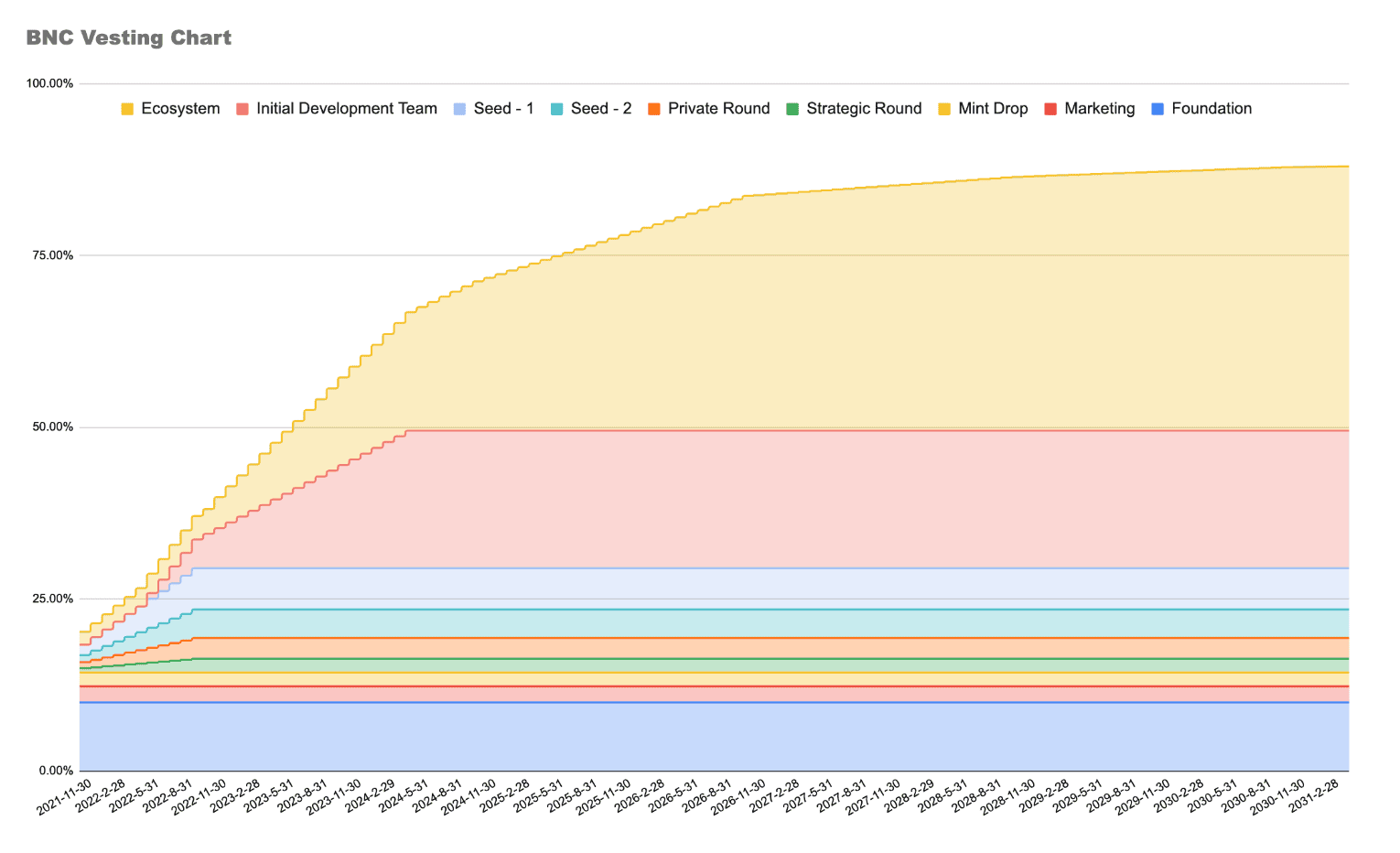

Bifrost Tokenomics 1.0 had similar limitations. $BNC was mainly used for participating in Bifrost OpenGov votes, paying transaction fees on the network, funding treasury spending, providing liquidity incentives, and compensating slashing losses via an insurance fund. However, long-term holders benefit less from this model.

After DeFi Summer, the market became more aware of the limitations of governance-only tokens. Without real yield, such tokens struggle to retain long-term value. Some protocols began redesigning their incentive structures, introducing a flywheel model—where protocol revenue fuels token buybacks and dividends, which attract more users and increase protocol usage.

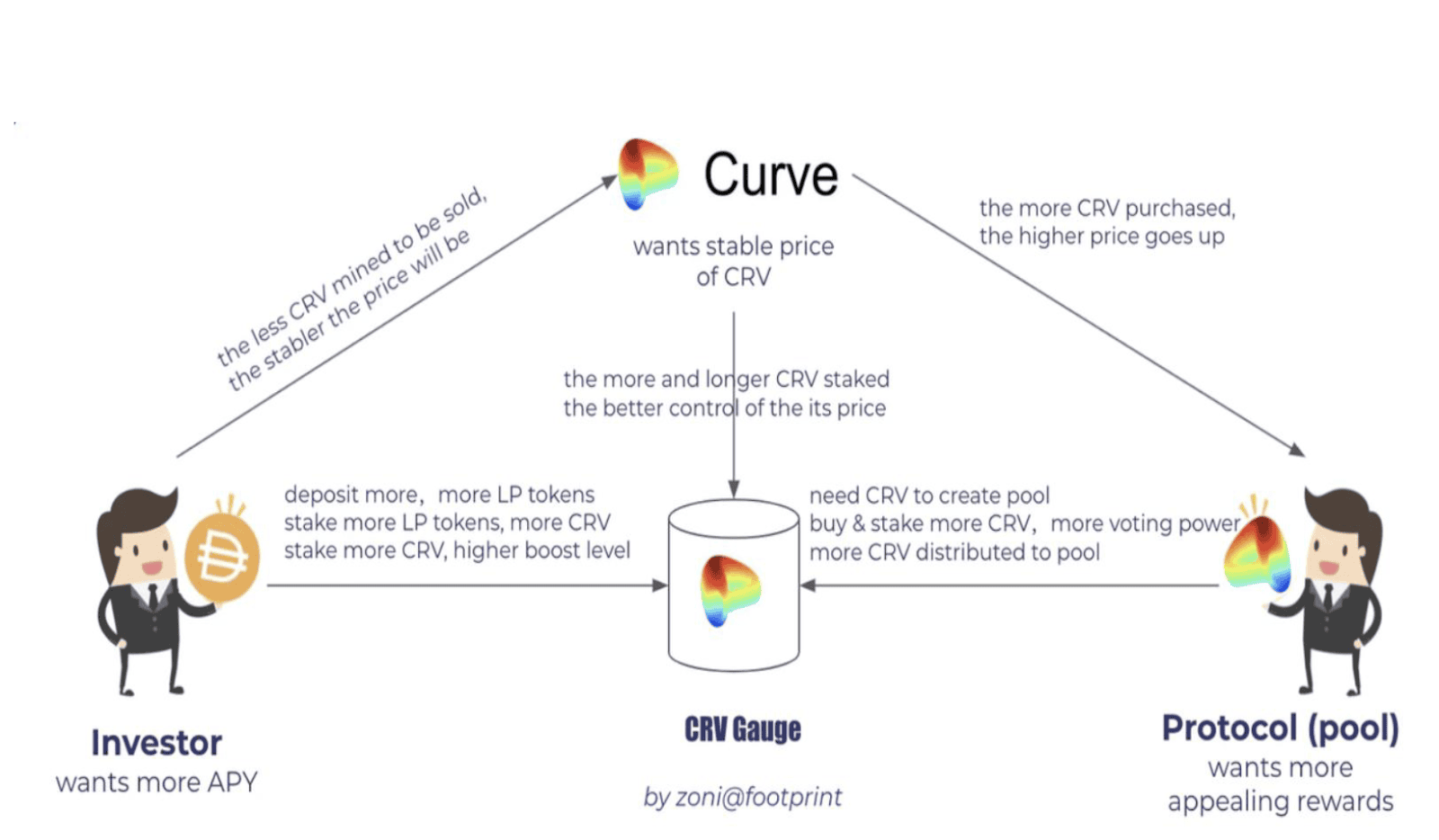

Curve was an early pioneer of this approach. Through the veCRV mechanism, it tightly integrated governance voting and liquidity incentives, increasing both TVL and token holder loyalty.

Other projects with steady revenue streams also began upgrading tokenomics—such as GMX, which adopted a Peer-to-Pool model with fee-sharing from trading revenue, and dYdX v4, which launched its own appchain to distribute 100% of trading fees to the community.

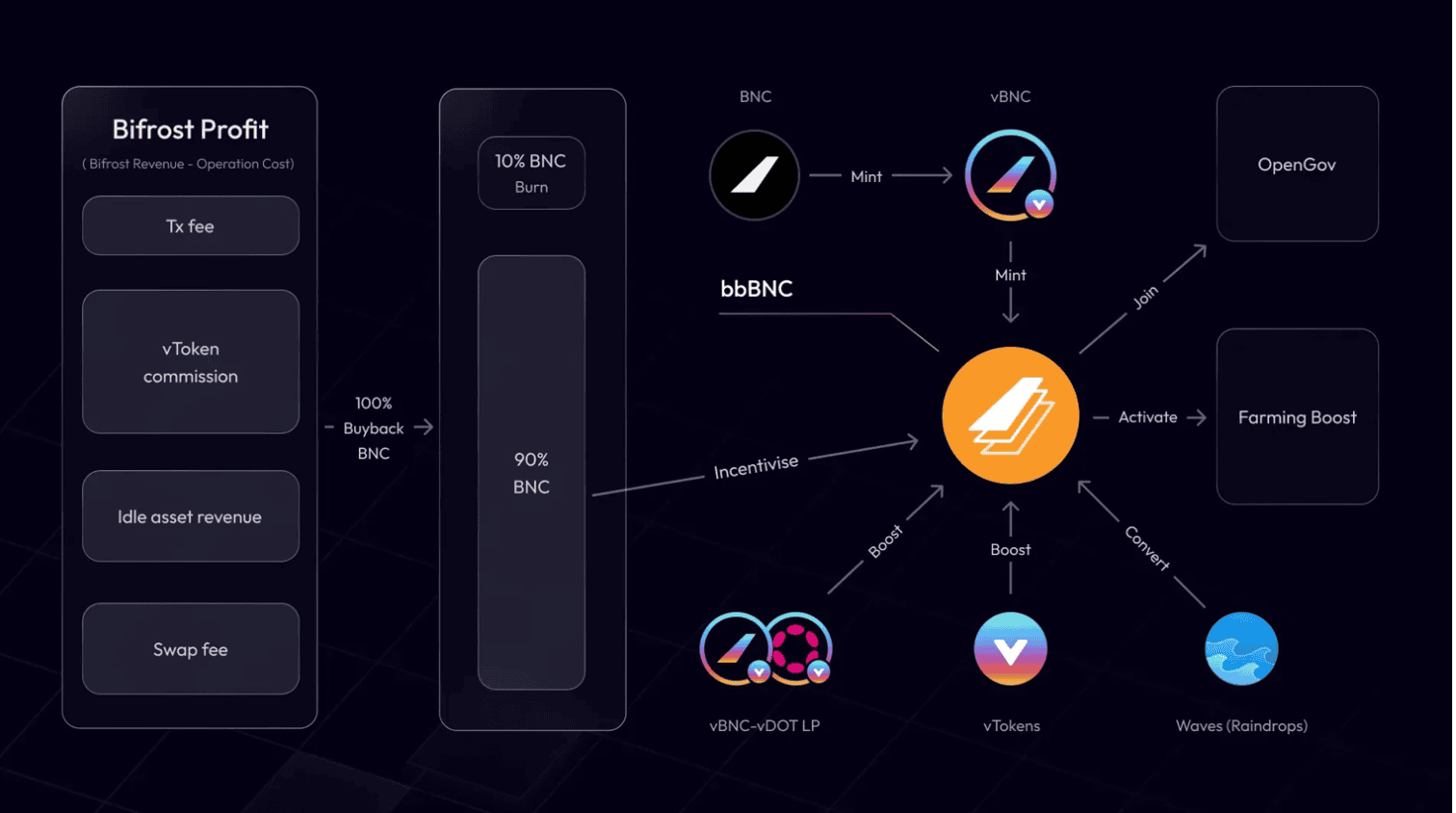

Bifrost Tokenomics 2.0 adopts the concept of Fee Switch. 100% of protocol profit is used to buy back BNC, with 90% is distributed to bbBNC holders, and 10% is burned. This mechanism increases Bifrost’s market cap via buybacks and burns. Higher market value and yield then attract more users to mint vTokens. Minting vTokens generates protocol fees, which are redistributed to bbBNC holders as rewards—encouraging users to lock BNC and reducing circulating supply, thereby forming a positive value loop.

So how do users get bbBNC? It starts with liquid staking BNC to mint vBNC, users then lock their vBNC to receive bbBNC. The amount of bbBNC a user gets depends on the quantity of vBNC locked and the duration of the locking period.

bbBNC = Governance + Staking Yields + Protocol Profit Sharing + Burning Mechanism

bbBNC is non-transferable and can only be redeemed into vBNC upon expiry, which can then be converted back into BNC. Redeeming before the expiry date may incur penalties, which ensures TVL stability and limits circulating supply. All slashed assets are added to protocol revenue and used for buybacks, burns, and bbBNC incentives.

Revenue sharing and token buybacks have become a growing trend in DeFi. However, the effectiveness of buybacks largely depends on the protocol’s ability to generate consistent revenue—without sustainable income, this model cannot be maintained.

At present, Bifrost has established a relatively stable revenue stream and is exploring more sustainable tokenomics based on protocol profit. Under the buyback + dividend model, BNC is no longer just a governance or incentive token. By redistributing protocol profit, it combines governance utility with value accrual. This encourages participation through a sustainable yield and flywheel mechanism, advancing the protocol while increasing long-term value for token holders.